Small Multifamily Investing 101: A Comprehensive Guide to Duplexes, Triplexes, and Quads

Small multifamily properties—like duplexes, triplexes, and fourplexes—are often seen as the sweet spot of real estate investing.

They offer the stability of multiple income streams without the intense management requirements of larger apartment buildings.

For experienced investors, they’re a way to expand portfolios without overextending. For beginners, they present an accessible step up from single-family rentals, providing an opportunity to learn the ropes of managing multiple residents while still keeping risk at a manageable level.

These properties blend the best of both worlds, making them versatile investments that adapt to different market conditions. Whether you’re looking to generate passive income, diversify your portfolio, or take advantage of financing opportunities unique to these property types, small multifamily investments are worth exploring.

If you are a beginner, check out our complete guide on investing in rental property.

In this guide, we will walk you through the essential aspects of investing in small multifamily properties. You’ll discover how to identify the right properties, evaluate investment potential, secure financing, and manage your investment efficiently. By the end, you’ll have the knowledge and confidence to navigate the complexities of small multifamily investing, whether you’re stepping in for the first time or looking to refine your existing strategies.

Understanding Small Multifamily Properties

What is a Small Multifamily Property?

Small multifamily investing generally involves residential buildings with two to four units, typically categorized as duplexes (two units), triplexes (three units), and fourplexes (four units). These properties fall within a unique niche in real estate, allowing investors to gain experience managing multiple residents without the large-scale complexities of larger apartment complexes.

Unlike single-family homes, small multifamily properties offer multiple income streams from a single location, creating a more consistent cash flow.

Key Characteristics and Unique Appeal

Small multifamily properties share a few defining features that make them popular among investors:

- Fewer Units, Lower Complexity: With only a handful of units, they’re generally easier to manage than larger buildings, requiring less extensive infrastructure, maintenance, and property management services.

- Residential Zoning and Mortgage Flexibility: Because they are smaller, they often fall under residential rather than commercial zoning regulations, making financing more straightforward and affordable.

- Unique Financing Options: These properties often qualify for residential mortgages, including FHA and VA loans, allowing investors to access favorable loan terms similar to those of single-family homes.

A Closer Look at Duplexes, Triplexes, and Quads

- Duplexes: These are properties with two separate units, often with their own entrances and utilities. Duplexes are a great entry point for new investors, as they’re relatively straightforward to manage and may even allow for owner-occupancy, where you live in one unit and rent out the other.

- Triplexes: Offering three separate units, triplexes increase income potential slightly but may come with added management responsibilities. Triplexes are still relatively low-maintenance, making them appealing for investors seeking manageable growth.

- Fourplexes (Quads): As the largest in this category, fourplexes offer four units, maximizing income potential while staying within residential financing guidelines. They provide a balance between single-family investments and larger multifamily properties, delivering a more robust income stream for the same property.

This is a great resource if you’re interested in learning more about the different types of rental properties available.

Small vs. Large Multifamily Properties: Key Differences

Investing in small multifamily properties differs significantly from large multifamily properties in key ways, which can influence both the management approach and the level of financial commitment.

- Scale and Management: Large multifamily properties, such as apartment buildings with ten or more units, often require on-site management teams or property management companies, as day-to-day operations can be extensive. Small multifamily properties are more manageable, and usually feasible for self-management or a single part-time property manager, although small multifamily property owners can greatly benefit from property management companies too.

- Financing and Regulations: Small multifamily properties (up to four units) qualify for residential loans, generally with lower interest rates, down payment requirements, and less stringent qualification criteria than commercial loans required for larger properties. However, this also means large multifamily buildings can unlock different financing structures, such as syndications, that allow investors to pool resources and invest on a larger scale.

- Resident Relations and Vacancy: Small multifamily investments offer flexibility in resident relations, as they involve fewer households than large complexes. However, with fewer units, the impact of a vacancy can be more noticeable. With only two to four units, each resident’s payment contributes more to the overall income, making resident stability crucial for a steady cash flow.

For investors weighing the benefits and drawbacks of small versus large multifamily properties, these differences are essential when planning long-term portfolio growth, financing, and management approaches. Small multifamily properties can be a great introduction to managing multiple residents and a reliable way to generate income without the intensive demands of larger investments.

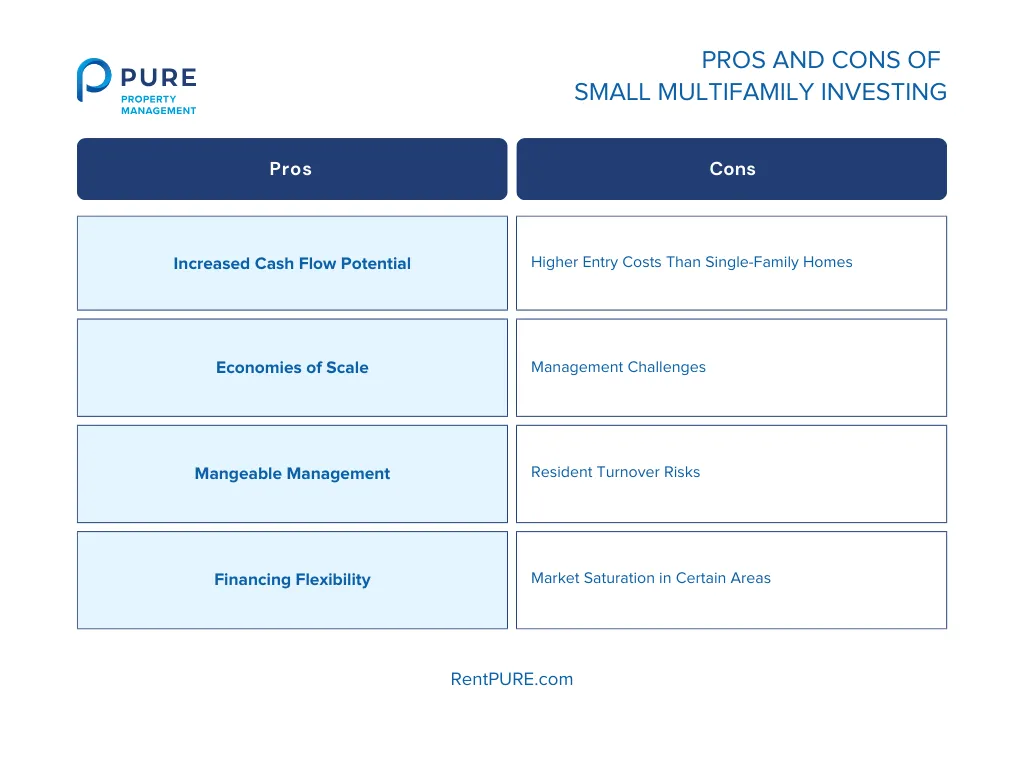

Weighing the Pros and Cons of Small Multifamily Investing

Investing in small multifamily properties has advantages and challenges unique to this property type. Understanding these pros and cons can help investors make strategic, informed decisions about duplexes, triplexes, or quads.

Advantages of Small Multifamily Investments

- Increased Cash Flow Potential

With multiple units in one property, small multifamily investments generate multiple income streams from a single location, enhancing cash flow and creating a more consistent monthly income than single-family rentals. - Economies of Scale

Managing a few units under one roof allows investors to spread expenses across several rental incomes. Costs like maintenance, property taxes, and insurance are consolidated, leading to lower per-unit costs and higher net profits. - Manageable Management Requirements

Small multifamily properties can seem manageable, but professional property management can streamline key tasks like tenant screening and maintenance. This reduces vacancy risks and maximizes returns, allowing investors to focus on broader goals. - Financing Flexibility

Small multifamily properties are eligible for residential financing options, including FHA and VA loans, with lower interest rates and down payment requirements. This provides easier access to financing, especially for first-time investors or those looking to maximize leverage.

Challenges of Small Multifamily Investments

- Higher Entry Costs Than Single-Family Homes

Due to the increased number of units, purchasing a duplex, triplex, or fourplex requires a larger initial investment than single-family properties. This can lead to higher purchase prices and larger down payments. - Management Challenges

Although smaller than large complexes, small multifamily properties still demand more management than single-family homes. Investors need to coordinate maintenance, address resident issues, and handle multiple leases, which can be especially challenging for new investors.

Additionally, some states and municipalities impose specific regulations on small multifamily properties that must be considered. These rules can add complexity to management, often making professional property management a practical necessity. - Resident Turnover Risks

With only a few units per property, the impact of resident turnover is more pronounced. When they leave, residents can take a considerable portion of the property’s income Consistent resident management is necessary to reduce vacancies and maintain cash flow. - Market Saturation in Certain Areas

In some markets, small multifamily properties can be highly competitive, leading to limited availability and higher prices. Additionally, in saturated rental markets, attracting residents may be more challenging, which can impact profitability and rent prices.

Here’s a quick summary of the pros and cons of investing in a multifamily property.

Who Should Consider Investing in Small Multifamily Properties?

Small multifamily properties create exciting opportunities for various types of investors. From first-time buyers to seasoned portfolio builders, these properties offer adaptable strategies to suit different goals, skill levels, and investment approaches. Knowing if this property type aligns with your profile and goals can lead you to long-term success.

Ideal Investor Profiles

- First-Time Investors

Small multifamily properties give new investors an accessible way to enter multifamily real estate. With just a few units, these properties make learning essentials like property management, resident relations, and cash flow analysis easier without the complexities of larger complexes. - Owner-Occupants

Small multifamily properties appeal to owner-occupants looking to live on-site while generating rental income. By residing in one unit and renting the others, you can offset your housing costs and often qualify for favorable financing options like FHA loans. This strategy lets you experience property management firsthand, helping you build equity while reducing personal housing expenses. - Investors Seeking Portfolio Diversification

Seasoned investors use small multifamily properties to add stable, cash-flowing assets to their portfolios. These properties generate multiple income streams and generally offer greater resilience during market fluctuations than single-family homes, making them a valuable addition to a diverse portfolio.

Assessing Your Investment Goals

Take a close look at your goals and resources to determine if small multifamily properties align with your strategy.

- Risk Tolerance

Small multifamily properties carry less risk than large complexes but require more oversight than single-family rentals. Consider how comfortable you are with managing multiple residents, handling turnover, and keeping cash flow steady. - Time Commitment

Managing a small multifamily property takes more time than single-family rentals, especially if you self-manage. Evaluate whether you’re ready to handle resident interactions, maintenance, and lease agreements or if you’d rather bring in a property management service. - Financial Resources

With higher purchase prices than single-family homes, small multifamily properties require a more significant initial investment. Ensure you have enough capital for down payments, reserves, and repairs. Strong financial preparation can make this investment more rewarding over time.

These profiles and goals offer a practical roadmap to determine whether small multifamily properties match your investment style and resources. Whether you’re just starting out or expanding, a clear sense of purpose can guide you toward a sustainable real estate portfolio.

How to Find Small Multifamily Properties

Locating promising small multifamily properties requires market insight, strategic searches, and evaluation skills. Here’s a streamlined approach to finding and assessing your next investment. If you want to know more about how to find rental properties, check out our complete guide.

Market Research and Location Analysis

When beginning with small multifamily investing, start by identifying promising locations. Look for areas with strong rental demand, stable or growing populations, and positive economic trends. Analyzing neighborhood specifics—like job opportunities, school quality, and nearby amenities—will give you a sense of long-term property value and rental potential.

Property Search Strategies

Use a combination of resources to find the best options:

- Real Estate Agents: Work with agents experienced in multifamily properties. They often have insights into local markets and access to properties before they hit major listings.

- Online Listings and Marketplaces: Platforms like Zillow, Realtor.com, and LoopNet can offer a range of multifamily listings.

- Networking and Off-Market Deals: Many multifamily properties change hands off-market. Networking with local investors, joining real estate groups, and connecting with property owners can uncover exclusive opportunities.

Evaluating Potential Investments

- Property Inspections: Conduct thorough inspections to assess each unit’s condition and maintenance needs. This will help you estimate repair costs and avoid unexpected expenses.

- Financial Analysis and ROI Calculations: Evaluate the property’s financials, including current rent, operating expenses, and potential cash flow. Calculating the return on investment (ROI) helps ensure the property meets your income goals and fits your broader investment strategy.

Purchasing Small Multifamily Properties

Each stage, from negotiation to closing, plays a crucial role in securing a strong investment when purchasing a small multifamily property. Here’s a balanced approach to navigating the purchase process.

Negotiating the Deal

Approach negotiations with a solid offer strategy. Aim to present a competitive offer while leaving room to negotiate terms that benefit you, like repairs or seller credits. Including contingencies—such as financing approval and property inspections—can provide leverage and allow you to back out if issues arise.

Due Diligence and Legal Considerations

Conduct a detailed inspection during due diligence to uncover any property issues and estimate repair costs. Review zoning laws to ensure the property’s use aligns with local regulations. If the property already has residents, examine existing lease agreements to understand the terms of the lease and responsibilities for maintenance. This step helps you avoid legal complications and ensures stable cash flow from day one.

Closing Process

In the closing phase, confirm that all documentation is in order, including title searches, loan paperwork, and inspection reports. Be prepared for various closing costs, such as title insurance, attorney fees, and recording fees, which are necessary to finalize the sale. Having a clear understanding of these fees upfront will help you budget accurately.

Financing Your Small Multifamily Investment

Securing the right financing can significantly improve the profitability of your small multifamily investment. Here’s a quick guide to financing options and preparation steps, but make sure you read our article dedicated to financing a property for more information on the topic.

Financing Options

- Conventional Mortgages: These standard loans offer competitive rates for investors with strong credit, typically requiring a 20–25% down payment. They’re a good fit for investors who meet higher credit standards and can afford the upfront costs.

- FHA and VA Loans: For owner-occupants, FHA loans (with as low as 3.5% down) and VA loans (with no down payment for veterans) can be attractive options. These loans are designed to make homeownership more accessible, but they require that you live in one of the units.

- Portfolio and Commercial Loans: For those seeking to build a multifamily portfolio, portfolio or commercial loans allow more flexibility with financing terms. They often come with higher rates but fewer restrictions, making them ideal for larger or multiple investments.

Preparing for Financing

- Credit Score Requirements: Most lenders require a good to excellent credit score for investment properties. Aim for a score above 700 to secure favorable terms, though some loans may have slightly lower requirements.

- Down Payments and Reserves: Expect to put down up to 30% or more, depending on the loan type. Lenders may also require cash reserves to cover several months of mortgage payments, especially for multifamily properties.

Working with Lenders

- Choosing the Right Financial Institution: Look for lenders experienced with multifamily investments, as they’ll understand the unique dynamics of these loans and offer more tailored guidance.

- Pre-Approval Process: Obtaining pre-approval helps clarify your budget and shows sellers you’re serious. This process involves submitting financial documents, running a credit check, and confirming loan eligibility, giving you an edge in competitive markets.

Managing Your Small Multifamily Property

Effective management keeps your small multifamily property profitable and helps avoid unnecessary stress. Focusing on strong resident relationships, clear responsibilities, and proactive maintenance can make all the difference in long-term success.

Property Management Choices: Self-Management vs. Hiring a Professional

- Self-Management

Taking on management yourself provides complete control over your property and can cut costs. For investors with fewer units, a nearby location, and hands-on skills, self-management offers a budget-friendly approach. However, managing residents, handling maintenance, and staying on top of legal responsibilities require time and commitment. - Hiring a Professional

Professional property managers take care of resident relations, property upkeep, rental turnover, and ensure compliance with local and state tenant-landlord laws. This can be especially helpful for investors with multiple properties or limited time. Although management fees typically range from 7–10% of monthly rent, experienced property managers often reduce vacancy rates and improve resident retention, adding value to your investment.

Key Responsibilities and Tasks

Whether you handle these tasks yourself or delegate them, clear management responsibility directly impacts resident satisfaction and property performance.

Resident Relations

- Screening Processes

Conduct a thorough resident screening to find reliable residents. Use a consistent process involving background and credit checks, income verification, and rental history. Effective screening increases the likelihood of securing long-term, responsible residents who pay on time and respect the property. - Lease Agreements

Utilize an explicit lease agreement to outline responsibilities, rent terms, maintenance expectations, and property policies. Well-structured leases help prevent misunderstandings and build a strong foundation for professional relationships with residents. - Conflict Resolution

Address resident issues early and with a solution-oriented approach to maintain a positive environment. Open communication, timely responses, and a willingness to mediate disputes reduce turnover and foster resident satisfaction.

Maintenance and Upkeep

- Routine Maintenance Schedules

Schedule regular maintenance for common areas and units to keep the property in excellent condition. Seasonal inspections for HVAC systems, plumbing, and electrical work, along with routine landscaping, prevent minor issues from becoming costly problems. - Budgeting for Repairs

Setting aside 1–3% of the property’s annual value for repairs helps you stay prepared for unexpected maintenance and future upgrades. Funds allocated for repairs allow prompt responses to issues, keeping residents satisfied and lowering turnover.

Careful management, attentive resident relations, and proactive maintenance strengthen your property’s performance. By approaching these responsibilities with a clear plan, you’ll see more consistent returns and longer-lasting resident satisfaction, making your small multifamily property a solid investment.

In Conclusion

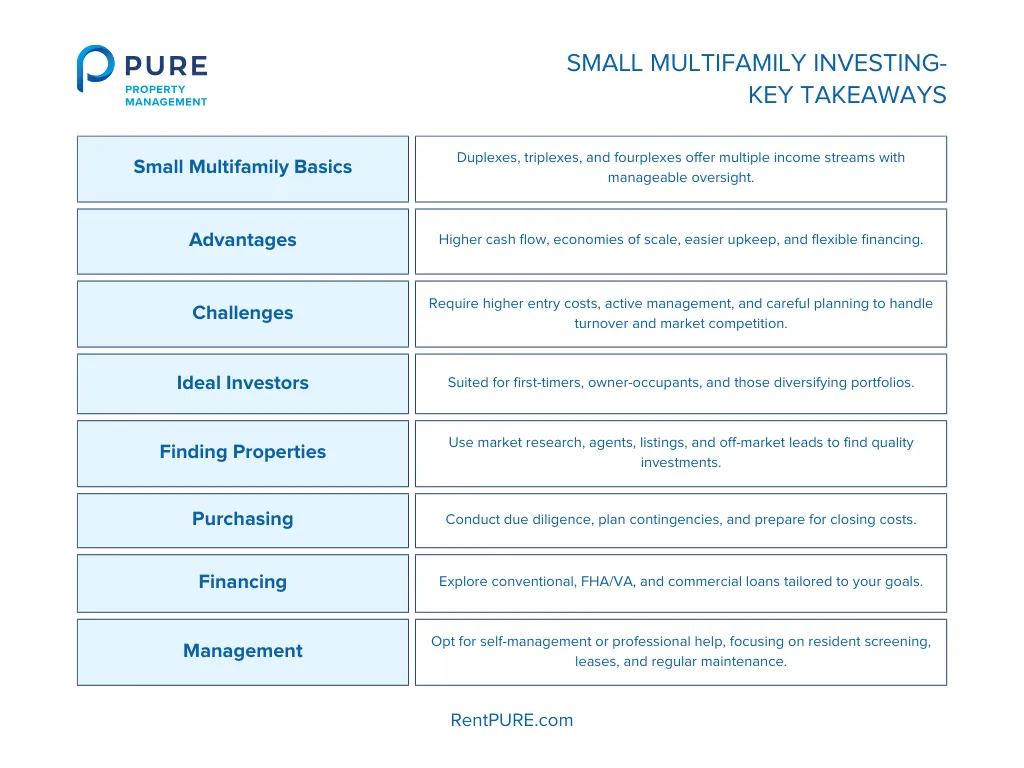

Small multifamily properties offer a unique and valuable entry into real estate investing, providing a balance between single-family homes and larger apartment complexes. Whether you’re just starting or aiming to diversify, these properties offer a variety of benefits and challenges that make them worth exploring. Here’s a recap to guide you through each essential area covered:

| Section | Details |

| Understanding Small Multifamily Properties | Learn how these properties combine multiple income streams with residential financing options, making them a versatile choice for investors of different levels. |

| Pros and Cons of Small Multifamily Investing | Pros: Cash flow potential, economies of scale, manageable management requirements, and access to residential loans.

Cons: Higher entry costs, management challenges, resident turnover, and market saturation risks. |

| Investor Profiles | First-Time Investors: Access an approachable way to learn multifamily management.

Owner-Occupants: Live on-site and generate rental income, often with favorable financing. Diversifiers: Add stability and cash flow to an established portfolio. |

| Finding and Evaluating Properties | Research strong markets, leverage agents and online resources, and consider off-market opportunities.

Conduct thorough property inspections and ROI calculations to ensure the investment aligns with financial goals. |

| Purchasing Process | Negotiate with contingencies, review zoning laws, and prepare for closing costs to make the purchase seamless and secure. |

| Financing Your Investment | Choose from options like conventional mortgages, FHA/VA loans, and commercial loans based on your goals, credit score, and down payment readiness. |

| Effective Management | Decide between self-management and hiring a professional.

Focus on resident screening, clear lease agreements, conflict resolution, and maintenance schedules to maintain resident satisfaction and property value. |

Small multifamily investing can be a rewarding addition to any portfolio, offering flexibility, potential cash flow, and a manageable approach to real estate. With careful planning and a clear strategy, you can maximize the benefits of this investment while building a strong foundation for future growth.

If you need help with purchasing or managing your multifamily rental, you can reach out to us.

If you’re interested in reading more about how to make your rental business successful, here are some great resources: