Finding the right investment property is key to building a successful rental portfolio. Whether you’re new to the game or have been doing this for years, knowing how to find investment properties that fit your goals is essential.

The right property can bring in steady income and help you grow your wealth, while the wrong one can cause headaches. In this post, we’ll show you how to find a good rental property to buy and all the places (virtual or otherwise) where you can find it.

Before we begin, though, if you are new to rental investing, we have prepared a quick guide that will help you learn everything you need to know to get started. It covers all the details of rental investing from starting to scaling.

If you already have a good idea of what rental investing entails, let’s get right into how you can find the right investment property for your rental portfolio.

Where to Find Investment Properties

Finding the right investment property can feel like searching for a needle in a haystack, but with the right approach, you can uncover opportunities that perfectly align with your goals.

Whether you’re a seasoned investor or just dipping your toes into the real estate market (in which case, you should start with our guide on how to become a landlord), there are plenty of sources to explore, both online and offline, to discover your next great deal.

1. Online Real Estate Marketplaces

Websites like Zillow, Realtor.com, and Redfin are fantastic starting points. These platforms allow you to filter your search by location, price range, property type, and even investment potential.

They provide a wealth of information, including property history, price trends, and neighborhood stats. For investors, sites like Roofstock are a game changer—they focus exclusively on properties that are either already tenanted or ready to rent out, often providing detailed financial analyses.

Don’t forget to explore platforms like LoopNet and Crexi if you’re considering commercial properties or multifamily units; they cater specifically to larger-scale investments.

2. Local Real Estate Agents

As an investor, you need to find an agent with experience in working with investors looking to expand their portfolio—someone who understands how to evaluate a property’s potential for profit, knows the local market trends, and has access to off-market deals (pocket listings).

These agents are also well-connected with property managers and contractors, making it easier for you to manage and improve your investment.

To find the right agent, ask for recommendations from other investors, and look for someone with a proven track record in helping clients achieve their investment goals.

3. Real Estate Wholesalers

Real estate wholesalers find and secure properties at below-market prices and then assign the contract to a buyer (like you) for a small fee.

These deals can be especially lucrative, but they often require quick decisions. Wholesalers are a great source for off-market properties that aren’t available to the general public.

You can connect with wholesalers through networking events, real estate meetups, or online forums, where many wholesalers list their latest deals.

However, please note that you need a certain level of competence in investing to work with wholesalers, so if you are beginning your investment journey, you may be better served by other investment opportunities.

4. Networking Events and Real Estate Meetups

In-person networking is often underestimated in today’s digital world, but it’s still one of the most effective ways to find investment opportunities.

Real estate investment clubs, meetups, and conferences offer you the chance to connect with other investors, wholesalers, and even landlords looking to sell.

These connections can lead to exclusive deals and provide valuable insights into the market. Many of these groups also have online forums or email lists where members share deals and tips. An excellent place to start your journey is Meetup.com, whee you can find local investor groups.

5. Local Auctions

Auctions, whether for foreclosures, tax liens, or estate sales, can be goldmines for investors willing to do their homework.

Properties sold at auction often come at a discount, but they usually require more due diligence on your part. You’ll need to research the property thoroughly since they are often sold as-is, with little to no opportunity for inspection.

Local government websites often list upcoming auctions, and you can also check out Auction.com or Hubzu for a wider selection of auction properties across the country.

6. Driving for Dollars

The tried-and-true method of “driving for dollars” is as simple as it sounds: drive around neighborhoods where you’d like to invest, looking for properties that appear vacant or poorly maintained.

These are often owned by people who might be eager to sell, especially if they’re struggling to keep up with the property’s condition.

Once you identify a potential investment, you can use tools like the county property appraiser’s website to find the owner’s contact information and reach out directly with an offer.

7. Public Records and County Clerk’s Office

Sometimes, the most valuable information is hidden in plain sight.

Public records and your local county clerk’s office can provide a wealth of data on pre-foreclosures, probate properties, and tax liens—properties that might not yet be on the market but could be bought at a discount.

By monitoring these records, you can get a jump on properties that are about to become available and reach out to the owners before anyone else does.

8. Real Estate Investment Trusts (REITs) and Crowdfunding Platforms

If you’re looking for a more hands-off approach, Real Estate Investment Trusts (REITs) and crowdfunding platforms like Fundrise or RealtyMogul allow you to invest in properties without having to buy them outright.

While this isn’t the same as owning a physical property, it’s an excellent way to diversify your portfolio and gain exposure to different types of real estate investments.

9. Word of Mouth and Personal Networks

Never underestimate the power of word of mouth. Letting friends, family, and colleagues know that you’re in the market for investment properties can lead to unexpected opportunities.

Someone might know of a neighbor who’s considering selling, or a friend might be moving out of state and looking to offload a rental property.

The more people who know you’re looking, the more likely you are to find hidden gems.

10. Online Communities

In today’s digital age, social media platforms like Facebook and LinkedIn can be surprising sources for real estate deals.

Joining local real estate groups or following pages dedicated to investment properties can give you access to off-market deals and insider information.

Online forums like BiggerPockets are also invaluable resources where experienced investors share deals, strategies, and advice.

11. Property Managers

Property managers can be a hidden gem when it comes to finding investment properties.

They manage a large portfolio of properties and often know owners who are looking to sell, sometimes even before the property hits the market. Because they understand the ins and outs of managing rental properties, they can also provide valuable insights into a property’s potential cash flow and any issues it might have.

Building a relationship with a reputable property manager could give you access to off-market deals and insider information that can help you snag the right investment before anyone else.

Plus, they can assist with managing the property after your purchase, making them a valuable long-term partner in your investment journey.

With so many avenues to explore, the key to finding the right investment property is persistence and creativity. Don’t rely on just one method—cast a wide net and keep your options open. The perfect property might be just around the corner, waiting for you to discover it.

What Makes a Good Investment Property?

When it comes to real estate, not all properties are created equal. Knowing how to find investment properties that not only meet your financial goals but also fit well with your long-term strategy is crucial.

It’s about finding the right balance between location, condition, and potential returns. Now that you are aware where to find potential investment properties, let’s look into the key factors that make a property a strong investment.

Financial Indicators of a Good Investment Property

Before you pick a rental property, it’s important to check a few key indicators that can tell you if it’ll be profitable. Here’s a quick overview:

- The 1% Rule: This is an easy way to see if a property might be a good deal. The idea is simple: the monthly rent should be ideally 1% or more of what you paid for the property, including all costs. Although these days it is pretty rare that a property will meet the 1% rule, getting close to that percentage is a good indicator that the property will cashflow. You can use tools like Zillow Zestimate to get a rough idea of rental rates.

- Net Operating Income (NOI): This is the money you have left after paying all the property’s expenses like maintenance and utilities. A good NOI is typically about 40% of your total rental income, showing you’re earning solid cash flow.

- Internal Rate of Return (IRR): IRR gives you an estimate of how much your investment could grow each year. It’s great for seeing the long-term potential, and online calculators like those on Calculator.net make it easy to figure out.

- Cash-on-Cash Return (CoC): If you’re using a loan to buy the property, CoC is important. It compares your yearly profit to the cash you put in, giving you a clear picture of your returns. If you bought the property without a loan, CoC will match your cap rate.

- Capitalization Rate (Cap Rate): Cap rate tells you how much profit your property makes each year compared to its current value. You find it by dividing your annual profit (after expenses) by the purchase price. A good cap rate usually falls between 4% and 10%.

- Capital Appreciation Potential: Consider the long-term growth in property value, influenced by market trends and developments in the area. A house in a neighborhood that’s growing may not bring in a lot of rent right now, but as the area improves, the rent could go up a lot.

Additionally, depreciation allowed to real estate investors can create a significant boost to your returns. Consult with your tax advisor to make sure you are taking full advantage of depreciation and the tax benefits of owning investment property.

The Right Market

If you’re planning to manage the property yourself, location is key. Being close by makes it easier to handle repairs, inspections, and resident turnovers without the hassle of long drives. Investing in a property near your home can save you time and stress.

But, if you’re thinking about hiring a property management company, proximity isn’t as important. A good property manager can handle everything for you, no matter how far away the property is, giving you peace of mind and more flexibility in where you invest.

In case you want to use a property management company, you have the freedom to invest in the most promising rental income locations, even if they’re far from where you live. This opens up opportunities in areas with high rental demand and strong returns.

But which markets are promising for rental investment? Overall, the best markets tend to be those with a growing population, economic stability, and increasing demand for rental housing. These factors make for a more secure and potentially profitable investment, whether the property is near your home or far away.

| KEY TAKEAWAY |

| Overall, the best markets tend to be those with a growing population, economic stability, and increasing demand for rental housing. |

An Attractive Location for Residents

The right location can make all the difference to your rental investment. Here’s why it matters:

- Resident Attraction: A good location attracts reliable residents who are more likely to stay long-term. Areas with strong amenities, low crime rates, and good schools draw residents who value these features, making your property more desirable.

- Rental Income: The right location directly affects how much rent you can charge. Properties in well-connected, thriving areas often command higher rents, boosting your overall income.

- Property Value: Investing in a growing area means your property’s value is likely to increase over time. This not only helps you build equity but also makes it easier to sell at a profit if you choose to down the road.

- Ease of Management: If your property is in a stable, well-maintained area, you’ll likely deal with fewer issues like resident turnover or property damage, making management smoother and less stressful.

Considering these points, here’s what a good location should look like:

Neighborhood Amenities

Look for neighborhoods with strong amenities like schools, parks, and low crime rates. These attract quality residents and keep demand high.

Transportation

Areas with good public transportation tend to offer better rental returns. Future development plans for new stops or stations can further increase property values.

Real Estate Development

More new building permits in the area is a great sign. High levels of development suggest the area is growing and could offer strong investment potential.

For more insights, talk to experts at property management companies or post questions on forums like Bigger Pockets, where experienced investors can share their thoughts on specific locations.

Good Vacancy Rates in the Area

A low vacancy rate means there’s strong demand for rentals, so you’re likely to fill your property quickly.

On the flip side, a high vacancy rate could mean there’s too much competition or not enough demand, which might leave your property sitting empty longer than you’d like.

You can find vacancy rates by checking real estate websites like Zillow or RentCafe, or by asking local property managers who know the area well. Knowing this number helps you pick a spot where your investment is more likely to stay rented and profitable.

Property Condition

When evaluating a property, its condition plays a major role in determining its potential as a rental.

Properties in Good Repair

A turnkey property that’s already in good shape usually requires less maintenance and can command higher rents. These homes might cost a bit more initially, but the reduced upkeep and ability to attract quality residents often result in better long-term returns.

Renovation Opportunities

On the other hand, some properties might need a little work. Basic renovations, like updating an outdated kitchen or bathroom, can drastically improve the property’s appeal and boost rental income.

New Construction

Some markets have significant new construction and development. Buying a new home can be more expensive, but can also command a higher rental value, have less short term maintenance, and be more attractive to potential residents.

There’s no universal rule here, so it’s essential to spend time researching and considering your options.

Amenities

When it comes to choosing a rental property, the basics matter: how many bedrooms and bathrooms it has, the overall size of the home, and those special features like a backyard, a garage, modern appliances, or even unique touches like a beautiful wooden floor or a cool chimney.

Modern kitchens and bathrooms are also significant selling points for residents. When figuring out how to find a good investment property, don’t be afraid of properties needing some amount of fixes—if they’re priced right, they can offer great opportunities to add value and increase your overall returns.

It’s important to note that finding an investment property is one thing, and growing a rental portfolio is another. Once you’ve started your rental business, you should know beforehand what your strategy for increasing your rental income is.

[BONUS] Things to Consider Before You Start Your Search

Before you start looking for a rental property, it’s important to think about a few key factors.

Your involvement level, the type of property, your investment style, finances, long-term goals, and the current market will all shape what makes the right property for you.

These considerations will guide you to a property that fits your needs and helps you reach your investment goals.

Is Being A Rental Investor Right for You?

Becoming a rental investor can be rewarding, but it’s not for everyone. Here are some key considerations to help you decide if it’s the right path for you:

Active Involvement:

As a rental investor, you’re not just buying property; you’re taking on a role that requires ongoing management. This includes:

- Resident Management: Handling resident issues, lease agreements, and ensuring your property is occupied.

- Maintenance and Repairs: Addressing repair needs and maintaining the property to keep it in good condition.

- Financial Oversight: Keeping track of rental income, expenses, and ensuring the property remains profitable.

Time Commitment:

Rental investing isn’t a hands-off venture. You’ll need to dedicate time to managing the property, addressing unexpected issues, and staying on top of your responsibilities.

Problem-Solving:

You’ll face challenges, from resident disputes to sudden repairs. Being a rental investor means being ready to solve problems as they arise.

If you enjoy being hands-on, are comfortable with financial management, and can handle the unexpected, rental investing might be a great fit for you. However, if these responsibilities seem daunting, it might not be the best choice. Consider hiring a property management company to help you out in that case.

In case you want to know more about what it’s like being a landlord, check out this resource.

The Types of Rental Properties You Can Invest In

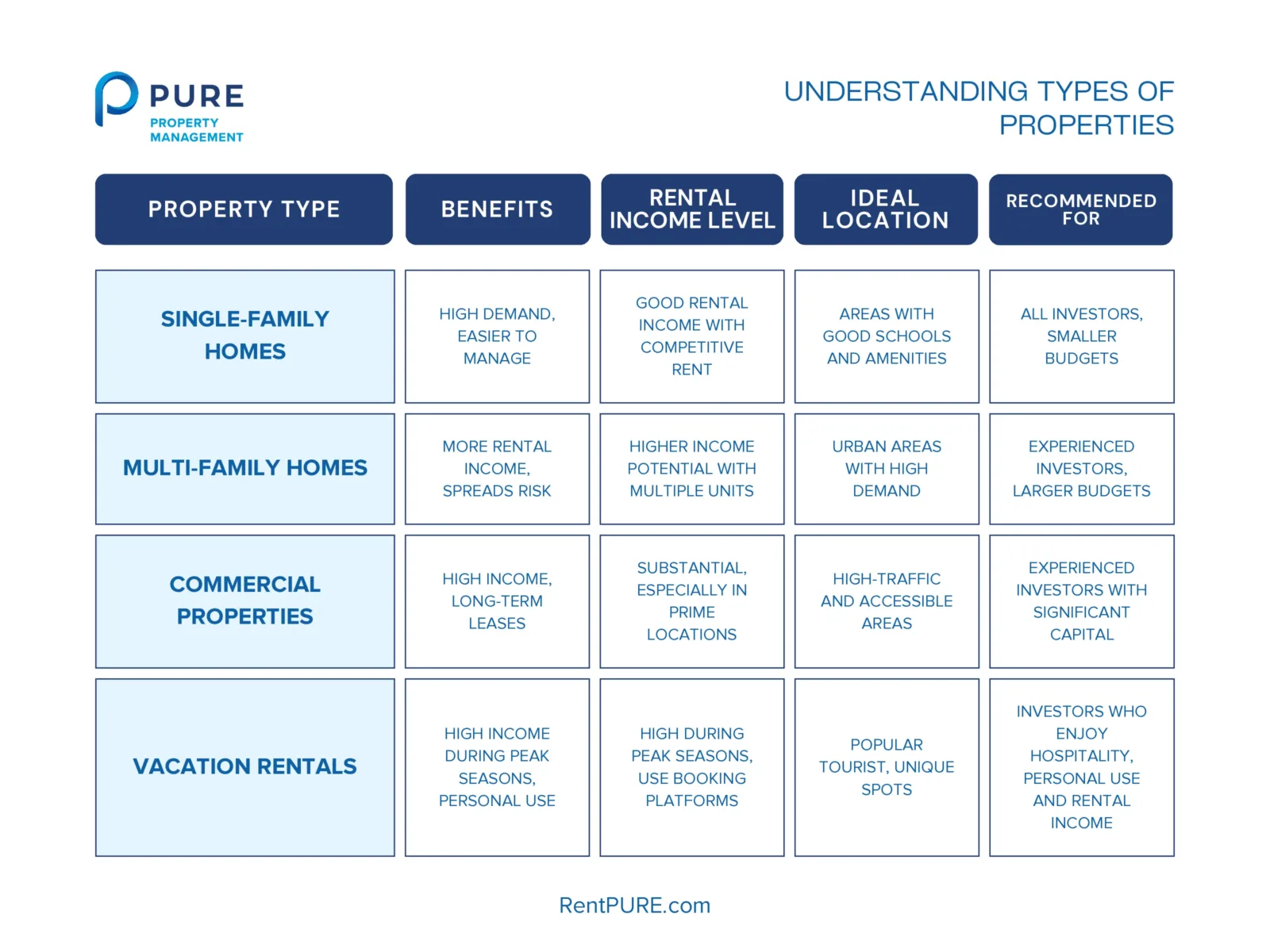

Choosing the right type of property is key to your success as a rental investor. Here’s a brief overview of the main options:

- Single-Family Homes: These are standalone houses built for one household. They’re easier to manage because you only deal with one resident or family, making them a great starting point for beginners. Plus, they’re usually in high demand, which can make finding residents easier.

- Multi-Family Homes: These properties have multiple units, like duplexes, triplexes, or small apartment buildings. They can generate more rental income because you’re renting to multiple residents at once. However, they require more management and upkeep, so they’re better suited for those with some experience.

- Commercial Properties: These include spaces like office buildings, retail stores, or warehouses. Commercial properties often come with long-term leases and can provide steady, high rental income. But they also require a larger initial investment and involve more complex management, making them ideal for seasoned investors.

- Vacation Rentals: These are properties rented out short-term to travelers, often in popular tourist areas. They can be very profitable during peak seasons, and you also have the flexibility to use the property yourself. However, they require more hands-on management and marketing to keep bookings consistent.

Read this article if you want to know more about what each type of property offers so you can align your investment goals properly.

Understanding Your Rental Investment Style

When it comes to rental investing, your style can greatly impact your overall investment strategy and expected outcomes. Here are a few things to keep in mind:

- Hands-On (Active Management): If you prefer being directly involved, this style is for you. You’ll handle everything from resident screening to maintenance and repairs. This approach gives you control over every aspect but also requires more time and effort.

- Hands-Off (Passive Management): If you’d rather not manage the day-to-day details, you can hire a property manager to take care of things. This style is ideal for those who want to enjoy the benefits of rental income without the hassle of managing the property themselves.

- Short-Term vs. Long-Term Rentals: Short-term rentals, like vacation homes, can offer higher income during peak seasons but require more frequent resident turnover and management. Long-term rentals, on the other hand, provide stable, consistent income with less frequent resident changes.

- Growth vs. Cash Flow: Some investors focus on properties that will appreciate in value over time (growth), while others prioritize properties that generate steady, immediate income (cash flow). Understanding which is more important to you will help guide your investment decisions.

Choosing the right investment style depends on your goals, how much time you can dedicate, and your level of experience. Whether you’re hands-on or prefer to take a backseat, there’s a rental investment style that can suit your needs.

Financial Readiness and Planning

You should have a good understanding of your financial standing and long-term goals so you can plan accordingly and know what to expect from your rental investments.

Make a thorough assessment based on the following aspects:

Negative Cash Flow Tolerance

Can you handle a situation where you’re spending more money on the property than you’re making, especially for the first 1-2 years?

Some properties, especially those needing renovations, might not generate enough rental income right away to cover all your expenses. You need to be ready to cover these costs out of pocket until the property starts bringing in steady cash flow.

If you believe the long-term gains are worth it, this can be a smart move, but it requires careful planning. If you’re looking for faster results, you should look into short-term rental investing.

Financing Options

How will you pay for the property? If you need a loan, consider how the interest rates and loan terms will affect your monthly payments and overall cash flow. A higher interest rate could mean higher payments, which might squeeze your profits.

Understanding these details before committing is important so you can plan your finances accordingly.

Emergency Fund

Do you have money set aside for unexpected costs, like repairs or vacancies? Even with a well-maintained property, things can go wrong—appliances might break down, or you might go a month or two without a resident.

Having an emergency fund ensures that these surprises don’t derail your investment.

Long-Term Investment Goals

When you’re investing, you should ask yourself what your long-term investment plans are. Focus on the following:

Investment Horizon

How long do you plan to keep the property? Your timeline will guide your investment strategy.

If you’re looking to flip the property quickly, you’ll focus on short-term gains. But if you’re in it for the long haul, you’ll want to consider properties that will appreciate over time and provide steady rental income.

Exit Strategy

What’s your plan for when you’re ready to move on from this investment?

Knowing how to find a good rental property is just the first step; whether you plan to sell, refinance, or hold onto the property indefinitely, having an exit strategy helps you make decisions that align with your long-term goals.

Market and Economic Factors

Finally, you need to look at market trends because they have a lot to do with what makes a good rental investment. Good timing is just as important as choosing the right location.

Positive Market Trends

Do you know what’s happening in the market where you’re buying?

Real estate markets can change quickly, and understanding whether you’re buying in a buyer’s market (where you might get a better deal) or a seller’s market (where prices might be higher) can help you make a smarter purchase.

Economic Stability

How stable is the area’s economy? Look at factors like job growth, industry presence, and population trends.

A strong economy usually means steady demand for rentals and property appreciation, making your investment more secure.

Favorable Interest Rates

Have you considered how current interest rates will affect your mortgage? If rates are high, your monthly payments will be higher, which could cut into your profits.

Keeping an eye on interest rates helps you plan better and decide when it’s the right time to buy.

Here’s a quick example that shows how important getting a low mortgage rate is for your rental income. Suppose you buy a property worth $300,000. Here’s how a mortgage rate of 3.5% compares to 6.5%. For simplicity, we’ll ignore HOA costs, property taxes, and maintenance.

| Scenario | Interest Rate | Monthly Mortgage | Rent | Monthly Profit |

| Low Mortgage Rate | 3.5% | $1,347 | $2000 | $653 |

| High Mortgage Rate | 6.5% | $1,896 | $2000 | $104 |

For the same property, different mortgage rates make a world of difference to your monthly income.

If you feel that you’re not prepared to deal with any of the above aspects, it’s always good to talk to a good property manager who can guide you.

In Conclusion

Finding the right investment property is key to building a successful rental portfolio. Whether you’re new to this or have experience, knowing how to find an investment property that matches your goals is essential.

We’ve covered the steps—from checking financial indicators to understanding market trends and picking the right location.

Investing in rental properties isn’t just about buying any property; it’s about making smart choices that will bring long-term benefits. Whether you manage the property yourself or hire a property manager, each decision should be based on solid research and clear financial goals.

Use the strategies we’ve discussed to navigate the real estate market confidently. Find properties that fit your plan, and focus on growing your wealth through well-thought-out decisions.

Stay aware of market changes, keep your finances in check, and don’t hesitate to get expert help when needed. With the right approach, you’ll find the perfect investment property that works for you.

Here are some helpful articles that will help you on your rental investment journey: