With over 45 million rental units in the U.S., real estate investment offers boundless opportunities—but the right type of rental property for you depends entirely on your unique situation.

Your capital, investment strategy, long-term goals, and risk tolerance, all play a crucial role in determining the best fit.

Whether you’re looking for the steady cash flow of single-family homes, the higher potential returns from multi-unit properties, or the seasonal flexibility of vacation rentals, each option presents different benefits and challenges.

You might also be considering commercial properties for their longer lease terms and business residents. The key is finding the right match for your financial goals.

In this guide, we’ll break down the different types of rental properties and provide a detailed comparison to help you decide which one fits your investment needs most. By the end, you’ll have a clear idea of where to focus your investment efforts, ensuring you’re making informed, strategic decisions.

And if you’re just getting started with rental investing, we suggest exploring our beginner-friendly guide on investing in rental property to help build a strong foundation before tackling these more advanced options.

Residential Properties

When it comes to residential rental properties, you have several key options to consider, each with its own appeal depending on your capital, goals, and management preferences.

From the classic, single-family home to condos, we’ve covered all the common types of residential rental investments below:

Single-Family Homes

Single-family homes are by far the most common type of property that rental investors choose to purchase, especially first-time investors. These standalone properties are designed for a single resident or household and offer a more hands-off approach compared to multi-unit buildings.

Why Consider Investing in Single-Family Homes?

The appeal lies in simplicity. Managing one resident is far less demanding than juggling multiple. Plus, single-family homes often attract long-term residents, meaning fewer turnovers and a more stable cash flow.

However, there’s a potential downside: if your resident moves out, your property may sit vacant while you cover the mortgage and expenses for weeks or months until it’s rented again.

Costs and Investment

The initial investment for a single-family home varies widely based on location. In many parts of the U.S., the price could range from $150,000 in more affordable markets to $450,000 or more in higher-demand areas.

Renovation costs can also vary; cosmetic updates such as new paint or new flooring may cost $5,000-$20,000 depending on size of the property, while significant updates like a new roof or HVAC system could add $10,000-$20,000.

Before deciding on what renovations are necessary for a home, it’s important to understand how much comparable properties in the area are renting for.

An experienced property manager who understands the local market could research pricing and pictures of these comparable properties and recommend rent ranges based on different levels of upgrades that the home could have.

A savvy investor could then calculate their returns on investment and decide what upgrades will yield the highest returns.

Management and Workarounds

While single-family homes require less day-to-day management than multi-family units, management can still be stressful and time-consuming. Some workarounds can help reduce your workload.

For example, hiring a property manager could cost you around 8-12% of the monthly rent, but they handle resident inquiries, maintenance, and rent collection. If you want to manage it yourself, tools like online rent payment platforms and automated maintenance request systems can simplify the process.

Renter Demographics

Renter demographics vary drastically depending on the location of the property. A thorough market research will reveal whether a market has mostly families or single professionals as well as the average income of the population.

Use renter demographics to help you decide what type of property will be in the most demand for the area.

Who’s It Best For?

Single-family homes are great for investors who prefer a low-maintenance, long-term investment with predictable returns. It’s especially appealing for those just starting out, as the management demands are lower, and you can focus on one property at a time.

Investment Pros and Cons

Advantages

- Simpler management: With just one resident or household, there’s less complexity compared to multi-unit properties.

- Lower turnover rates: Single-family homes often attract long-term residents, providing more stability.

- Steady appreciation: In well-located and desirable neighborhoods, these properties tend to appreciate consistently over time.

- Tax benefits: Eligible for tax deductions, including mortgage interest and property depreciation, which can offset costs.

Disadvantages

- Vacancy risk: When vacant, there’s no rental income, but you still need to cover mortgage and maintenance expenses.

- Lower cash flow: Compared to multi-unit properties, the income from a single unit is generally lower.

- High upfront costs: Especially in competitive or high-demand markets, the initial investment can be substantial.

- Full maintenance responsibility: All repair and maintenance costs fall on you, particularly during vacancies, which can be expensive.

Key Considerations

- Initial Investment: $150,000–$400,000 depending on the market. Renovations could start at $5,000 and go up to $65,000 or higher, depending on the property’s condition..

- Cash Flow Potential: Moderate. Expect monthly rent to be around 0.7% to 1% of the property’s value, so a $200,000 property might generate $1,400 to $2,000 per month.

- Management: Low to moderate. You can reduce your workload by hiring a property manager, who can also ensure compliance with local and state tenant-landlord laws, or using technology to handle payments and maintenance requests.

- Risk Level: Moderate, with the primary risk being vacancy. Strategies like long-term leasing agreements can help mitigate this.

- Appreciation Potential: Historically strong in well-located areas. A home in a growing market can appreciate 3-5% annually.

- Tax Considerations: Eligible for deductions, including mortgage interest, property depreciation, and certain maintenance expenses. However, you won’t get the scale advantages of multi-family properties.

Extra Tips for Success

- Workaround for Vacancy: Consider offering incentives for longer-term leases (e.g., slightly reduced rent for a two-year agreement). This keeps cash flow steady and minimizes turnover.

- Leverage Market Research: Research neighborhoods with strong job growth or school districts, as these areas tend to attract long-term residents and appreciate faster.

- Maintenance Strategy: To avoid costly repairs, schedule routine maintenance (like HVAC check-ups) and set aside a small reserve (typically 1-2% of the property value annually) for unexpected issues.

- Renter Happiness: Happy renters stay longer. Fast turnaround time on maintenance requests and prompt and friendly communication go a long way.

Single-family homes are a solid starting point for investors who want a manageable, low-maintenance property with the potential for appreciation. Among the many types of rental properties, single-family homes offer simplicity, but while vacancies can impact cash flow, strategic planning and careful resident selection can keep things steady.

Multi-Family Properties (Duplexes, Triplexes, Fourplexes)

Multi-family properties are an excellent option for investors looking to step up from single-family homes. These buildings contain multiple rental units, typically between two and four, allowing for more residents and multiple income streams. Duplexes, triplexes, and fourplexes are popular choices due to their balance of affordability and cash flow potential.

Why Consider Multi-Family Properties?

These properties offer the advantage of diversifying your rental income. With multiple residents, you’re not relying on a single source of rent. Even if one unit is vacant, the others can keep your cash flow moving. However, managing multiple units naturally brings more responsibilities, from handling resident concerns to maintenance requests across several households.

Costs and Investment

The price for a multi-family property depends on the size, condition, and location. A duplex might start around $300,000 in an average market, while a fourplex could cost upwards of $600,000. Renovation costs are also a consideration, with each unit possibly requiring individual attention.

Typically, with multi-unit investment properties, you pay less per unit than you do for single-family properties.

Investors should be prepared to set aside anywhere from $5,000 to $20,000 per unit depending on the extent of updates needed.

Management and Workarounds

Managing multi-family properties is more demanding, but many landlords find that the higher cash flow makes up for the increased effort.

Hiring a property manager becomes more appealing here, especially if you’re managing three or four units. Management fees typically range from 8% to 12% of the monthly rent, but that can be offset by the multiple income streams. Another option is to use property management software that helps streamline rent collection and resident communications.

Overall, the property management process isn’t different from single-family homes, however you might see savings in management fee percentages if you have 5 or more rental units.

Renter Demographics

Multi-family units often attract a mix of residents, including small families, couples, and single individuals looking for more affordable housing options. These properties tend to be in high demand in urban areas where housing costs are higher.

Who’s It Best For?

This property type is ideal for investors looking for higher cash flow and are comfortable managing multiple residents. It’s especially suited for those who want to grow their portfolio without diving into larger, more complex apartment buildings.

Multi-Family Investment Pros and Cons

Advantages

- Multiple income streams: With several units, you can generate rental income from multiple sources within one property, increasing cash flow potential.

- Lower vacancy risk: If one unit is vacant, income from other units helps cover expenses, reducing the impact of vacancies.

- Financing is easier: Typically, it’s simpler to secure financing for small multi-family properties than larger complexes, especially for duplexes and triplexes.

- Economies of scale: Managing multiple units in one location can reduce costs for repairs and services, making the overall management more efficient.

Disadvantages

- Management-intensive: Dealing with multiple residents means more day-to-day management and a higher likelihood of frequent maintenance requests.

- Higher maintenance costs: Especially with older buildings, the cost of repairs across multiple units can add up.

- Slower appreciation: Compared to single-family homes, multi-family properties may appreciate at a slower rate in some markets.

- Higher upfront investment: The initial cost of purchasing a multi-family property is generally higher than that of single-family homes.

Key Considerations

- Initial Investment: $300,000–$600,000+ depending on the market and number of units. Renovation costs vary by unit, typically $10,000–$50,000 per unit.

- Cash Flow Potential: Higher than single-family homes due to multiple residents and economies of scale with repairs and services.

- Management: More intensive due to multiple residents. Consider hiring a property manager, who can also ensure compliance with varying local and state tenant-landlord laws, or using automated tools to handle the extra workload.

- Risk Level: Lower vacancy risk due to multiple units, but higher resident turnover can increase management needs.

- Appreciation Potential: Moderate. These properties tend to appreciate steadily but are more sensitive to market shifts.

- Tax Considerations: You’ll benefit from deductions for mortgage interest, property depreciation, and maintenance expenses across multiple units.

Extra Tips for Success

- Renovation Priorities: If you’re updating the property, prioritize common areas like entrances or landscaping—these make a big impact on resident satisfaction across all units.

- Screen Residents Carefully: With multiple residents, thorough screening becomes even more important to avoid problematic residents that can impact others in the building.

Multi-family properties are a great choice for investors looking for higher cash flow and the ability to spread out risk. While they require more management, the benefits of multiple income streams can far outweigh the added work.

If you want to explore how to find, finance, and manage duplexes, triplexes, and quads to grow your real estate portfolio, please refer to our in-depth post here.

Condominiums (Condos)

Condos are individually owned units in a larger building or community, where owners share common areas like gyms, pools, and gardens. Condos are typically more affordable than standalone homes, making them an appealing entry point for investors.

The unique aspect of condo ownership is the homeowners’ association (HOA), which oversees the maintenance of common areas and enforces community rules.

Why Consider Condos?

Condos are an excellent choice for investors looking for a more hands-off approach to property management. Among the types of rental properties available, condos stand out because the HOA handles exterior maintenance and common areas, so you don’t need to worry about landscaping, building repairs, or amenities.

However, this convenience comes with monthly HOA fees, which can affect your overall profit margins. In addition, some HOAs impose rental restrictions, so it’s important to carefully review the rules before investing.

Costs and Investment

Condos often present a lower cost of entry compared to single-family homes or townhouses. Prices typically range from $150,000 to $300,000, making them accessible for newer investors. However, HOA fees (ranging from $200 to $500 per month or more) are an important factor to consider, as they can significantly impact your net cash flow.

Management and Workarounds

While the HOA handles most exterior upkeep, condo owners are still responsible for interior repairs and resident issues. Condos tend to attract residents seeking lower-maintenance living, which may lead to longer-term residents and reduced turnover. However, make sure to plan for any interior renovations that may arise over time.

Renter Demographics

Condos appeal to young professionals, small families, and retirees looking for a simple lifestyle and easy access to urban amenities. They are particularly attractive in urban areas or places where space is at a premium, and shared amenities like pools and gyms add extra appeal.

Who’s It Best For?

Condos are ideal for investors who want to minimize their involvement in property management and prefer to focus on urban or high-demand areas. If you’re looking for a hands-off, low-maintenance investment, condos might be the best fit.

Pros and Cons of Condos

Advantages

- Lower maintenance: HOAs handle exterior upkeep, landscaping, and common areas, making property management less hands-on.

- Affordable investment entry: Condos are often cheaper than single-family homes, providing an accessible entry point for investors.

- Amenity appeal: Shared amenities like pools, gyms, or lounges attract residents, adding value to your rental and boosting potential rent rates.

- Boost in rent potential: Common amenities can justify higher rent, making condos more appealing in competitive markets.

Disadvantages

- HOA fees impact profits: Monthly HOA fees can cut into your net rental income, affecting cash flow.

- Limited control: Owners have less say over the exterior or shared spaces, which can be frustrating when it comes to making improvements.

- Rental restrictions: Some HOAs limit or restrict the ability to rent out the unit, which could interfere with your investment plans.

- Slower appreciation: In some markets, condos may appreciate more slowly compared to single-family homes.

Key Considerations

- Initial Investment: $150,000–$300,000, with HOA fees of $200–$500.

- Cash Flow Potential: Moderate. HOA fees reduce net income.

- Management: Low, as the HOA handles most maintenance.

- Risk Level: Moderate. HOA rules and rental restrictions can add complexity.

- Appreciation Potential: Moderate to strong, especially in desirable urban locations.

- Tax Considerations: Similar to single-family homes, but HOA fees are not tax-deductible.

Condos are a solid investment option for those looking to balance affordability and lower maintenance responsibilities.

While HOA fees can chip away at profits, the convenience of having exterior upkeep handled and access to shared amenities makes condos an attractive choice for investors who want a hands-off approach.

For those willing to navigate HOA rules and focus on urban areas, condos can offer steady returns and long-term appreciation.

Townhouses

Unlike condos, townhouses typically include ownership of both the interior and exterior of the unit, offering more autonomy and fewer restrictions from HOAs. Townhouses often feature multiple stories and may have private yards, making them more similar to single-family homes in terms of privacy and space.

Why Consider Townhouses?

Townhouses offer a balance between the affordability of condos and the independence of single-family homes. They provide more space and ownership rights while still benefiting from shared amenities and, in some cases, exterior maintenance through an HOA.

However, HOA fees for townhouses are often lower compared to condos, and there may be fewer rental restrictions.

Costs and Investment

Townhouses can be slightly more expensive than condos, with prices typically ranging from $200,000 to $400,000 depending on the location and market. While there are still HOA fees, they tend to be lower, around $150 to $300 per month, and cover fewer services, such as community upkeep rather than exterior maintenance.

Management and Workarounds

With a townhouse, you’re responsible for both the interior and exterior maintenance. However, townhouses often require less maintenance than single-family homes since they share walls with neighbors, reducing the need for full landscaping and exterior upkeep.

Townhouse residents tend to stay longer due to the additional space and privacy compared to condos.

Renter Demographics

Townhouses appeal to families, professionals, and residents seeking more space and privacy than what’s offered in condos. These units often attract residents looking for a suburban lifestyle with the added benefit of shared amenities.

Who’s It Best For?

Townhouses are a great option for investors who want more control over their property without the heavy responsibilities of a single-family home. If you’re seeking a balance between space, autonomy, and shared amenities, townhouses are an attractive choice.

Pros and Cons of Townhouses

Advantages

- More autonomy: Townhouse owners typically have full control over both the interior and exterior, offering more independence compared to condos.

- Increased space and privacy: Townhouses provide more living space and a higher level of privacy, often with private yards or patios.

- Attractive to families and long-term residents: The extra space and privacy appeal to families and those looking for longer-term rentals.

- Steady appreciation: Townhouses generally offer moderate appreciation, typically more than condos but slightly less than single-family homes.

Disadvantages

- Higher maintenance responsibilities: Owners are responsible for both interior and exterior upkeep, leading to more work and costs.

- HOA fees: Though typically lower than condos, townhouse HOAs still charge fees for common area upkeep and amenities.

- Potential rental restrictions: Some HOAs may impose restrictions on renting, limiting your investment flexibility.

- HOA limitations: Rules set by the HOA may still restrict modifications or changes, limiting personal preferences.

Key Considerations

- Initial Investment: $200,000–$400,000, with HOA fees of $150–$300.

- Cash Flow Potential: Moderate. Fewer restrictions, but higher maintenance costs.

- Management: Moderate, as owners handle both interior and exterior upkeep.

- Risk Level: Moderate, though stable resident demographics lead to longer leases.

- Appreciation Potential: Slower than single-family homes, but steady in high-demand suburban areas.

- Tax Considerations: Similar to single-family homes, with deductions for mortgage interest and depreciation.

Townhouses strike the perfect balance between independence and convenience. With more space and control than condos, they appeal to a wide range of residents, from families to professionals.

Although there’s more responsibility for exterior maintenance, the lower HOA fees and stable renter demographics make townhouses an excellent option for investors seeking long-term residents and steady cash flow.

If you’re after a property that offers privacy and space without the full commitment of a standalone home, townhouses could be your ideal investment.

Apartment Buildings

Apartment buildings, typically defined as properties with five or more units, are ideal for investors seeking to scale their portfolio significantly. With more units comes more cash flow, but also more management complexity.

Why Consider Apartment Buildings?

Apartment buildings are income-generating machines if managed well. With multiple residents, cash flow becomes much more consistent. However, these properties require a more significant initial investment and more intensive management.

It’s not uncommon for apartment building owners to hire full-time property managers or even on-site staff to handle the day-to-day operations. For larger buildings, this is almost a necessity.

Costs and Investment

The cost of purchasing an apartment building can range dramatically depending on location and size, but expect to pay upwards of $1 million for a modest building in many urban markets. Bigger complexes can cost dramatically more (in the tens of millions).

There are 2 common strategies when it comes to apartment acquisitions. One strategy is to acquire a property that is already renovated and leased up – meaning fully occupied or with few vacancies. These types of properties typically cost more with a lower CAP (Capitalization Rate) rate.

CAP rate is used in the apartment/multifamily space to calculate the value of a property, and is calculated by dividing a property’s net operating income (NOI) over its market price.

The second strategy is to acquire a property that is in need of rehab and/or is suffering from high vacancy and high delinquency. The acquisition costs for these properties are lower, allowing the buyer to reserve the cash needed to perform the necessary rehab and spend time to fill the vacancy.

This strategy is called “value add”. In a successful scenario, the investor will enjoy a significant appreciation in property value by raising rents and decreasing vacancy.

Additionally, renovation and upkeep can be significant, especially if you’re purchasing an older property. Set aside at least 5-10% of the building’s value for annual maintenance and repairs.

Management and Workarounds

Managing an apartment building can be complex and time-consuming, but professional management services or an on-site team can handle much of the workload for you. The cost of property management services typically ranges from 6-10% of the total monthly rent, which can quickly add up. However, the economies of scale often make this expense worth it.

Renter Demographics

Apartment buildings appeal to a wide range of renters, including students, professionals, and families seeking affordable housing in urban areas. Larger buildings often attract renters looking for long-term leases.

Who’s It Best For?

Experienced investors who are ready for more hands-on management—or are willing to outsource it. Apartment buildings offer high returns but demand careful oversight.

Pros and Cons of Apartment Buildings

Advantages

- High cash flow potential: With multiple rental units, apartment buildings can generate substantial income streams, especially when fully occupied.

- Economies of scale: Costs such as maintenance, repairs, and management services can be spread across multiple units, reducing the per-unit expense.

- Reduced vacancy risk: With multiple residents, vacancy in one unit has less impact on overall cash flow compared to single-unit properties.

- Potential for significant appreciation: In growing urban markets, apartment buildings often see substantial appreciation, especially in areas with high demand for rental housing.

Disadvantages

- High upfront costs and ongoing expenses: Purchasing an apartment building requires a significant initial investment, and maintenance costs can add up quickly, particularly for larger properties.

- Intensive management requirements: Apartment buildings often require professional management due to the complexity of handling multiple residents, repairs, and regulations.

- Complex financing and operations: Securing financing for apartment buildings can be more complicated and may involve larger loans, stricter requirements, and additional operational challenges.

- High resident turnover: Larger buildings with many residents can experience frequent turnover, leading to periods of vacancy and the need for constant resident management.

Key Considerations

- Initial Investment: $1 million and up, depending on location and size. Budget for significant ongoing maintenance costs.

- Cash Flow Potential: Very high, especially with a fully occupied building. A 20-unit building could easily generate $20,000+ per month.

- Management: High. Professional management is almost always required, particularly to ensure compliance with local and state tenant-landlord laws that can vary by property type.

- Risk Level: Lower vacancy risk due to multiple residents, but higher resident turnover and market sensitivity.

- Appreciation Potential: High in growing markets with strong rental demand. Urban areas offer the greatest appreciation potential.

- Tax Considerations: Significant tax deductions are available for depreciation, mortgage interest, and operating expenses. However, managing taxes can be more complex for larger properties.

Extra Tips for Success

- Hire a Property Manager: Apartment buildings require more day-to-day oversight. Hiring a professional will save you time and reduce resident complaints. For larger properties, on-site management would be necessary.

- Leverage Economies of Scale: Use bulk purchasing for repairs and maintenance services. Hiring a single contractor for multiple units saves money in the long run.

- Focus on Retention: Reducing turnover by offering lease renewal incentives can help keep your building full and your cash flow steady.

Apartment buildings provide incredible cash flow opportunities for seasoned investors, but they require a strong management strategy and significant upfront investment. For those looking to scale quickly, apartments are a proven path to long-term financial success.

Commercial Properties

Commercial properties present a unique set of challenges compared to other types of rental properties. Leased to businesses instead of individuals, they offer distinct opportunities while requiring a different approach from residential investments.

The leases tend to be longer, often stretching from three to ten years, and rent structures can be more complex, with businesses paying additional costs like property taxes and insurance.

While residential properties usually focus on providing homes, commercial spaces are driven by location, demand, and business potential. This makes commercial investments potentially more lucrative but also more intricate.

A key difference is renter expectations. Businesses demand reliable infrastructure, ample space, and a location that meets their customer or operational needs. Commercial property management also tends to require more oversight, as resident needs can vary based on the type of business.

For investors, the upside can be significant—longer leases mean more stable cash flow, and the income potential is often higher than in residential properties. However, commercial properties often come with higher risks, including economic sensitivity and more demanding tenants.

Office Buildings

Office buildings offer a broad spectrum of investment opportunities, but understanding their classifications is crucial. Real estate developers usually divide office spaces into three classes—A, B, and C—each catering to different resident profiles and needs.

- Class A: High-end office spaces in prime locations, often with top-tier amenities. These attract large corporations or businesses willing to pay premium rent.

- Class B: Mid-range office spaces, generally well-maintained but without the luxury or prime location of Class A buildings. These appeal to mid-sized companies.

- Class C: Older buildings in less desirable locations. While less glamorous, they often provide affordable spaces for startups or smaller companies.

Why Consider Office Buildings?

Office buildings provide stable, long-term income thanks to the nature of commercial leases, which often run for several years. These tenants tend to sign longer leases—usually 5 to 10 years—ensuring consistent cash flow.

However, office buildings can be sensitive to economic shifts, with vacancies often rising during downturns.

Leasing and Management

Leasing office spaces often involves negotiating terms such as rent escalations and resident improvement allowances, which can affect overall profitability.

Class A tenants may expect high levels of service, including regular maintenance and building upgrades. Managing these properties requires more involvement, especially for Class A spaces, where tenants have higher expectations for upkeep and amenities.

Renter Demographics

Office buildings cater primarily to corporate tenants, from large multinationals in Class A buildings to smaller startups in Class C buildings. The resident profile impacts rent rates and stability, with larger corporations offering more stability but requiring more investment in property features.

Best For

Investors looking for long-term, stable income and who are comfortable with potential fluctuations in occupancy due to economic cycles.

Pros and Cons of Office Buildings

Advantages

- Long-term leases provide stable income: Commercial tenants often sign leases of 5–10 years or more, offering consistent rental income over longer periods.

- High return potential: Especially for Class A buildings in prime locations, office buildings can generate significant income, often from high-profile business tenants willing to pay premium rents.

- Business tenants manage interior upkeep: Many commercial leases, especially triple net (NNN) leases, place the responsibility for interior maintenance on the resident, reducing the landlord’s workload.

- High appreciation potential: In well-located business districts, office buildings can see strong appreciation, driven by increasing demand for office space.

Disadvantages

- Vacancy risk during economic downturns: Office buildings can experience higher vacancy rates during economic slumps, as businesses downsize or close, leaving space unoccupied.

- High management expectations: Class A buildings, in particular, have high maintenance and service standards, often requiring extensive management efforts to meet resident demands.

- Sensitive to economic shifts: Changes in the economy can directly affect occupancy rates, particularly in office spaces tied to industries vulnerable to downturns.

- Complex leasing terms: Leasing for office spaces often involves negotiating terms like rent escalations and resident improvement allowances, which can add layers of complexity to managing the property.

Key Considerations

- Initial Investment: Class A buildings can range from $10 million to $100+ million, while Class B or C buildings are more affordable, starting at around $1–$5 million.

- Cash Flow Potential: High with long-term leases. Expect annual returns of 6-8% for Class A and higher for lower-class buildings with more risk.

- Management: Intensive, particularly for Class A. High-quality maintenance, security, and amenities are often expected.

- Risk Level: Moderate to high. Vacancy rates can be tied closely to the economy, so these properties are sensitive to market downturns.

- Appreciation Potential: High, especially in growing business hubs.

- Tax Considerations: Significant tax deductions for depreciation and operating expenses. However, tax liabilities can increase if the property appreciates substantially.

Extra Tips for Success

-

Negotiate Escalations: Including rent escalation clauses in your lease allows you to increase rent periodically, often annually, to account for inflation.

This helps you maintain your rental income’s value over time and covers rising property costs. Escalations can be set as a fixed percentage or linked to an inflation index like the Consumer Price Index (CPI), ensuring your investment stays protected.

- Understand Resident Needs: Offering flexibility, like co-working spaces or adaptable layouts, can attract a wider range of businesses.

Office buildings offer high-income potential but come with a need for active management and market awareness. If you’re willing to navigate resident expectations and economic sensitivity, they can provide strong, consistent returns.

Retail Spaces

Retail properties range from small strip malls to large shopping centers and even standalone stores. These spaces rely heavily on location and foot traffic to ensure success for their tenants, making them more sensitive to shifts in consumer behavior and the local economy.

Why Consider Retail Spaces?

Retail properties can generate high rental income, especially if located in high-traffic areas. Tenants usually sign triple net leases (NNN), meaning they pay rent plus property taxes, insurance, and maintenance. This reduces the burden on landlords. However, the retail market can be volatile, especially with the rise of e-commerce, so location and resident mix are critical.

Types of Retail Properties

- Strip Malls: Smaller retail centers with 3–10 tenants. They usually cater to local businesses like salons, small restaurants, or convenience stores.

- Shopping Centers: Larger spaces with anchor tenants such as grocery stores or big-box retailers. These offer greater foot traffic but require significant upfront investment.

- Standalone Buildings: Single-resident properties like fast-food restaurants or specialty stores. These are usually less management-intensive but can be vulnerable to resident turnover.

Leasing and Resident Mix

Leasing retail spaces involves more than just renting square footage. The success of a shopping center or strip mall often depends on the resident mix. Strong anchor tenants attract smaller retailers, creating a balanced ecosystem. Landlords often negotiate longer-term leases, and for prime locations, rental rates can be high.

Renter Demographics

Retail tenants range from small local businesses to large national chains. The resident profile directly impacts foot traffic, rental rates, and lease stability.

Best For

Investors who want high returns but are comfortable with the additional risk that comes with location sensitivity and resident turnover.

Pros and Cons of Retail Spaces

Advantages

- Tenants cover expenses: Triple net (NNN) leases typically place responsibility for property taxes, insurance, and maintenance on tenants, reducing costs for landlords.

- High rental income potential: Prime retail locations can command higher rent, especially in bustling commercial zones or malls.

- Anchor tenants drive foot traffic: Large retailers or supermarkets can attract more customers, benefiting smaller businesses in the same property.

- Less hands-on management: With NNN leases, the landlord’s role is largely passive, as tenants handle most operational expenses and upkeep.

Disadvantages

- Vacancy risk tied to tenants: Economic shifts or poor resident performance can lead to vacancies, impacting cash flow.

-

High upfront costs: Securing prime retail spaces can require a significant initial investment, particularly in high-demand areas. Upfront costs also includes marketing and Tenant Improvement credits.

Tenant Improvement (TI) credits are funds provided by landlords to tenants to cover the costs of customizing or renovating a rental space to meet the tenant’s specific needs. This can include things like remodeling, installing fixtures, or making other improvements to the property. TI credits are common in commercial leases.

- Sensitive to consumer behavior: Changes in shopping habits, such as the rise of e-commerce, can impact the success of retail tenants.

- Resident mix is critical: A successful retail property relies on the right mix of tenants to attract and retain customers; poor resident choices can harm the property’s appeal.

Key Considerations

- Initial Investment: Strip malls can start around $1 million, while shopping centers or standalone buildings can reach $10–$50+ million.

- Cash Flow Potential: High, especially with anchor tenants. NNN leases provide steady income with fewer operational costs.

- Management: Moderate, depending on lease structure. With NNN leases, tenants handle most of the maintenance, reducing your involvement.

- Risk Level: High. Success depends heavily on location, resident mix, and economic factors.

- Appreciation Potential: Strong in high-traffic areas or desirable retail zones.

- Tax Considerations: Triple net leases allow you to reduce property expenses, and depreciation can offer valuable tax deductions.

Extra Tips for Success

- Choose the Right Location: Proximity to major highways, popular retail spots, and affluent neighborhoods boosts your chances of securing high-quality tenants.

- Build a Strong Resident Mix: Anchor tenants like grocery stores or big-box retailers can drive traffic to smaller businesses, creating a sustainable rental ecosystem.

Retail spaces can be lucrative if you find the right location and resident mix. However, they’re not without risks—shifts in the retail market and resident performance play a large role in success.

Industrial Properties

Industrial real estate includes properties like warehouses, distribution centers, and manufacturing facilities. These properties are often more specialized but can offer stable long-term income due to the growth of e-commerce and logistics.

Why Consider Industrial Properties?

Industrial properties have surged in popularity, especially as e-commerce grows and companies need more space to store and distribute products.

These properties tend to have long-term leases, and tenants typically handle the bulk of the property’s upkeep. However, industrial spaces can be challenging to manage due to their size and specific resident needs.

Types of Industrial Properties

- Warehouses: Used for storage and distribution, warehouses are in high demand, particularly in areas near major highways or transportation hubs.

- Distribution Centers: Similar to warehouses but often larger, these facilities handle high-volume logistics and require excellent transportation access.

- Manufacturing Facilities: These properties are specialized for industrial production and may require significant customization for resident operations.

Resident Demand and Lease Structures

Tenants in industrial properties often sign long-term, triple-net leases, similar to retail. This creates stable, predictable income for investors. However, industrial spaces can remain vacant for longer periods between tenants due to their specialized nature.

Renter Demographics

Tenants include logistics companies, manufacturers, and e-commerce businesses. These businesses typically look for proximity to transport infrastructure and sufficient space for operations.

Best For

Investors seeking long-term, stable cash flow with minimal management requirements. Industrial properties tend to be less glamorous but provide excellent returns for patient investors.

Pros and Cons of Industrial Properties

Advantages

- Stable income from long-term leases: Tenants in industrial spaces often sign long leases, providing reliable income for years.

- Tenants handle maintenance: With NNN leases, tenants are responsible for the bulk of maintenance and improvements, reducing management burdens.

- Rising demand: With the growth of e-commerce, logistics, and distribution centers, demand for industrial properties is increasing.

- Low management intensity: Resident responsibilities typically reduce the landlord’s involvement in daily operations and upkeep.

Disadvantages

- Longer vacancy periods: Industrial properties, especially those with specialized uses, may sit vacant for longer between tenants due to the niche requirements.

- High upfront costs: Purchasing or developing large industrial facilities can require a significant initial investment.

- Limited resident pool: The specialized nature of many industrial properties means fewer potential tenants, particularly for manufacturing spaces.

- Relocation risks: If a business outgrows the space or relocates, it can leave the property vacant for extended periods.

Key Considerations

- Initial Investment: Warehouses and distribution centers can range from $2 million to $20+ million depending on size and location. Manufacturing facilities may require more customization, increasing costs.

- Cash Flow Potential: High. Industrial properties often yield strong, consistent returns due to long leases (10-20 years).

- Management: Low. Tenants usually handle most of the upkeep and improvements under NNN leases.

- Risk Level: Moderate. While vacancy risks are lower due to long leases, finding a new resident can take time if the space is highly specialized.

- Appreciation Potential: Strong in areas with growing demand for logistics and manufacturing. Proximity to transport hubs is key.

- Tax Considerations: Significant deductions for depreciation, especially for larger facilities. Triple net leases also reduce your property-related expenses.

Extra Tips for Success

- Leverage Location: Focus on properties near major highways, airports, or shipping ports to ensure resident demand remains high.

- Specialize for Stability: Customizing your property to meet the needs of logistics or manufacturing tenants can lead to longer leases and reduced turnover.

Industrial properties are a solid choice for investors seeking long-term, low-maintenance income. While resident turnover can be challenging, the growing demand in sectors like e-commerce ensures that these properties will continue to offer stable returns.

Mixed-Use Developments

Mixed-use properties combine residential and commercial spaces within a single building or development. These properties offer diversification, as they attract both tenants and businesses, providing multiple streams of income.

Why Consider Mixed-Use Developments?

Mixed-use developments are gaining popularity in urban areas where people seek convenience and accessibility.

These properties combine residential units (such as apartments or condos) with commercial spaces (like retail stores or offices), creating a vibrant, multi-purpose environment.

The advantage here is diversification—if one section (residential or commercial) faces challenges, the other can help sustain income.

Benefits of Diversification

By blending residential and commercial spaces, mixed-use developments reduce the risk associated with relying on a single type of resident.

For instance, if the retail portion of your property struggles, residential units can still provide steady cash flow, and vice versa. This mix also tends to attract high-quality tenants who value convenience and lifestyle amenities.

Zoning and Property Management Considerations

Zoning regulations for mixed-use developments can be complex, as they must meet both residential and commercial codes. Managing these properties also requires more coordination, as residential and commercial tenants have different needs and expectations.

Renter Demographics

Tenants in mixed-use developments are typically professionals, young families, and retirees who appreciate living near businesses and amenities. On the commercial side, tenants range from small retailers to offices, restaurants, and service businesses.

Best For

Investors who want to diversify their portfolio and are comfortable with the complexities of managing both residential and commercial tenants.

Pros and Cons of Mixed-Use Developments

Advantages

- Multiple income streams: Residential and commercial tenants provide diverse revenue sources, reducing reliance on one sector.

- Diversified risk: Combining different resident types reduces overall risk, as one sector may perform better when the other lags.

- High demand in key areas: Urban centers and rapidly growing areas see strong demand for live-work spaces.

- Appreciation potential: Mixed-use properties tend to appreciate significantly in desirable, high-growth locations.

Disadvantages

- Complex zoning and management: Navigating zoning regulations for mixed-use properties can be challenging, often requiring compliance with both residential and commercial codes.

- High development or acquisition costs: These projects usually require larger upfront investments due to their complexity and scope.

- More involved management: Handling both residential and commercial tenants increases management complexity.

- Resident balance challenges: Meeting the needs of both residential and commercial tenants requires careful coordination to ensure both are satisfied.

Key Considerations

- Initial Investment: Large mixed-use developments can start at $5 million and reach upwards of $50 million in prime urban areas.

- Cash Flow Potential: High. With multiple income streams, mixed-use properties can generate significant cash flow. Retail spaces can provide higher rental income, while residential units offer stability.

- Management: Complex. Managing both commercial and residential spaces requires careful attention to resident relations and upkeep.

- Risk Level: Moderate. Diversification helps mitigate risk, but managing different resident types can add operational complexity.

- Appreciation Potential: High, especially in urban areas where demand for live-work-play environments is growing.

- Tax Considerations: Significant deductions for depreciation, operating expenses, and mortgage interest across both property types.

Extra Tips for Success

- Maximize Resident Mix: Focus on creating a balanced resident mix that complements each other, such as retail stores that cater to the needs of your residential tenants.

- Understand Zoning: Work with local authorities to navigate zoning requirements early on, as these can complicate development or renovations.

Mixed-use developments offer an attractive blend of income streams, making them an ideal choice for investors who want to diversify and reduce risk. While they require more management and upfront investment, the returns can be substantial, especially in urban settings.

Other Investment Property Types

Beyond traditional residential and commercial properties, there are various types of rental properties that cater to niche markets, each offering unique levels of risk and reward.

Options like vacation rentals and mobile home parks may target specific audiences but can provide solid returns if managed well. We’ll explore these properties, each with its own distinct appeal.

Vacation Rentals

The short-term rental market has exploded in recent years, thanks to platforms like Airbnb and Vrbo, which make it easier than ever to list and manage vacation properties. Vacation rentals cater to travelers seeking unique, home-like accommodations in prime locations, and they offer investors the opportunity for higher returns compared to long-term rentals.

|

Important: Short-Term Rental (STR) regulations have become increasingly common in top destination cities, often limiting the number of STRs, restricting property qualifications, and enforcing specific rules like permit requirements. If you’re considering investing in a property for STR use (less than 29 nights), it’s essential to research the local regulations thoroughly. Some cities may impose strict limits on where and how you can operate an STR, so understanding the rules beforehand will help you avoid potential fines and ensure your investment aligns with local laws. |

Why Consider Vacation Rentals?

Vacation rentals offer the potential for high rental income, especially in desirable tourist destinations. Since guests typically stay for short periods, you can charge premium rates, particularly during peak travel seasons. However, this also means the income can fluctuate with demand, making it a less predictable investment than long-term rentals.

Location and Property Amenities

Location is everything for vacation rentals. Properties near beaches, national parks, or popular tourist cities tend to do best. Additionally, amenities like pools, hot tubs, and fully stocked kitchens can help set your rental apart from others, allowing you to charge more per night.

Property Management and Guest Services

Managing a vacation rental can be more intensive than long-term rentals. Frequent guest turnover means more cleaning, maintenance, and communication.

Some owners use property management companies that specialize in vacation rentals, though these services can charge 15-30% of the rental income (and that doesn’t include the commission that platforms like Airbnb and Vrbo charge for each booking—these will impact your cash flow).

Additionally, you’ll need to consider guest services—responding to booking inquiries, handling check-ins, and addressing any issues during a guest’s stay.

Renter Demographics

Vacation rentals cater to a wide range of travelers, from families on vacation to solo adventurers and business travelers. Your target demographic will depend heavily on your property’s location, size, and amenities.

Best For

Investors who want to capitalize on short-term rental trends and are willing to manage—or outsource—the more hands-on aspects of frequent turnovers.

Pros and Cons of Vacation Rentals

Advantages

- Higher income potential: Peak seasons offer lucrative rental rates, especially in tourist-heavy areas.

- Flexible pricing: Adjust rental rates based on demand, giving you the ability to maximize revenue.

- Personal use: When not rented, owners can enjoy the property themselves.

- Increased demand: Platforms like Airbnb and Vrbo have expanded the vacation rental market, increasing potential renters.

Disadvantages

- Unpredictable income: Seasonal demand fluctuations can lead to inconsistent cash flow.

- High management demands: Frequent turnovers and guest communication require more attention.

- Regulation risks: Local short-term rental laws may restrict or complicate your operations.

- Higher maintenance costs: Regular guest turnover results in increased wear and tear, raising maintenance expenses.

- Higher expenses: The owner has to pay for all expenses related to the home including utilities, internet, pest control, cleaning, landscaping, furniture/furnishings replacement, linens and laundry, etc.

Key Considerations

- Initial Investment: Vacation properties can vary widely, with prices ranging from $200,000 to $1 million+ depending on location. This investment also includes furnishing the home with furniture, home decor, kitchen appliances and cookware, linens, towels, etc.

- Cash Flow Potential: High during peak travel seasons. Expect to charge 2-3 times what you would for a long-term rental, but income fluctuates based on demand.

- Management: High. Regular cleaning, guest communication, and maintenance are required. Property management services can help but will reduce your net income.

- Risk Level: Moderate to high. The market is highly dependent on location and seasonal demand. Regulations on short-term rentals can also impact income.

- Appreciation Potential: High in popular tourist areas, though demand can fluctuate based on trends.

- Tax Considerations: Significant deductions for operating costs, but short-term rentals may face additional taxes in some areas (like hotel taxes).

Extra Tips for Success

- Automate Guest Services: Use automated booking systems and messaging apps to streamline communication with guests and reduce your management burden.

- Optimize for Reviews: Positive reviews drive more bookings. Focus on providing a clean, comfortable, and memorable experience to attract repeat guests.

Vacation rentals can be highly profitable, but they require hands-on management and are sensitive to location and seasonality. If you’re in a high-demand area and willing to manage the property or hire help, this investment can yield excellent returns.

Mobile Home Parks

Mobile home parks provide an affordable housing option for residents and steady income for investors. These properties consist of individual mobile homes situated on rented lots, and investors typically own the land rather than the homes themselves.

Mobile home parks offer lower entry costs compared to traditional residential properties and can provide stable, long-term income.

Why Consider Mobile Home Parks?

Mobile home parks cater to the affordable housing market, which remains in high demand across the U.S. With low vacancy rates and long-term residents, these properties can provide steady cash flow with relatively low operating costs.

Additionally, because residents often own their mobile homes, they tend to stay longer, reducing turnover.

Resident Screening and Park Management

Screening residents is crucial in mobile home parks, as these residents are often there for the long haul. Park management involves maintaining the common areas, roads, and utilities, but the residents are usually responsible for their own homes. This reduces the need for major repairs compared to other rental properties.

Zoning and Regulatory Considerations

Mobile home parks are often subject to local zoning laws, which can limit where and how many units you can place on the property. Additionally, some areas have strict regulations regarding park maintenance and resident rights, which must be carefully navigated.

Renter Demographics

Mobile home parks appeal to residents seeking affordable housing options. Many residents are retirees or single households who prefer the stability of owning their own home without the cost of buying land.

Best For

Investors seeking steady, long-term income with lower management intensity compared to traditional rental properties.

Pros and Cons of Mobile Home Parks

Advantages

- Stable demand: The need for affordable housing remains high, ensuring a steady market.

- Low vacancy rates: Residents tend to stay long-term, reducing turnover concerns.

- Lower maintenance costs: Residents own and maintain their homes, minimizing landlord responsibilities.

- High cash flow potential: Due to low overhead costs, mobile home parks can generate significant income.

Disadvantages

- Negative stigma: Mobile home parks can have a reputation that affects resale value.

- Zoning restrictions: Local laws may limit development or expansion opportunities.

- Financing challenges: Securing loans for mobile home parks is often more difficult than for other property types.

- Management complexity: Overseeing utilities and common areas requires active involvement.

Key Considerations

- Initial Investment: Mobile home parks can range from $500,000 to $5 million depending on size and location.

- Cash Flow Potential: High. Monthly lot rent typically ranges from $200 to $800 per unit, depending on the region.

- Management: Moderate. You’re responsible for maintaining the common areas and utilities, but residents handle their own homes.

- Risk Level: Low to moderate. Mobile home parks have lower turnover and vacancy risks, but zoning issues can be a hurdle.

- Appreciation Potential: Moderate. While parks don’t appreciate as fast as other properties, the consistent cash flow makes them valuable investments.

- Tax Considerations: Depreciation on land improvements, utilities, and common areas can provide significant tax benefits.

Extra Tips for Success

- Resident Relations: Building a strong relationship with residents ensures long-term stability and a low turnover rate.

- Maintain Common Areas: Well-maintained roads, utilities, and community spaces help improve resident satisfaction and can justify higher lot rents.

Mobile home parks provide stable, long-term income with relatively low overhead. While they may not appreciate as fast as other investments, the steady cash flow and demand for affordable housing make them an attractive option for the right investor.

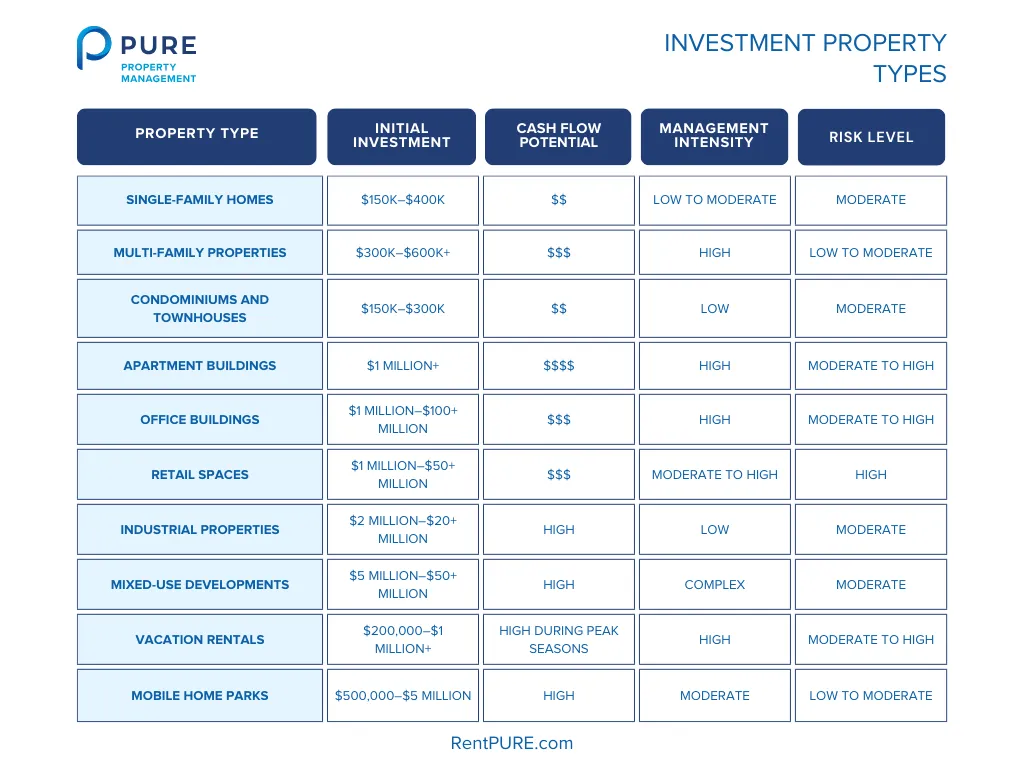

To summarize, here’s a quick table comparing all the different types of properties that we’ve covered:

Choosing the Right Investment Property

By now, we’ve explored a wide range of types of rental properties, from residential homes and multi-family units to commercial spaces, vacation rentals, mobile home parks, and more. But the question remains—how do you choose the right one for your portfolio?

The answer depends on a combination of factors, including your investment goals, risk tolerance, financial capabilities, and even your preferred property management style.

Here’s a great resource on how you can find the property you need in case you need a full guide.

Let’s break down each key consideration to help you make the best decision.

Investment Goals

The first step in choosing the right property is to clearly define your investment goals. Are you looking for steady cash flow, or is long-term appreciation your priority? Different property types align with different goals:

- If your goal is cash flow, multi-family properties and mobile home parks tend to offer reliable, steady income streams with multiple residents or clients.

- For long-term appreciation, single-family homes in growing markets or mixed-use developments in urban areas might be your best bet. These properties benefit from rising property values over time.

- Short-term high returns can be found with vacation rentals, which allow you to charge higher rents during peak seasons. However, these can fluctuate based on market demand and seasonality.

Match the property type to your specific financial goals. Cash flow-focused investors may prefer multi-unit properties, while those aiming for long-term gains might lean towards single-family homes or mixed-use developments.

Risk Tolerance

Your tolerance for risk is another critical factor. All investments come with some level of risk, but certain property types carry more volatility than others. Here’s how the properties we’ve discussed rank in terms of risk:

- Lower-risk properties like multi-family units and mobile home parks provide stable, long-term residents and lower vacancy rates. The demand for affordable housing makes these options safer bets, especially during economic downturns.

- Moderate-risk properties include single-family homes. While generally stable, these properties can experience fluctuations in demand and rental income.

- Higher-risk investments like vacation rentals and retail spaces are more sensitive to market conditions. Vacation rentals depend heavily on location and seasonality, while retail properties are affected by shifts in consumer behavior and the local economy.

Assess your comfort with risk and market volatility. If you prefer stability, focus on properties with lower vacancy rates and longer-term residents. For investors with a higher risk tolerance, vacation rentals and retail spaces can offer bigger rewards but with greater uncertainty.

Financial Capabilities and Available Capital

Your available capital will heavily influence which property type you can invest in. Some properties require a higher upfront investment, while others offer lower-cost entry points. Let’s look at what each property type requires in terms of capital:

- High upfront costs are required for commercial properties like office buildings, retail spaces, and large multi-family apartment complexes. These properties can cost millions to purchase and maintain, but they offer higher cash flow and appreciation potential.

- Moderate investment options include single-family homes and vacation rentals. These properties are more accessible for smaller investors but can still generate solid returns.

- Lower-cost investments such as mobile home parks provide steady income with lower entry costs. Mobile home parks, in particular, can offer high returns due to low operating costs.

Match your investment to your financial situation. Larger investors may gravitate toward commercial properties or large multi-family units, while those with less capital might find mobile home parks or vacation rentals more attainable.

Market Research and Due Diligence

No matter which property type you choose, market research is essential. The success of your investment will depend on the strength of the local market, property demand, and economic trends. Here’s how to approach market research for each property type:

- For residential properties, focus on neighborhood trends, school districts, job growth, and proximity to amenities. Single-family homes and multi-family units perform best in areas with stable or growing populations.

- For commercial properties, evaluate local business demand, economic development, and competition. Office buildings and retail spaces thrive in areas with robust business activity and foot traffic.

- For niche properties like vacation rentals or mobile home parks, location is key. Vacation rentals need to be near tourist attractions, while mobile home parks perform best in regions with high demand for affordable housing.

Thorough market research is crucial. Look for areas where property demand is growing, and ensure that the property type you’re investing in aligns with local trends.

Property Management Style

Different property types require different levels of management. Some investors prefer a hands-on approach, while others would rather outsource day-to-day operations to a property management company. Here’s how management intensity varies across the property types we’ve covered:

- Low-management properties like mobile home parks allow for relatively passive income. Residents are responsible for much of their own maintenance, and management demands are minimal.

- Moderate-management properties include single-family homes and long-term rental apartments. While these properties require regular upkeep, they’re not as demanding as short-term rentals or commercial properties.

- High-management properties like vacation rentals and office buildings often require daily attention. Vacation rentals, in particular, involve frequent resident turnover, while commercial properties may involve complex lease negotiations and resident needs.

Consider how much time you want to dedicate to managing your property. If you prefer a hands-off approach, look for low-management investments like mobile home parks. For those who enjoy being more involved, vacation rentals or office spaces might be a better fit.

Choosing the right investment property requires a balance of financial goals, risk tolerance, capital, and personal management preferences.

Whether you’re looking for stable cash flow from multi-family properties, long-term appreciation from single-family homes, or the high-income potential of vacation rentals, your success will depend on how well your investment aligns with your broader strategy.

It’s always worth taking the time to assess your capabilities and thoroughly research your options so you can confidently choose the right property type for your portfolio.

In Conclusion

Rental investment is as much about understanding your goals as it is about the properties you’re investing in. But first, what are the different types of rental properties?

- Single-Family Homes: The most common entry point for investors, providing simplicity with long-term residents but potential vacancy risks.

- Multi-Family Properties (Duplexes, Triplexes, Fourplexes): Higher cash flow from multiple income streams, though management intensity increases with multiple residents.

- Condominiums: Low-maintenance investment, as HOAs manage common areas, but be mindful of fees and rental restrictions.

- Townhouses: More autonomy and space than condos, but with some maintenance responsibilities and potential HOA rules.

- Apartment Buildings: Ideal for experienced investors with high upfront costs but offering significant cash flow potential.

- Vacation Rentals: High income during peak seasons but sensitive to location and local STR regulations.

- Commercial Properties: Long-term leases and higher rent potential, but management is more complex.

- Mobile Home Parks: Affordable housing options with steady income but may face zoning challenges.

Each property type offers a unique set of benefits and challenges, but the best investment will always be the one that aligns with your financial expectations, risk tolerance, and vision for the future.

Whether you’re chasing steady cash flow with multi-family units or seeking the higher stakes and rewards of vacation rentals, every decision you make sets the course for your investment journey. The key is to know your direction.

Real estate is not a one-size-fits-all venture—it’s about making informed, strategic choices that reflect your long-term aspirations.

As you move forward, remember that patience and research are your greatest allies. Take your time to understand your market, choose properties that complement your strengths, and don’t be afraid to seek out help if managing day-to-day operations feels overwhelming.

The right property will not only grow your wealth but also create opportunities that match your lifestyle and values.

Keep in mind that part of your success as a rental investor stems from keeping your residents happy. Quick maintenance, friendly communication, and a good onboarding experience can go a long way in setting you up for long-term success.

In the end, real estate investment is about building a future on your terms. So choose wisely, stay the course, and your portfolio will thank you for it.

If you want to read more about what comes after you’ve purchased your investment property, here are some great resources: