The path to becoming a successful real estate investor is filled with immense opportunity, and the potential rewards are undeniable.

As of June 2024, the typical real estate investor’s home sold for $190,404 more than the original purchase price.

Combine this with the average gross rental yield of 6.10% in the United States, and it’s clear that property investment can be one of the most powerful wealth-building strategies available.

However, buying a property is nowhere near the first step you should be taking if you’re planning on becoming a rental investor. Here’s a quick recap of what you need to know beforehand:

- Finding the right property: This step is where your strategy begins. It’s not just about location; it’s about finding a property that aligns perfectly with your investment goals—whether that’s immediate cash flow, long-term appreciation, or both.

- Evaluating your options: Smart investors don’t just compare prices; they dig deeper. You need to assess the growth potential, analyze market trends, and ensure the property fits into your broader investment plan.

- Securing financing: The right financing is crucial to maximizing your returns and managing risk. Whether it’s a conventional loan or an alternative method, your financing choice directly impacts your profitability and scalability.

In this guide on how to buy an investment property, we focus exclusively on the purchase process—the critical phase where all your planning comes together. Our goal is to provide you with a precise roadmap, filled with the insights and strategies that have helped countless investors succeed.

If you’re looking for detailed guidance on what it means to be a rental investor, how to buy a rental property, and evaluate opportunities, we have a detailed guide on how to be a landlord.

Now, let’s get into the heart of the process: how to buy an investment property and set yourself up for long-term success.

Step 1: Preparing for the Purchase

Preparation is the foundation of a successful property investment. Ensuring your finances and legal structure are in order before you begin the purchasing process can significantly reduce risks and streamline your path to ownership.

Overlooking these crucial steps can result in unnecessary setbacks or complications that could have been avoided with proper planning.

Financial Readiness

Before making any offers, review your financial situation thoroughly. Several key expenses should be taken into account:

- Down Payment: Lenders typically require 20% or more for investment properties. Having this amount ready not only strengthens your negotiating position but also improves your chances of securing favorable financing terms.

- Closing Costs: These additional fees—such as appraisals, inspections, title insurance, and legal expenses—can add up to 2-5% of the purchase price. Planning for these upfront prevents unwelcome surprises at the closing table. We have covered these costs in more detail later on in this article.

- Reserves: Most lenders require you to have reserves equivalent to six months of mortgage payments. This is a financial buffer that reassures lenders and protects you from potential vacancies or unexpected repairs.

Additionally, your credit score plays a critical role in securing favorable loan terms.

For investment properties, lenders typically look for a score of 700 or higher to qualify for better interest rates and conditions.

While you can still get financing with a lower credit score, it usually comes with higher interest rates and less favorable terms—things that can really cut into your profits over time.

Keeping your credit score in good shape boosts your chances of approval and helps you secure better deals, saving you money throughout the life of your loan.

It’s also worth keeping an eye on interest rates and locking in a good one when the timing is right, as this can make a big difference in your overall returns.

Pre-Approval: A Critical Step

Securing pre-approval for a mortgage is an important step in the process. Pre-approval means that a lender has evaluated your financial information and is willing to offer you a loan up to a certain amount.

This not only shows sellers that you’re serious but also gives you a clear understanding of your budget and what you can afford.

Here’s what’s involved in the pre-approval process:

- You’ll submit financial documents, such as proof of income, tax returns, and bank statements, to the lender.

- The lender will review your credit score, debt-to-income ratio, and overall financial health to determine how much they’re willing to lend.

- Once approved, the lender will issue a pre-approval letter outlining the loan amount and terms.

This letter strengthens your position in negotiations. Sellers prefer buyers with pre-approval because it reduces the risk of financing falling through at the last minute. For you, it brings clarity and helps ensure you’re targeting properties within your realistic budget.

Legal and Tax Considerations

When investing in real estate, protecting your personal assets and optimizing your tax strategy are essential. There are several important legal and tax considerations to keep in mind:

Legal Considerations

- Liability Protection through an LLC: Establishing an LLC (Limited Liability Company) is one of the most effective ways to protect your personal assets from legal action related to the property. An LLC separates your personal assets from the property, so if legal issues arise, your personal wealth is shielded.

- Property Ownership Structures: In addition to LLCs, there are other structures such as partnerships, corporations, or trusts. Each structure has different implications for liability protection and estate planning. It’s worth consulting with a legal professional to determine the best structure for your investment goals.

- Lease Agreements and Tenant Rights: Ensuring that your lease agreements comply with local and state laws is critical. Familiarize yourself with tenant rights and make sure your lease covers important legal terms, including rent collection, maintenance responsibilities, and lease termination conditions.

Tax Considerations

- Pass-Through Taxation with an LLC: Income from rental properties in an LLC is taxed at the owner level, not the corporate level, helping you avoid double taxation.

- Potential Deductions: Real estate investors can take advantage of several deductions to reduce their taxable income, including depreciation, repairs, mortgage interest, and property management fees.

- 1031 Exchange: This tax deferral strategy allows you to sell a property and reinvest the proceeds into a new investment property without paying capital gains tax immediately. It’s a powerful tool for investors looking to scale their portfolios.

- Capital Gains Tax: If you sell a rental property for a profit, you’ll need to account for capital gains tax. The rate varies depending on how long you’ve owned the property, so planning your sale carefully can minimize this tax burden.

Given the complexity of real estate tax law and legal structures, working with a tax professional and legal advisor ensures you’re maximizing your benefits and staying compliant with all regulations.

Additional Considerations: Insurance

While you won’t need to secure insurance until you’re closer to closing, it’s important to start considering your options early in the process of how to buy an investment property. Once you have a property under contract, you’ll need to get landlord insurance in place, which is often required by lenders to finalize the mortgage.

Landlord insurance offers protection beyond standard homeowner’s insurance, covering property damage, liability issues, and lost rental income if the property becomes uninhabitable.

Step 2: Making an Offer and Negotiating

Now that your financials are in order and you’re prepared to make a move, the next critical step is crafting and negotiating your offer. This part of the process can determine whether or not you secure the property, especially in a competitive market.

A well-developed offer and strong negotiation strategy can make all the difference between winning the deal or losing out.

Crafting a Competitive Offer

Your offer needs to do more than simply reflect the asking price; it must demonstrate that you’re a serious buyer. Several key elements go into a purchase offer, including:

- Offer Price: The price you’re willing to pay for the property. It’s essential to strike a balance between making a competitive offer that stands out and staying within your budget.

- Contingencies: These are conditions that must be met before the sale is finalized, such as passing an inspection or securing financing. While contingencies protect you, too many can weaken your offer, especially in a competitive market.

- Closing Timeline: Offering flexibility in your closing timeline can make your offer more attractive to the seller. If you can accommodate their preferred timeline, it may give you an edge over other bidders.

To further strengthen your offer, consider the following tactic:

- Earnest Money Deposit: Including an earnest money deposit shows the seller you’re committed to the purchase. This deposit is typically 1-3% of the purchase price and is applied toward the down payment or closing costs. A larger deposit can demonstrate that you’re a serious and trustworthy buyer.

- Acknowledgement of Reports and Inspections: If the listing includes any disclosures, reports, or inspections for buyers to review in advance, acknowledging that you have reviewed these documents will make the seller more comfortable. It demonstrates that you understand the property’s condition when submitting your offer. However, you should still conduct your own due diligence before finalizing the purchase.

To make your offer stand out, also include a pre-approval letter to show the seller you’re financially ready to close the deal. Reducing contingencies, where possible, can make the process smoother and faster for the seller, increasing your chances of acceptance.

In competitive markets, speed matters. Being ready to submit your offer quickly when buying an investment property, with all financials and documents in place, can be just as important as the offer itself.

|

KEY TAKEAWAY To secure a property, a competitive offer should not only reflect the price but also demonstrate your seriousness as a buyer. Key strategies include offering an earnest money deposit, acknowledging seller-provided reports, and including a pre-approval letter. In competitive markets, speed and preparation are just as important as the offer itself. |

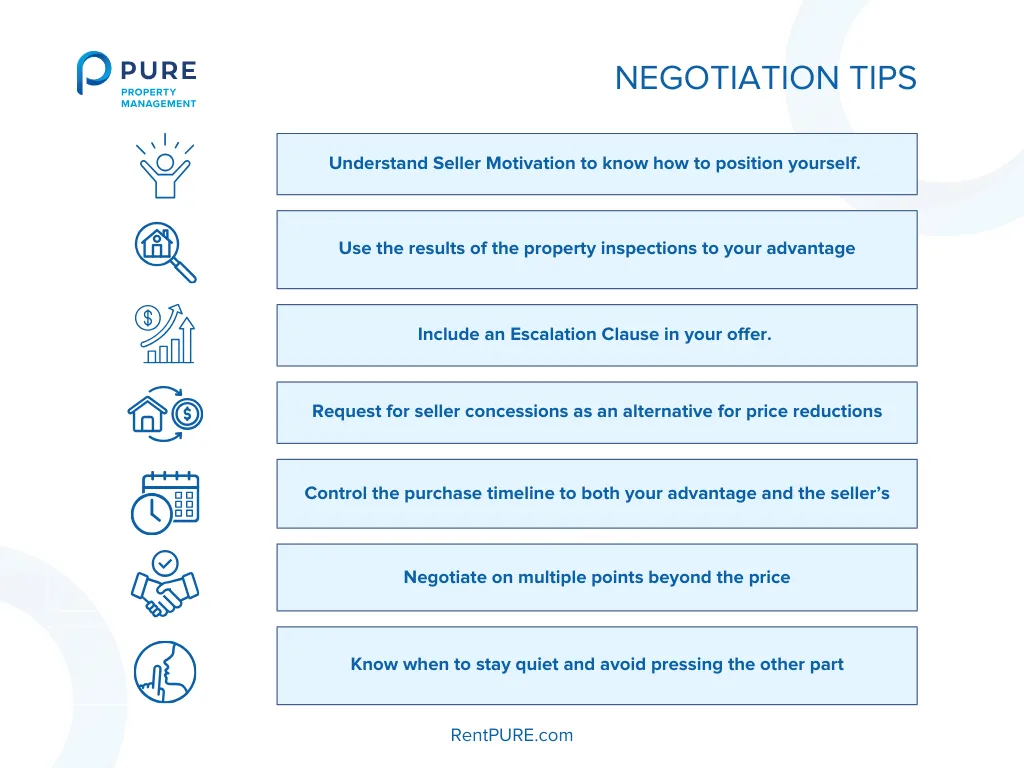

Negotiation Strategies

Negotiation is critical to securing the best deal on your investment property.

While it’s tempting to think of it as a simple back-and-forth on price, the most successful negotiations are about more than just numbers—they’re about strategically positioning yourself to get the best terms possible. Here’s how you can approach the process with an advantage:

-

Understand Seller Motivation: One of the most powerful things you can do in a negotiation is understand why the seller is selling. Are they trying to close quickly due to a job relocation, or are they in no rush?

Are they emotionally attached to the property or simply looking for a quick transaction? Knowing their motivation allows you to craft a tailored offer that appeals to their specific needs.

If they’re eager to close, for example, offering a quicker closing timeline could work in your favor without needing to increase your offer price.

-

Leverage Inspections: A property inspection can reveal issues that you can use as leverage in negotiations.

Instead of viewing repairs as a hurdle, consider them an opportunity to ask for either a lower purchase price or a credit at closing to cover repair costs. This allows you to keep your initial offer competitive while securing concessions after the inspection.

-

Include an Escalation Clause: In a competitive market, you can include an escalation clause in your offer.

This clause is a provision in your offer that automatically increases your bid by a specific amount if another competing offer comes in higher. You set a maximum cap to ensure you don’t overpay.

This strategy helps you avoid getting outbid without blindly raising your offer price from the start and ensures you remain competitive in bidding wars while keeping control of your budget.

-

Request Seller Concessions: If you’re pushing your budget on the purchase price, consider asking for seller concessions instead of a price reduction.

These are costs that the seller agrees to cover—such as part of the closing costs or even home warranty fees—that can ease your financial burden while still keeping the seller satisfied with the overall deal.

-

Control the Timeline: While flexibility can make your offer more attractive, controlling the timeline can also work to your advantage.

For example, setting a shorter deadline for accepting your offer can apply subtle pressure on the seller to act quickly. Alternatively, offering an extended closing date could benefit sellers who need time to vacate or relocate, without you needing to adjust your offer price.

-

Use Multiple Points of Negotiation: Don’t focus solely on the price of the property.

By keeping negotiations open on other terms—such as contingencies (like inspection or financing), repairs, or even personal property (such as appliances, furniture, or fixtures)—you create opportunities for flexibility.

For example, you might agree to take care of certain repairs yourself in exchange for a lower price, or request that the seller include specific appliances as part of the deal.

This way, you can “give” on something that matters less to you while “gaining” something that adds value to the deal.

Negotiating on multiple points allows both parties to feel like they’ve won, resulting in a smoother transaction where both you and the seller are happy with the final terms.

-

Know When to Stay Quiet: Sometimes the best move is to wait. After submitting an offer or counteroffer, giving the seller time to consider without pressing them can be a powerful tool.

Often, buyers get impatient and over-negotiate, when a bit of patience could have secured the deal on better terms.

Above all, understanding how to buy an investment property involves partnering with an experienced real estate agent. A skilled agent knows the subtle dynamics of negotiation and can help you navigate counteroffers, identify leverage points, and avoid costly mistakes.

Step 3: Due Diligence and Inspections

Before finalizing any property purchase, conducting thorough due diligence is essential.

This phase ensures that you’re fully aware of the property’s condition and any potential risks, giving you the opportunity to address issues before they become costly problems. Here’s how to approach this crucial step with precision.

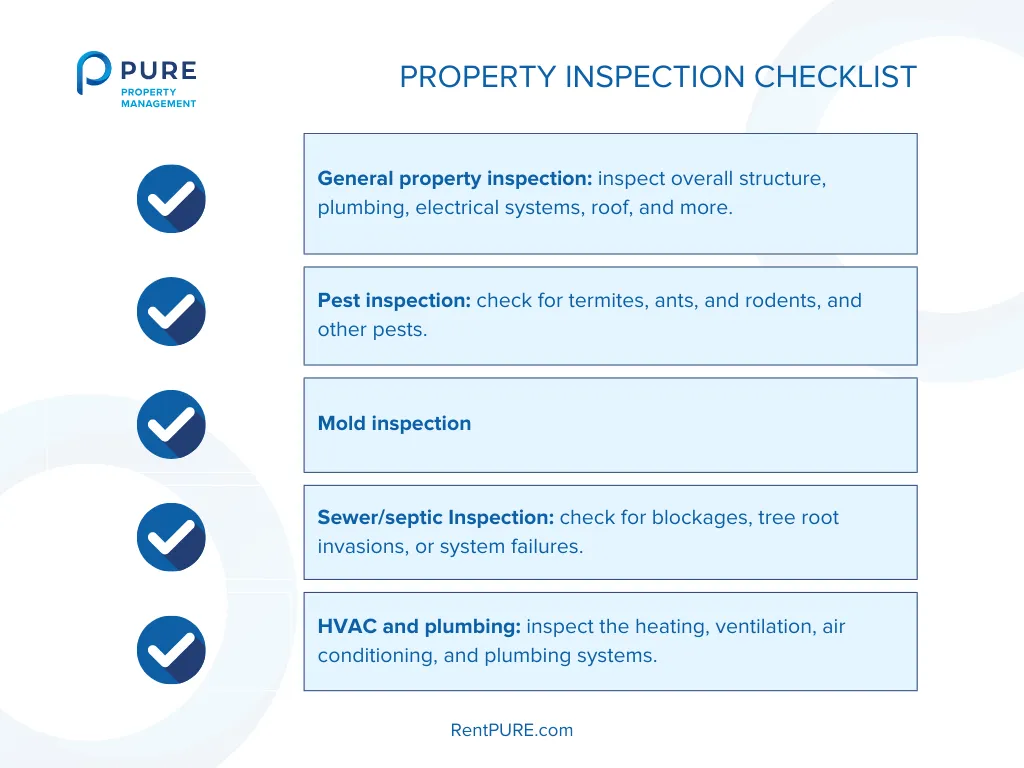

Property Inspections

A proper inspection can uncover problems that aren’t immediately visible, and it gives you leverage for negotiation.

More importantly, it can help you avoid costly repairs down the line. While many buyers opt for a general inspection, there are several specific inspections you should consider:

- General Home Inspection: This is your baseline. A licensed inspector will evaluate the property’s overall structure, plumbing, electrical systems, roof, and more. Their report will highlight any issues that require attention, from minor repairs to major structural concerns.

- Pest Inspection: Termites, ants, and other pests can cause significant damage over time. A pest inspection will reveal any signs of infestation or damage, allowing you to take action or negotiate repairs.

- Mold Inspection: Mold can sometimes go unnoticed in damp or poorly ventilated areas. A mold inspection ensures that you’re not dealing with a health hazard or costly remediation efforts.

- Sewer/Septic Inspection: For older homes or properties with private septic systems, a sewer inspection can uncover hidden issues like blockages, tree root invasions, or system failures.

- HVAC and Plumbing: If these systems are aging or poorly maintained, repairs or replacements can be expensive. An inspection of the heating, ventilation, air conditioning, and plumbing systems gives you a clear idea of their current condition and lifespan.

Thorough inspections help you either negotiate for repairs or walk away from a deal that would otherwise become a money pit. If major issues are found, this is your opportunity to request a price reduction or a credit at closing.

Title Search and Insurance

Before finalizing your investment, it’s essential to ensure that your ownership rights are fully protected.

Two key components of this process are the title search and title insurance. Together, they verify the property’s legal standing and safeguard you from any potential issues that could arise after closing.

Title Search

A title search is one of the most important parts of due diligence when buying property. It’s a detailed investigation of public records conducted by a title company or escrow company. The goal of a title search is to verify that the seller legally owns the property and has the right to sell it.

This process involves reviewing documents such as deeds, tax records, and court filings to ensure that there are no liens, claims, or legal disputes tied to the property that could affect your ownership. A title search also uncovers any easements (legal rights that allow others to use part of the property) or covenants (restrictions on how the property can be used).

For example, if there’s an easement that allows utility companies access to a portion of your land, or a covenant restricting certain types of renovations, these factors could impact your investment plans. Make sure to ask your title company for full transparency on any restrictions tied to the property.

Title Insurance

Title insurance is equally important and protects you from unforeseen claims on the property, such as unpaid property taxes, outstanding liens, or clerical errors in public records. Once the title search is completed, title insurance acts as a safeguard against any potential legal challenges to your ownership.

Title insurance is a one-time cost paid at closing, and it shields you from expensive legal battles or even the loss of the property itself. For example, if an undisclosed heir or an unpaid tax lien surfaces after you’ve purchased the property, title insurance will cover the legal costs to resolve the issue or compensate you if necessary.

It’s worth noting that title insurance is mandatory if you’re using a lender, but even if you’re buying the property in cash, purchasing title insurance is a small price to pay for long-term peace of mind. Without it, unresolved issues could arise that lead to legal disputes or jeopardize your ownership.

Appraisal

An appraisal is required by lenders to ensure that the property is worth the amount you’ve agreed to pay.

An appraisal is a formal, written document created by a licensed appraiser. This document provides an objective estimate of a property’s fair market value, which is determined after a thorough inspection of the property and comparison to recent sales of similar homes in the area (often called “comps”).

The appraisal report typically includes details about the property’s condition, size, location, and features, along with the appraiser’s analysis of the local real estate market.

If the appraisal comes in lower than the agreed-upon price, it gives you leverage to renegotiate the price or request concessions from the seller. Keep in mind that an appraisal protects your investment when buying a rental property by confirming that you’re not overpaying in a hot market or for a property with inflated pricing.

While an appraisal is standard practice, buyers should be aware of potential delays in the appraisal process, especially in competitive markets where appraisers are in high demand.

Delays could push back your closing date, so it’s worth coordinating early with your lender and staying on top of the timeline.

Also, if you’re concerned about the appraisal coming in below the offer price, it’s a good idea to include an appraisal contingency in your contract.

An appraisal contingency is a key part of how to buy an investment property. It protects you by allowing renegotiation or even walking away if the property’s appraised value doesn’t match the agreed-upon price. This is particularly important in fast-moving markets where prices can fluctuate or be overly aggressive.

Step 4: Closing the Deal

Once negotiations are complete and all contingencies are satisfied, the final step is closing the deal. But there are still a few important details to handle before the keys are in your hand. Here’s how to navigate the closing process with confidence.

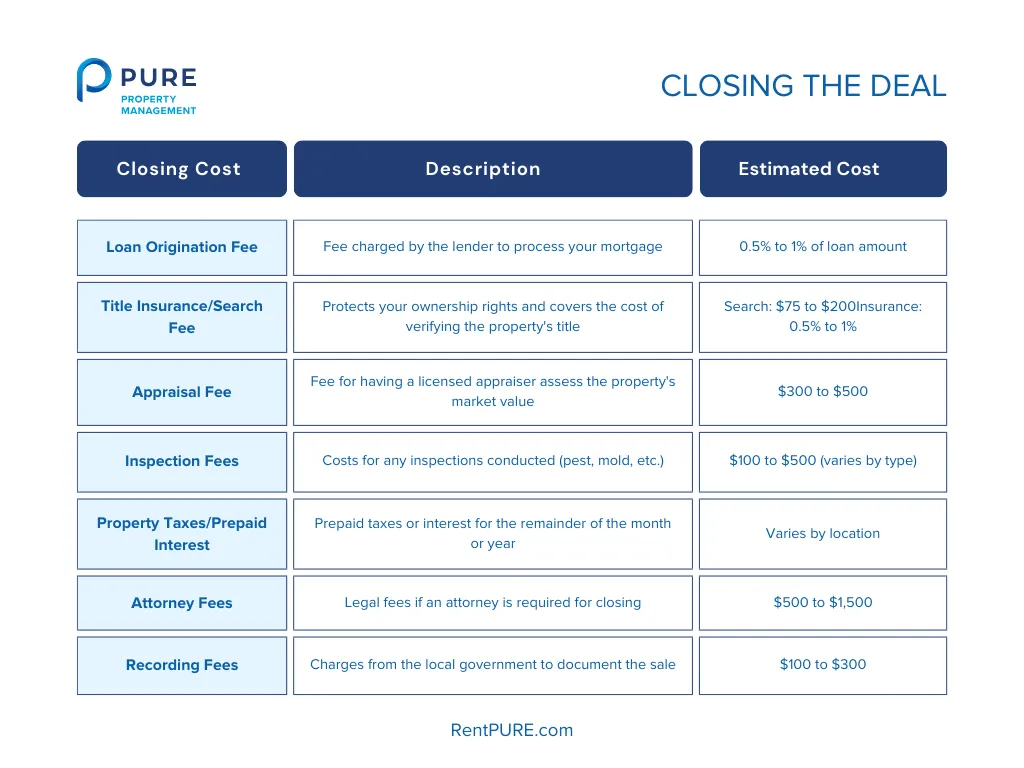

Closing Costs and Fees

Closing on a property involves more than just signing paperwork—it also comes with a variety of fees, collectively known as closing costs. According to Zillow, you can expect to pay around 3% to 5% of the home’s total price in closing costs. Your local real estate agent can help you estimate what to expect.

These can vary depending on location and the specific deal, but here’s a general breakdown of what to expect:

Please note that these fees are a general guide and they may differ in your location.

To avoid surprises, follow these steps:

- Understand Prepaid Items vs. Closing Costs: It’s important to differentiate between closing costs and prepaid items like property taxes and homeowner’s insurance. Prepaid items are expenses you’ll cover upfront for future services, while closing costs are related to the transaction itself.

- Review the Closing Disclosure: A few days before closing, you’ll receive a Closing Disclosure, which details every cost you’re responsible for. Carefully review this document and compare it to your initial loan estimate to ensure everything is accurate. Double-check all fees and reach out to your lender or closing agent if anything seems off.

- Negotiating Closing Costs: You may also be able to negotiate certain closing costs with the seller. This is particularly common in buyer’s markets. You can ask for seller concessions or closing credits to help cover some of these expenses.

- Property Insurance: Some lenders require that the first annual premium for property insurance be paid upfront before closing. The premium can vary significantly depending on the location, level of coverage selected, and the property’s risk assessment. Make sure to budget for this cost and consult with your lender to understand the insurance requirements specific to your property.

Be sure to review your settlement statement carefully before closing. Unplanned expenses, such as prepaid interest or property taxes, can sometimes catch buyers off guard. A thorough review will help you avoid any last-minute surprises.

Final Walkthrough

Before the deal is officially sealed, a final walkthrough is essential. This step ensures that the property is in the condition you agreed upon and that any negotiated repairs have been completed. Here’s what to look for during your walkthrough:

- Check Repairs: Ensure that any repairs the seller agreed to have been completed as promised.

- Test Major Systems: Check appliances, plumbing, and heating/cooling systems to verify everything is functioning correctly.

- Inspect for New Damage: Make sure no new issues have appeared since your last visit. Pay close attention to walls, floors, and ceilings for any signs of damage.

Don’t rush through this process. If anything looks out of place, address it immediately. Once the sale is complete, it can be much harder to request repairs or credits for damages.

The walkthrough typically occurs within 24 to 48 hours before closing. If any problems arise, you can request that they be resolved before proceeding, or negotiate a credit to cover the cost of repairs.

Signing Documents and Transfer of Ownership

Finally, the closing process involves signing the necessary documents and transferring ownership. Here’s what happens during this final phase:

- Prepare Valid ID: It’s a small detail, but buyers should ensure they bring a valid, government-issued ID to the closing. Without it, they may not be able to sign the necessary documents, which could delay the process.

- Double-check Loan Terms: Before signing the mortgage agreement, it’s important to review the final loan terms (interest rate, monthly payments, etc.) to ensure nothing has changed since receiving the loan estimate. Mistakes or unexpected changes can sometimes occur between approval and closing, so verifying the terms one last time is crucial.

- Sign the Closing Documents: You’ll be signing several documents, including the mortgage agreement, deed, and settlement statement (which outlines the costs being paid by both parties). Review everything carefully, and don’t hesitate to ask questions if anything is unclear.

- Transfer of Ownership: Once all documents are signed, the property’s deed will be transferred into your name, and you’ll receive the keys. This officially makes you the new owner.

At this point, you’ll also need to provide payment for the down payment and closing costs (often via wire transfer or cashier’s check), and your lender will disburse the funds to the seller.

Lastly, avoid making any significant financial changes (such as applying for new credit) until after the transaction is finalized. Any major shifts in your financial status can delay or disrupt the closing process.

Step 5: Post-Closing Steps

Congratulations! The deal is done, and you’re now the proud owner of an investment property. But the real work begins after closing. To ensure long-term success, there are a few key steps you should take right away.

Property Management

One of the first decisions you’ll need to make is whether to manage the property yourself or hire a property management company. For investors with limited time, or those managing multiple properties, professional property management can make a big difference. Here’s why:

- Tenant Screening: Property managers handle all the heavy lifting when it comes to finding the right residents. They screen applications, check backgrounds, and ensure you’re leasing to responsible renters, which minimizes headaches down the road.

- Rent Collection: No need to worry about late payments—a property manager will take care of collecting rent, handling any delays, and even dealing with residents who fall behind.

- Maintenance and Repairs: Property managers arrange regular maintenance, handle emergency repairs, and coordinate with contractors so you don’t have to juggle everything on your own.

If you’re a hands-on investor, managing the property yourself may be appealing. But if you want to save time and reduce stress, professional management is often worth the investment, usually costing 8-10% of your rental income.

Insurance and Ongoing Maintenance

Securing the right insurance is key to protecting your investment.

Landlord insurance is a must—it covers risks unique to rental properties, including liability coverage if a resident or guest gets injured, protection against property damage, and even loss of rental income if the property becomes uninhabitable due to damage.

To keep the property in great shape and avoid costly repairs down the line, it’s smart to have a maintenance plan in place:

- Regular Inspections: Catch small problems before they become big ones by scheduling routine inspections. Checking things like plumbing, electrical systems, and the roof ensures you’re staying on top of any issues.

- Seasonal Maintenance: Have a checklist for each season to tackle tasks like cleaning gutters, maintaining HVAC systems, and checking for weather damage.

- Budgeting for Repairs: Plan for the unexpected. Set aside 1-2% of the property’s value each year to cover ongoing repairs and maintenance.

It’s also wise to build a financial buffer for emergencies—things like replacing a major appliance or dealing with a sudden roof leak. Having that cushion in place ensures you’re never caught off guard.

Finally, if you choose to manage the property yourself, building a good relationship with your residents goes a long way. Open communication, quick responses to maintenance requests, and treating residents fairly can encourage long-term leases and reduce resident turnover.

In Summary

Investing in real estate offers incredible opportunities, but to truly succeed, understanding how to buy an investment property is key. Throughout this guide, we’ve outlined the essential steps to set you up for success in buying and managing your investment property. Here are the key takeaways:

- Prepare Your Financials: Securing financing and ensuring your credit score is in good shape are crucial. Pre-approval strengthens your offer, while understanding all the costs involved—from down payments to closing fees—prevents surprises.

- Craft Smart Offers: In a competitive market, it’s not just about the highest bid. Leverage tactics like earnest money deposits and flexible timelines to make your offer stand out, and use negotiations wisely to secure favorable terms.

- Do Your Due Diligence: Inspections, title searches, and appraisals protect you from hidden issues and inflated prices. Skipping this step can lead to costly problems down the road.

- Navigate Closing Efficiently: Review your Closing Disclosure carefully, conduct a final walkthrough to ensure repairs are made, and be mindful of closing costs. A smooth closing process makes the transition to ownership easier.

- Post-Closing Success: Whether you hire a property manager or handle things yourself, staying on top of maintenance and protecting your investment with landlord insurance are key to long-term profitability.

Taking the time to plan, negotiate smartly, and manage your property effectively will ensure your investment delivers lasting returns.

You can learn more about what comes after buying a rental property in the following resources: