If you’re new to rental property investing, you might be wondering where to start.

Before we get into the details, though, you might also want to check out our article on what it’s like to manage rental properties day-to-day. It’s a great resource if you’re interested in understanding the practical side of being a landlord and working with residents.

Unlike flipping houses or developing new properties, rental investing involves purchasing a property with the goal of earning income by renting it out. This can offer a steady stream of income and the potential for property value appreciation over time.

In this guide, we’ll explore these different types of rental investments and how you can start and scale a successful rental portfolio. This is a step-by-step approach to investing in rental property for beginners.

Is Rental Property Right for You?

Before you jump into rental property investing, it’s important to ask yourself if it’s really the right fit for you. Owning rental properties can be a great way to earn income, but it does come with its own set of challenges.

If you want to know more about what the daily life of a landlord entails, check out our full landlord 101 guide, but here are are two things to think about:

Time Investment Needed

Investing in rental properties isn’t a “set it and forget it” kind of deal. It takes time, especially if you’re hands-on.

- Managing the property: Whether it’s finding residents or handling repairs, there’s always something that needs your attention.

- Unexpected surprises: Be ready for those late-night calls when something breaks or an issue pops up.

Of course, a hands-off approach where you hire a property manager to take care of your portfolio for you means you won’t need to spend much time at all.

Landlord Responsibilities

Being a landlord means more than just collecting rent. To truly understand how to invest in rental property, you’ll need to be on top of everything to keep your residents happy and your property in good shape.

- Maintenance and repairs: From fixing a leaky faucet to making sure the property meets safety standards, these tasks can add up.

- Legal know-how: You’ll need to understand the basics of tenant rights, lease agreements, and other legal responsibilities.

- Tenant screening: Finding the right tenants involves background checks, credit checks, and sometimes tough decisions about who to rent to.

- Rent collection and financial management: You’ll be responsible for collecting rent on time, handling any late payments, and keeping detailed financial records for tax purposes.

- Conflict resolution: Sometimes, things don’t go smoothly. You might have to deal with resident disputes, complaints, or even eviction proceedings.

What to know before searching for Properties

Before you start looking for properties, get clear on how you want to manage things and what type of rental setup you’re aiming for.

This will help you find the right property that fits your goals and lifestyle. Know whether you’ll handle management yourself or hire it out, and decide on the kind of rental terms that work best for you.

Management Style: DIY vs. Professional Property Management

Deciding between self-managing your rental property or hiring a professional impacts your time, finances, and involvement. Read more about management styles here.

Professional management offers convenience, legal expertise, and stress reduction but comes with added costs.

DIY management gives you full control and avoids fees but demands significant time, knowledge, and local availability.

Think about your goals, budget, and how involved you want to be. Weighing these factors will help you choose the management style that best fits your needs and ensures your rental property runs smoothly.

Establishing Your Rental Business Model

Before jumping into property hunting, it’s essential to define how you want your rental business to operate. Setting up a clear business model will guide your decisions and help ensure long-term success.

Read more about rental business models here.

Length of Tenancy

Decide on how long you want to rent out your property. Your options range from short-term to long-term, and even very long-term rentals, each with its own pros and cons.

Short-Term Rentals:

- Pros: Potential for higher profits, flexibility in rental periods, and easier access for maintenance and inspections.

- Cons: Inconsistent income due to seasonal demand, higher costs for furniture and maintenance, and the risk of negligent guests.

Long-Term Rentals:

- Pros: Consistent rental income, lower operating costs, and less frequent turnover, giving you more free time.

- Cons: Lower monthly income, potential long-term issues with difficult residents, and limited access to the property for addressing issues.

Very Long-Term Rentals:

- Pros: Extremely stable income with minimal day-to-day involvement.

- Cons: Lower rental income (around 60-70% of market value) and reliance on tenants to manage the property effectively.

Finding a Good Property

When you’re investing in rental property as a beginner, knowing what to look for pays off. Finding the right property matters because it will help you attract residents, generate income, and fit your long-term investment goals.

You should have a solid idea of what sort of property you want to purchase and also what a good rental property actually looks like:

Choosing What Type of Property to Invest In

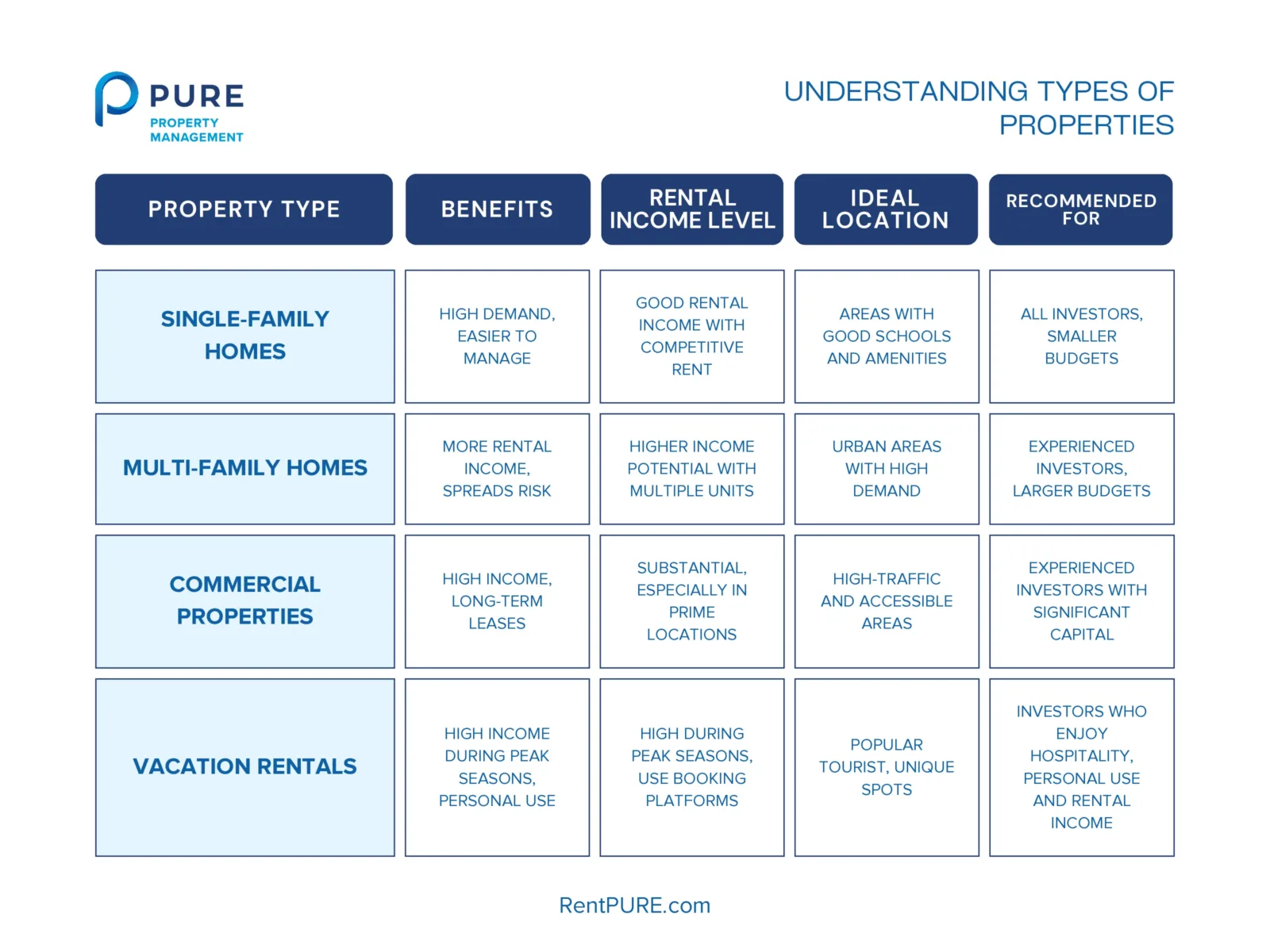

When starting out in rental property investing, it’s important to know the different types of properties you can invest in and how they align with your goals.

The type of property you choose will influence your initial investment, ongoing management, and potential returns. Whether you’re after simplicity or looking to maximize income, understanding the benefits and challenges of each property type will guide you in making the right choice.

- Single-family Homes: A great starting point for beginners—easy to manage and usually in high demand. You’ll get steady rental income, especially if you choose a good location.

- Multi-family Homes: If you’re ready to take on more responsibility, these can bring in more income since you have multiple residents. Just be prepared for higher costs and a bit more work. Learn the essentials of small multifamily investing in our in-depth post here.

- Commercial Properties: These can be a big moneymaker with long-term leases, but they do need a bigger upfront investment and some knowledge of the commercial market.

- Vacation Rentals: Perfect if you love the idea of hosting travelers. They can bring in a lot of money during peak seasons, but they do require more hands-on management with frequent guest turnover.

If you’re unsure whether to invest in single-family or multifamily properties, we have a full guide for you.

For investors ready to scale their portfolio, multifamily properties are an attractive option. These investments not only offer multiple income streams but also provide opportunities to build equity faster compared to single-family homes. However, succeeding in this space requires a solid understanding of the market and smart evaluation skills.

- If you’re curious about how to get started with multifamily real estate, check out our guide: How to Invest in Multifamily Real Estate.

- For those ready to analyze potential deals and determine their profitability, we recommend reading: How to Evaluate a Multifamily Investment Property.

Exploring these resources equips you with the insights needed to take confident steps toward multifamily investing success.

Indicators of a Good Rental Property

Deciding where you’re investing is one of the first steps to building your rental portfolio. You should give this blog post a read to find out more about the specifics of what the right investment property for you is.

Finding the right rental property is key to making your investment work. You want a place that’s easy to rent out, brings in steady income, and hopefully grows in value over time. Here are some things to keep an eye on:

- Location: Proximity to schools, public transportation, shopping centers, and low crime rates make a property more attractive to residents.

- Rental Demand: High demand in the area ensures lower vacancy rates and steady rental income.

- Property Condition: A well-maintained property with minimal required repairs reduces initial costs and attracts quality residents.

- Affordability: The property should be priced within your budget while offering a good return on investment (ROI).

- Potential for Appreciation: Look for areas with strong economic growth, as this can lead to property value increases over time.

- Competitive Rent: Research local rental rates to ensure your property can command a rent that covers expenses and generates profit.

- Low Property Taxes: Lower taxes can significantly impact your net income, so consider this when evaluating potential properties.

- Profitability Indicators: These are metrics which help you quickly analyze properties and identify which ones are good investments. You can read more about them here.

Financing the Property

When investing in a rental property, securing the right financing is crucial. There is a lot that goes into this, so we highly recommend you read our full guide on financing a rental investment property.

Start by exploring loan options tailored for investment properties:

- Conventional Loans: These are common for rental properties, typically requiring a 20% down payment. Interest rates may be slightly higher than for primary residences, but the terms are generally straightforward, making them a popular choice for investors.

- Investment Property Loans: These loans are specifically designed for purchasing rental properties. They often have stricter approval criteria, including higher credit score requirements and lower debt-to-income ratios. Down payments can also be higher, sometimes up to 25% or more.

However, these loans are structured to support the needs of landlords, offering features like interest-only payment periods or options that cater to the unique cash flow challenges of rental properties.

It’s important to shop around and compare offers from different lenders to find the best rates and terms. Since rental properties often involve larger down payments and higher interest rates, understanding your total costs is key.

Besides the loan, consider additional expenses like closing costs, property taxes, insurance, and any repairs needed to get the property rental-ready. These will affect your cash flow and overall return on investment.

Finally, getting pre-approved for your loan is essential. This not only clarifies your budget but also strengthens your position when making offers, showing sellers that you’re a serious, qualified buyer.

Purchasing the Property

Buying a rental property involves several key steps that ensure you make a sound investment. From securing financing to making an offer and closing the deal, each step is crucial to your success. Here’s a simple guide to help you navigate the process.

- Get Pre-Approved for a Loan: Start by talking to a few lenders to see what loan amount you can get. This helps you know your budget before you start looking at properties.

Make sure you have your financial paperwork, like tax returns and pay stubs, ready to go. Knowing what types of loans are available will also help you choose the best option. - Find a Real Estate Agent: Look for a real estate agent who knows about investment properties. They’ll be able to help you find a good deal and guide you through the buying process.

- Make an Offer: Once you’ve found a property you like, work with your agent to make an offer. It’s a good idea to include conditions, like being able to back out if the inspection shows major problems or if financing falls through.

- Get the Property Inspected: Hire a professional to inspect the property. They’ll check for any issues that need fixing. If something serious comes up, you can ask the seller to handle repairs or lower the price.

- Check the Market: Research the rental market in the area. Look at current rents, how easy it is to find residents, and whether property values are rising. This helps you set a competitive rent and ensures the property will be a good investment.

- Finalize Your Financing: Once your offer is accepted, finish up your loan process with the lender. They’ll likely require an appraisal to confirm the property’s value.

- Do a Final Walkthrough: Before closing the deal, walk through the property one last time to ensure everything is in order and any agreed repairs are done.

- Review the Paperwork: Carefully look over all the documents you’ll be signing. If anything is confusing, don’t hesitate to ask questions.

- Close the Purchase: Sign the final papers, pay any closing costs, and get the keys to your new property. Afterward, make sure the utilities are in your name and arrange for property insurance.

You can find out where to find the rental property of your choice here.

Transforming the Property into a Rental

Once you’ve bought your property, it’s time to turn it into a rental.

If you’re planning on running your rental business yourself, here’s a resource on managing your rental property efficiently. It will help you automate the activities mentioned below.

In the meantime, here’s what you need to focus on so you can get your property ready to rent out:

Marketing

To attract residents, you’ll need to get the word out about your rental. Listing it on popular rental websites, putting up a yard sign, or sharing it on social media are all effective ways to reach potential renters.

Resident Placement

Choosing the right resident is crucial. You’ll want to screen applicants to ensure they’re reliable—this might involve checking their credit, verifying their income, and talking to their previous landlords.

Resident Relations

Building a good relationship with your residents is important for a smooth rental experience. Be responsive to their needs, communicate clearly, and address any issues promptly. Good communication can prevent most problems.

Maintenance

Keeping your property in good condition requires regular maintenance. This could range from small fixes to bigger repairs, like plumbing or electrical work. Staying on top of maintenance helps you avoid more significant issues later.

Turnovers

When a resident moves out, you’ll need to get the property ready for the next one. This might mean cleaning, making repairs, or even doing some updates to keep the place attractive. The faster you can turn the property around, the less time it stays vacant.

Professional Property Management vs. DIY

You’ll need to decide whether to manage the property yourself or hire a professional. Managing it on your own can save money, especially if you have the time to handle resident issues and maintenance.

But if you’d rather take a step back, a property manager can handle everything for you, from finding residents to dealing with repairs and legal matters.

Hiring a property management company helps you run your rental business on autopilot.

Scaling Your Rental Portfolio

As you gain experience with your first rental property, you might start thinking about expanding your portfolio. Scaling a rental portfolio can increase your income and build long-term wealth, but it’s important to approach it in a manageable way, especially if you’re just starting out.

There’s a lot more that goes into scaling a rental portfolio than what’s mentioned below. If you want to know more, consider reading this piece on building a portfolio.

Set Clear Goals

Begin by setting clear, realistic goals for your portfolio. Think about how many properties you want to own and what kind of rental income you’re aiming for. Start small, like adding one property per year, and gradually increase as you gain more confidence and resources.

Focus on Market Research

Before purchasing additional properties, take time to research the market. Look for areas with strong rental demand, good growth potential, and reasonable property prices. Understanding local market trends will help you make informed decisions and avoid costly mistakes.

Diversify Your Investments

While it’s tempting to stick with what you know, diversifying your portfolio can reduce risk. Consider adding different types of properties, like single-family homes, multi-family units, or even properties in different locations. This variety can help protect your investments from local market fluctuations.

Leverage Financing Wisely

As you build equity in your existing properties, you can use it to help finance new purchases. Consider options like home equity loans, lines of credit, or even refinancing to free up cash. Just be careful not to overextend yourself—make sure you can comfortably manage your debt.

Hire a Property Management

Managing properties on your own can get overwhelming, especially as your portfolio grows.

If you’re finding it tough to keep up, hiring a property management company might be the solution. They can handle everything from resident issues to maintenance, giving you more time and less stress as you expand your investments.

Monitor Your Progress

Regularly review your portfolio’s performance to ensure you’re on track with your goals. Keep an eye on key metrics like cash flow, property value appreciation, and occupancy rates. Adjust your strategy as needed based on what’s working and what’s not.

Scaling your rental portfolio takes time and patience, but by setting clear goals, doing thorough research, and managing your properties wisely, you can steadily grow your investments and achieve your financial objectives.

In Conclusion

Investing in rental property is a great way to build wealth and create a steady income stream, but it’s important to start off on the right foot. By understanding the different types of properties, knowing what makes a good rental, and getting your financing in order, you’ll be well-equipped to make smart investment decisions.

As you get more comfortable with your first property, you might consider growing your portfolio. Investing in rental property for beginners means starting small, setting clear goals, and always doing your market research. Scaling doesn’t have to be overwhelming if you take it step by step and stay focused on your long-term objectives.

Every successful investor started with just one property. With the right approach, you can steadily grow your investments and reach your financial goals. Remember, the journey is just as important as the destination, so take your time and enjoy the process.