Should You Invest in a Single Family Home or Duplex? Pros and Cons of Single-Family vs Small Multifamily Investing

Investing in rental properties is a reliable way to build wealth, but deciding between a single-family home and a small multifamily property isn’t always straightforward. Each has its benefits, so understanding what each offers can help guide your choice.

When you invest in a single-family home or duplex, each option presents unique advantages. Single-family homes often come with simpler management and lower initial costs. On the other hand, small multifamily properties, like duplexes or triplexes, allow for multiple rental streams, which can help cover expenses more reliably.

This guide walks you through both options to find the right fit for your investment goals.

Here’s what we’ll cover:

- the basics of single-family and small multifamily rentals,

- the pros and cons of each,

- practical management tips,

- expected returns and exit strategies,

- and which option might align best with your investment goals.

By the end, you’ll have a clear understanding of which property type best supports your wealth-building journey. If you’re new to rental investing, you might also want to explore our investing in rental property for beginners an in-depth guide to investment in small-multifamily properties.

Understanding Property Types

Choosing the right property type is critical to your success as a rental investor. Here’s what you need to know about the main investment options:

What is a Single-Family Property?

A single-family property is a residential structure designed for one household. It typically has its own entrance, yard space, and utility connections. While many single-family homes are freestanding, some, like townhouses, may share external walls with neighboring units but remain self-contained.

Single-family homes typically offer more privacy and autonomy in property decisions. Their styles range from ranch-style houses to multi-story homes in various architectural designs.

Real estate investors commonly use single-family properties as long-term rental investments. These properties appeal to residential residents and future homebuyers — creating flexible exit strategies. The market shows strong demand, with 41% of American renters preferring single-family housing.

What is a Small Multifamily Property?

A small multifamily property contains 2-4 separate residential units within a single structure. This category includes duplexes, triplexes, and fourplexes. Each unit has its own kitchen, bathrooms, and living spaces. These properties feature shared walls between units and often include common areas like yards, parking lots, or laundry facilities.

Small multifamily properties maintain residential classification, unlike larger apartment buildings with 5+ units that fall under commercial real estate rules. This fundamental distinction allows owners to access residential financing options and operate under more straightforward regulations.

Many investors start with duplexes or triplexes to benefit from multiple rental incomes while staying within residential property guidelines. Statista’s report shows that multifamily properties dominate U.S. real estate investment, representing over one-third of all commercial real estate investments in 2024.

The Pros and Cons of Single-Family vs. Multifamily Investing

Choosing to invest in a single-family home or duplex comes down to balancing simplicity with income potential. Each option offers distinct benefits and challenges that impact cash flow, management needs, and long-term growth, helping you align your choice with your financial strategy.

Pros and Cons of Single-Family Investing

Pros of Single-Family Investing

| Pros | Details |

| Simplicity of Management | Managing a single-family rental is straightforward, with all tasks centralized. Rent collection and maintenance involve just one household, providing full control over property decisions. |

| High Demand and Easy to Rent or Sell | Attracts quality residents and long-term renters seeking residential living spaces. These properties are appealing to both rental markets and potential buyers. |

| Typically Lower Entry Costs | Lower initial capital needs make it easier to enter real estate investing. Financing is often accessible, allowing you to test your investment strategy without a large financial commitment. |

| Potential for Appreciation | Location-driven growth in suburban areas can drive significant appreciation. Targeted improvements often increase property value more than in multifamily. |

Cons of Single-Family Investing

| Cons | Details |

| Single Income Stream | Relying on one resident means all income depends on a single household. Any payment issues or vacancies impact the entire investment, draining reserves quickly during resident transitions. |

| Higher Relative Vacancy Risk | Vacancies completely halt income, while marketing costs and lost rent accumulate. The property carries all operating expenses with zero income during transitions. |

| Reduced Economies of Scale | Maintenance and repair costs hit at full price, lacking the bulk discounts or shared expenses available in multifamily properties, impacting your margins. |

| Financing Limitations | Investment loans may have higher interest rates and stricter requirements, limiting the ability to expand your portfolio and adding complexity to financing additional properties. |

Pros and Cons of Small Multifamily Investing

Pros of Small Multifamily Investing

| Pros | Details |

| Multiple Income Streams | – Steady cash flow from multiple units – Vacancy buffer: One vacant unit doesn’t stop income |

| Economies of Scale | – Lower per-unit costs through shared expenses – Volume discounts on maintenance and renovations |

| Financing Flexibility | – More lending options: Eligible for both residential and commercial loans – Favorable terms due to perceived lower risk |

| Owner-Occupied Benefits | – Reduce living expenses by living in one unit – Immediate oversight of your property |

Cons of Small Multifamily Investing

| Cons | Details |

| Complex Management Demands | – Requires organization for multiple residents – Shared spaces need extra attention to maintain satisfaction |

| Higher Initial Investment | – Larger upfront costs than single-family homes – Reserves needed for down payments, repairs, and turnovers |

| Resident Dynamics | – Additional complexity managing resident relationships – Swift conflict resolution needed for common area disputes and noise complaints |

| Regulatory Requirements | – Stricter zoning laws and insurance costs – Special permits/inspections often required for improvements |

Property Management Styles

When you invest in a single-family home or duplex, different types of rental property require a distinct management approach. The style you choose directly impacts your investment returns and resident satisfaction. Your management strategy needs to align with your property type and investment goals.

Managing Single-Family Rentals

Understanding property management options is crucial when expanding your portfolio. Whether handling responsibilities yourself or hiring professionals, having systematic processes for maintenance, resident screening, and property oversight determines your success.

Financing an investment property is just step one—deciding how to manage it comes next. When choosing between self-management and professional services, consider your time availability, expertise, and investment goals.

You must establish clear procedures to protect your investment when maintaining your rental property and managing resident relationships. Without systematic maintenance and communication protocols, you risk higher repair costs, resident turnover, and reduced property value. Here are the key things to help:

- Inspection checklists: Document property condition at move-in and move-out with photos and detailed notes

- Maintenance protocols: Create clear procedures for submitting and handling repair requests efficiently

- Digital systems: Implement online systems for rent collection, maintenance requests, and resident communications

- Emergency plans: Establish 24/7 response procedures for urgent issues like water damage or heating failures

- Vendor network: Develop relationships with reliable contractors for consistent service quality

- Scheduled inspection: Schedule quarterly inspections to catch problems early and plan preventive maintenance

Managing Small Multifamily Properties

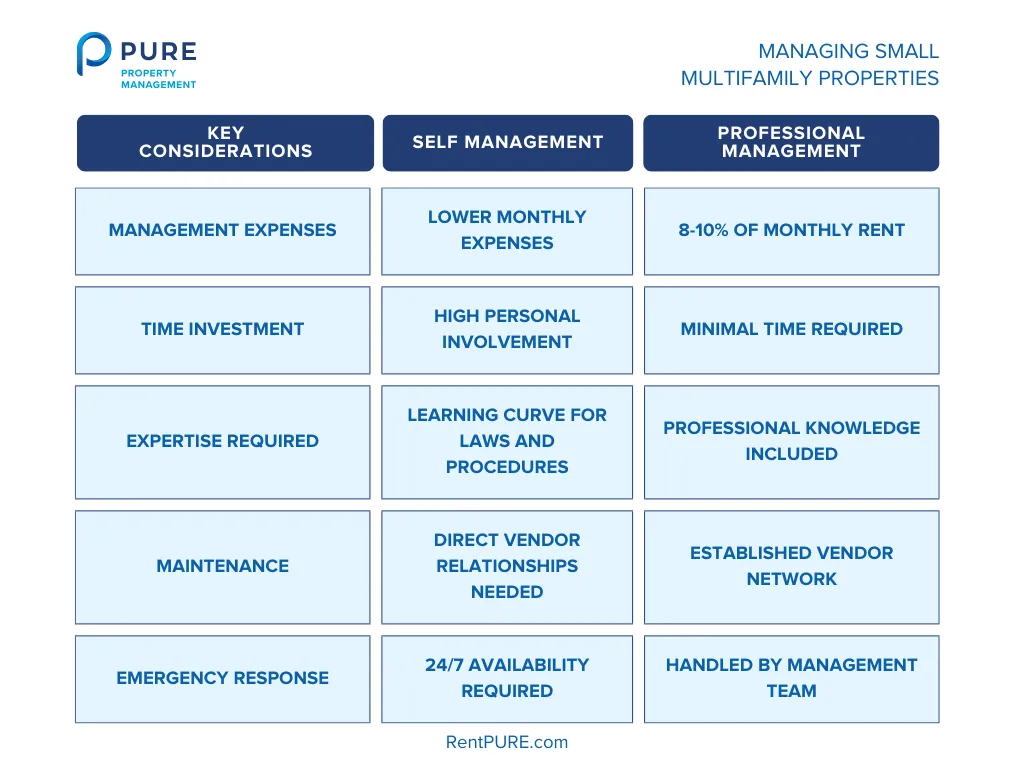

When managing a small multifamily property, like a duplex or fourplex, you have two main options: on-site or off-site management. The right choice depends on your availability, budget, and how hands-on you want to be.

On-site management: In this management style, the owner or a live-in manager is based on the property. This approach allows for quick responses to resident needs, fosters closer relationships, and helps keep a closer eye on maintenance. However, it requires significant personal involvement.

Off-site management: This management style involves hiring a property management company to handle daily tasks, such as rent collection, maintenance requests, and resident communications. While this reduces your day-to-day responsibilities, it typically involves a management fee of 8-10% of monthly rent.

Tenancy in multifamily properties can be a bit of a balancing act. With multiple residents sharing a single property, you manage various personalities, expectations, and needs under one roof.

A structured approach to communication and clear guidelines are essential. Implementing a system for handling maintenance requests, rent payments, and inquiries can reduce misunderstandings and create a positive living experience for everyone.

Shared facilities like laundry rooms, parking areas, and courtyards add another layer of complexity. Prevent potential conflicts by setting clear usage guidelines for these shared spaces. These can range from assigning designated parking spots to establishing time limits in laundry rooms to ensure fair access for all residents.

Evaluating ROI for Single-Family vs. Small Multifamily Properties

To make an informed choice when you invest in a single-family home or duplex, your ROI evaluation should focus on metrics that accurately capture each type’s unique income potential and risk factors. Here’s a breakdown:

Single-Family ROI Evaluation

Single-family properties often appreciate well but rely heavily on resident stability. Here’s how to evaluate their ROI:

- Rental Yield and Annual Appreciation: Calculate the rental yield by dividing the annual rental income by the property’s current market value. Research the historical appreciation rate in the area as single-family homes can have high-value growth, especially in suburban locations.

- Cash Flow After Operating Costs: Subtract regular expenses (mortgage, insurance, taxes, maintenance) from monthly rent. Pay close attention to vacancy periods with single-family properties, as a single gap cuts all income.

- Comparable Sales Analysis: Look at recent sales of similar homes in the area. Compare the prices, rent potential, and appreciation trends to see if your investment’s appreciation aligns with local standards.

- Long-Term Exit Potential: Consider the buyer pool—single-family homes often have broader appeal (to both homebuyers and investors), which can increase demand and improve exit opportunities.

Small Multifamily ROI Evaluation

Multifamily properties deliver cash flow from multiple units, which often makes ROI more stable and predictable. Here’s how to assess ROI for these properties:

- Cap Rate and Gross Rent Multiplier (GRM): Use the cap rate (net operating income divided by property price) to evaluate income efficiency. A higher cap rate typically indicates better cash flow. GRM (property price divided by gross rental income) quickly compares similar properties to see if your investment price is reasonable.

- Per-Unit Cost and Income Analysis: Calculate the average cost per unit and average income per unit. This approach helps you understand which properties generate the highest per-unit return and reveals if the property’s costs are manageable relative to its income.

- Expense Ratios and Shared Costs: Multifamily properties have more complex operating costs, but shared expenses across units can improve efficiency. Calculate expense ratios by dividing total operating expenses by total income. A lower expense ratio indicates more profitability.

- Vacancy and Rent Variance: Multifamily properties handle vacancies better because income from other units often offsets them. Evaluate local rental demand and vacancy rates to anticipate the area’s turnover costs and rent variability.

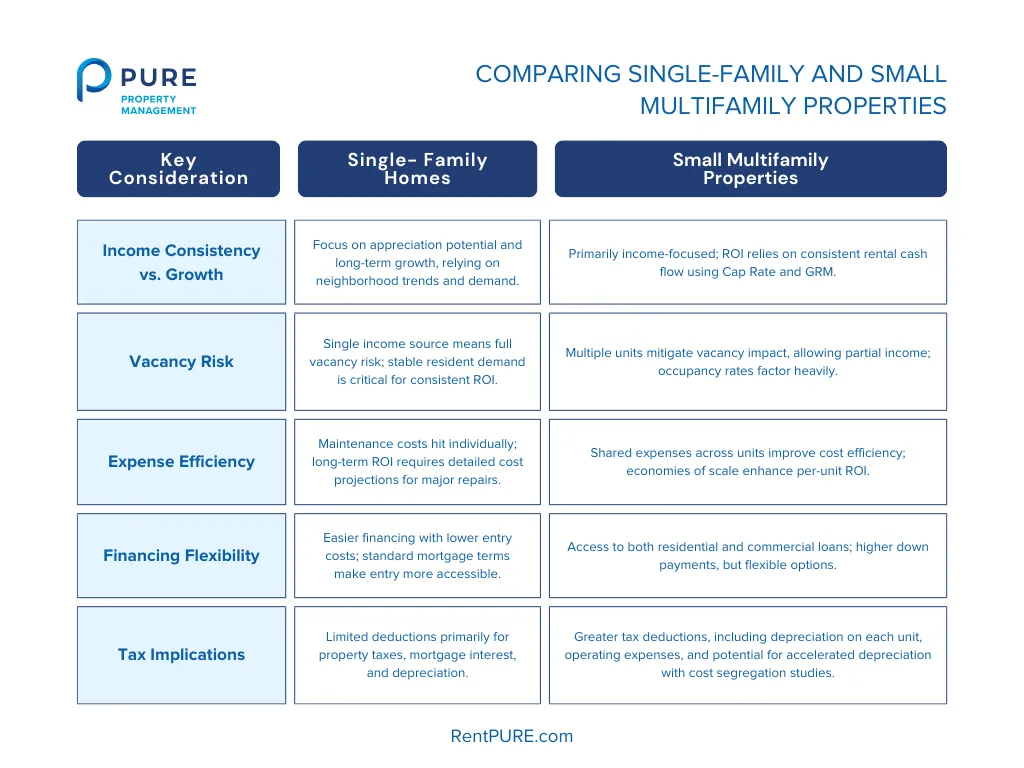

Key Comparative Factors for ROI Evaluation

- Vacancy Risk and Income Stability

- Single-Family: Evaluate potential vacancies carefully; periods without residents result in zero income. Higher resident retention rates are a positive indicator here.

- Multifamily: A vacancy in one unit won’t disrupt total cash flow as significantly. Calculate the local vacancy rate to understand its impact on cash flow stability.

- Expense Analysis

- Single-Family: Analyze individual system costs (HVAC, plumbing, etc.). The lack of shared resources can increase maintenance costs, making a higher reserve necessary for repairs.

- Multifamily: Evaluate shared expense savings. If shared, systems like HVAC or plumbing reduce per-unit operating costs. Calculate potential savings based on these efficiencies to get an accurate cost per unit.

- Financing and Capital Allocation

- Single-Family: Lower entry costs and straightforward financing make single-family homes easier for portfolio diversification. However, evaluate your loan options, as higher interest rates on investment loans can impact returns.

- Multifamily: Small multifamily properties benefit from flexible financing (e.g., FHA or VA loans for owner-occupied duplexes). Compare potential down payments and interest rates across loan types to see which offers the best ROI impact.

- Market Responsiveness

- Single-Family: Appreciation trends are more favorable in suburban and family-oriented neighborhoods. Evaluate long-term market growth indicators, like planned developments, that signal steady appreciation.

- Multifamily: Cash flow stability often remains stronger in urban, high-density areas. Market demand in these areas helps balance income even if appreciation is slower.

This table format quickly compares single-family and small multifamily properties, emphasizing the distinct ROI evaluation approaches for each.

Exit Strategies for Single-Family and Multifamily Properties

Your exit strategy can shape your long-term returns and define your overall investment success. When you invest in a single-family home or duplex, each property type offers distinct paths to maximize profits, suited to different goals. Understanding your options allows you to align investment choices with your financial objectives, helping you decide when to sell, hold, or flip.

Selling Single-Family Properties

Single-family properties attract both investors and homeowners, broadening your buyer pool. While homeowners might pay a premium for a move-in-ready property, investors typically focus on the rental yield and any value-added potential.

Tips for Maximizing Single-Family Sale Value

- Stage to appeal to families: Highlight spaciousness and family-friendly features.

- Document improvements: Record all upgrades, from renovations to regular maintenance.

- Show rental history: Investors appreciate a documented history of rental performance.

- Focus on curb appeal: Curb appeal plays a significant role in drawing emotional buyers.

- Sell in peak seasons: Timing your sale with market demand can enhance visibility.

- Consider seller financing: Offering financing options can attract more investors.

You can read more about how to maximize the value of your rental property here.

For those new to buying investment properties, understanding the purchasing process can also impact your exit strategy. Check out this complete guide on how to buy a rental property to align your purchase decisions with long-term goals.

Selling Small Multifamily Properties

Small multifamily properties, like duplexes and triplexes, appeal to experienced investors who prioritize steady cash flow. To appeal to these buyers, present detailed financials, including income statements, expense reports, and resident histories, as these help buyers gauge the property’s stability and profitability.

Strategies for Selling to Investors

- Provide detailed financial records: Include income, expenses, and occupancy rates.

- Show value-add opportunities: Emphasize areas where the buyer could increase value.

- Highlight operational efficiencies: Point out any systems in place that reduce costs.

- Present rental comps: Use local rental comparisons to validate income potential.

- Document resident payment histories: Resident reliability is a key selling point.

- Outline property improvements: Share completed upgrades that enhance property value.

Long-Term Hold vs. Flip

Your investment timeline can guide you in deciding whether holding or flipping is your best exit strategy. A long-term hold allows you to build equity and benefit from appreciation, while a flip can generate immediate returns. Consider the following factors:

| If You Have | Then Choose | Because |

| 5+ year timeline | Hold | Build equity through appreciation |

| Need for quick returns | Flip | Generate immediate profits |

| Strong rental market | Hold | Benefit from rising rents |

| High rehab expertise | Flip | Maximize renovation return |

| Limited management desire | Flip | Avoid ongoing responsibilities |

| Tax benefits needed | Hold | Leverage depreciation advantages |

| Rising interest rates | Hold | Lock in current financing |

| Market uncertainty | Hold | Weather market fluctuations |

Carefully weighing these factors will help ensure that your exit strategy aligns with your goals and maximizes your investment returns.

Investor Profiles: Which Property Type Suits You?

Choosing the right property type depends on your financial goals, risk tolerance, and preferred level of involvement. Single-family homes and small multifamily properties can yield rewarding returns, but each attracts a different type of investor.

Who Should Invest in Single-Family Homes?

- First-time investors – Single-family homes are straightforward and generally easier to manage, making them ideal for those new to real estate.

- Those seeking simplicity and lower risk – With just one resident, single-family rentals involve less complex management and lower resident turnover.

- Investors focused on appreciation – These properties are popular among homebuyers, often supporting steady appreciation over time.

Who Should Invest in Small Multifamily Properties?

- Investors seeking higher cash flow – Multiple units mean increased income potential, even with a few vacancies.

- Those comfortable with management complexity – Handling several residents requires a systematic approach, which suits investors with experience or management resources.

- Investors aiming for portfolio growth – Multifamily properties offer an efficient way to scale quickly by adding multiple units in a single transaction.

Besides your investor profile, you’ll also want to consider:

Market and Location

Where you invest shapes your property’s performance. High-demand areas, like cities and college towns, often suit multifamily properties better due to a steady renter pool.

In pricey markets, multifamily properties can spread costs and enhance cash flow, while single-family homes may struggle to generate profit.

Financial and Tax Considerations

Financing and tax benefits can sway your choice. Single-family rentals typically qualify for traditional home loans, while multifamily properties (especially those with 5+ units) require commercial loans, which usually have higher rates but offer more loan structuring options.

Multifamily investments allow more deductions, such as depreciation and operating expenses, which can offset management costs and increase returns.

Management and Maintenance

Assess how much time and resources you’re willing to invest. Multifamily properties demand more involvement in resident relations and upkeep. If you prefer a hands-off approach, single-family homes or hiring a property manager might suit you.

On the flip side, multifamily properties offer quicker growth potential. A single 10-unit building can accelerate your portfolio’s growth and streamline management compared to owning multiple single-family homes.

In Summary

Investing in rental properties—whether you choose to invest in a single-family home or duplex—offers distinct paths to wealth-building. Each property type brings unique advantages and challenges, and aligning your choice with your investment style is essential. Here are the key points:

Selecting the right property type depends on your financial goals, market conditions, and preferred management level. You will set a strong foundation for lasting investment returns by aligning your choice with these factors.

To explore more strategies for rental success, check out: