Becoming a landlord is a profitable and reliable way to earn income and build wealth over time. This comprehensive guide will walk you through everything you need to know about managing a rental property, whether you purchased it or inherited it.

You’ll learn about your responsibilities as a landlord, how to prepare and maintain your property, and strategies for finding and keeping reliable residents. We’ll also cover essential legal and financial aspects to ensure your success.

This guide is tailored for new and aspiring landlords. If you’re just starting out or considering renting out a property, you’ll find this information very helpful. Let’s embark on your journey to becoming a successful landlord!

How to Become a Landlord: Understanding the Role

As a landlord, you have several important responsibilities:

- Managing Properties and Residents: You are in charge of overseeing your rental properties and ensuring they are in good condition. This includes handling resident inquiries, addressing their concerns, and ensuring their satisfaction.

- Maintenance and Repairs: Keeping your property in excellent shape is crucial. You need to perform regular maintenance, address repair needs promptly, and ensure the property meets health and safety standards.

- Handling Finances and Legalities: Managing rent collection, keeping financial records, and budgeting for expenses are key tasks. Additionally, you must stay informed about and comply with local landlord-resident laws and regulations.

Key Skills and Traits of Successful Landlords

To be a successful landlord, you need several important skills and traits:

- Communication: Clear and effective communication with residents is essential. This helps in addressing their concerns quickly and maintaining a positive relationship.

- Organization: Keeping track of rent payments, maintenance schedules, and legal documents requires strong organizational skills.

- Patience: Handling resident issues and property problems calmly and patiently is crucial for maintaining a good landlord-resident relationship.

- Problem-Solving: Quick and effective problem-solving skills help in managing unexpected issues that arise with the property or residents.

If you feel like you don’t have the right personality or skills for the job, that doesn’t mean you should give up on your rental income goals. Hiring a property manager is always a good option.

|

SUMMARY To become a landlord, you must manage properties and residents, perform regular maintenance, handle repairs, and comply with local laws. Key skills include effective communication, strong organization, patience, and problem-solving. |

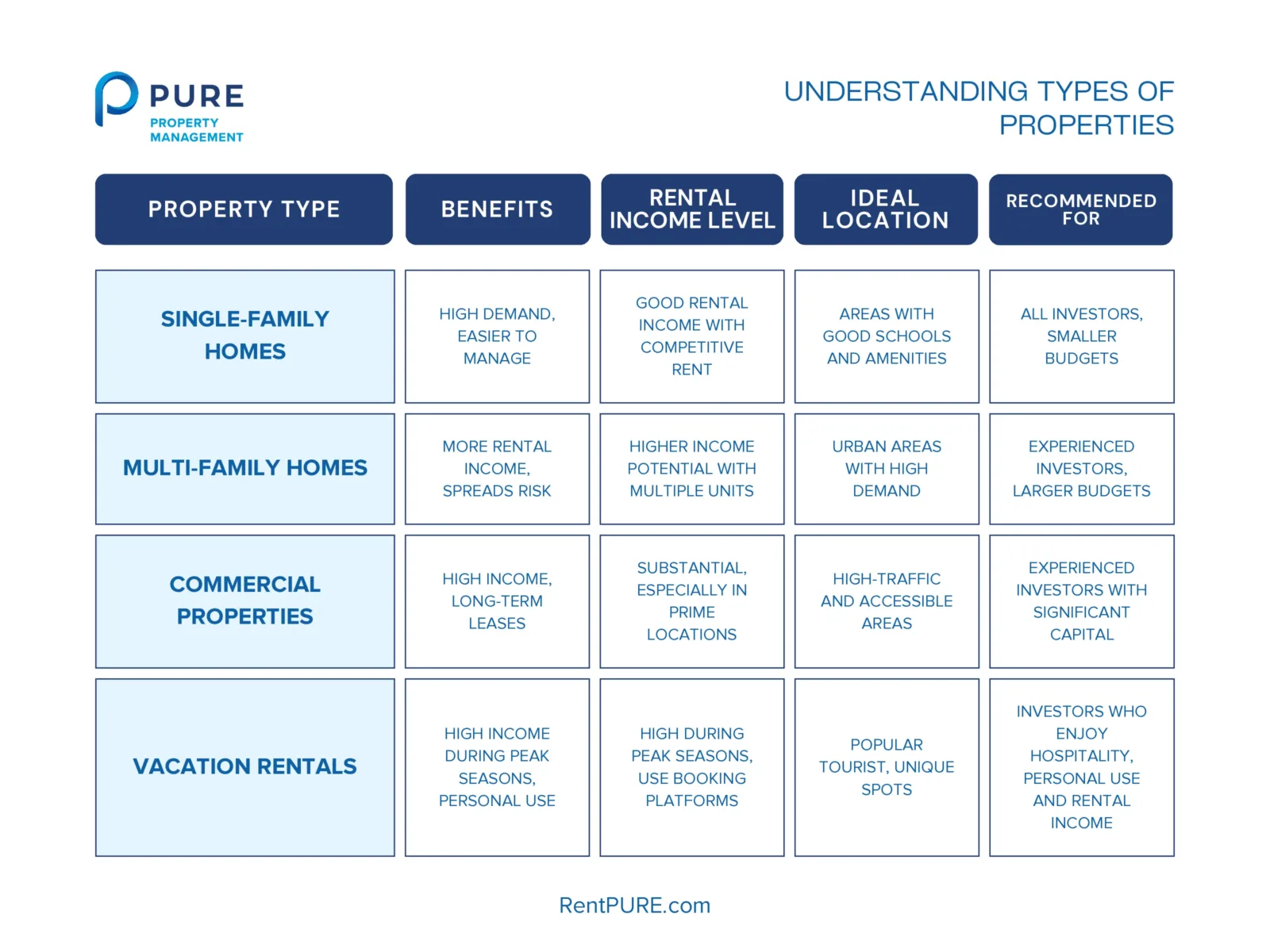

Understanding Types of Properties

Once you’ve become comfortable with knowing the prerequisites of being a landlord, you’re ready to buy your first rental property. It’s good to know what sort of rental investment properties exist so you can begin with what suits you.

If you’re just starting your rental income portfolio and learning how to become a landlord, we highly recommend starting with a single-family home.

Establish a Rental Business Model

Before diving into property hunting, it’s crucial to establish how you want your rental business to operate. Reflecting on a couple of key parameters will guide your decisions and set you up for success in property investment.

Length of Tenancy

First, consider how long you are willing to rent out your property. Your options range from short-term to long-term, to very long-term rentals, each with unique benefits and challenges that will influence your property choice, location, furnishings, and interior decor.

Short-Term Rentals:

Short-term rentals, such as vacation rentals, are rented out on a daily, weekly, or monthly basis. Popular platforms like Airbnb have boosted the market, attracting vacationers and business travelers alike.

| Advantages | Disadvantages |

|

|

Long-Term Rentals:

Long-term rentals typically involve leasing the property on an annual basis, with options to renew the lease each year.

| Advantages | Disadvantages |

|

|

Very Long-Term Rentals:

In this lesser-known category, properties are leased for several years, sometimes up to 20 years or more. residents often sublease and handle most landlord responsibilities.

| Advantages | Disadvantages |

|

|

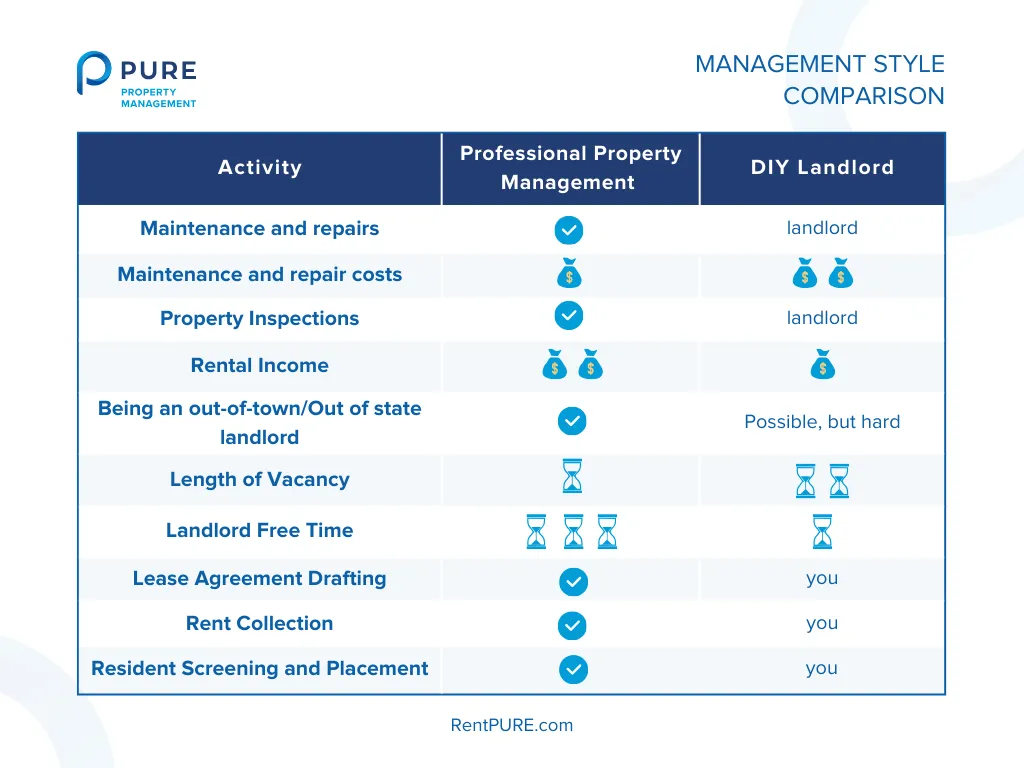

Management Style

Many investors choose to hire a professional property manager instead of choosing to learn how to become a landlord. Making the decision between DIY management and hiring a professional is critical and will impact your free time, financial forecast, and level of involvement.

Professional Property Management:

- Many landlords opt for professional property management due to the legal expertise and industry knowledge these companies provide.

- Advantages are reduced hassle, more free time, and professional handling of resident issues, legal matters, and maintenance.

- The downside is the cost, including monthly management fees and additional charges.

DIY Management:

- Some landlords prefer to manage properties themselves to maintain control over the budget, because being a landlord is their main job, or due to emotional attachment to the property.

- Benefits include full control over management decisions and budget and potentially higher profits without management fees.

- However, DIY management requires significant time and effort to manage residents and maintenance, necessitates gaining comprehensive property management skills, and requires a local presence to handle on-site issues.

To help you decide, we’ve provided a detailed comparison of property management activities performed by professionals versus DIY landlords. This will give you a clearer understanding of what to expect and help you make an informed choice.

|

SUMMARY Start with single-family homes for easy management. Multi-family homes and commercial properties offer higher income but need experience. Decide on short-term, long-term, or very long-term rentals based on your goals. Choose between DIY management for control and potentially higher profits, or hire a property manager for less hassle. |

Quick Takeaways

-

What are short-term rentals?

Daily, weekly, or monthly rentals (e.g., Airbnb) that offer flexibility and high-profit potential but involve inconsistent ROI and higher operating costs. -

What defines long-term rentals?

Annual leases with predictable income, lower costs, and less turnover, but lower monthly rent and limited property access. -

How do very long-term rentals work?

Leases spanning several years (up to 20+), offering stability and minimal involvement, though rent is usually 60–70% of market value. -

What are the pros and cons of professional property management?

It reduces hassle and ensures compliance, but comes with monthly fees and extra charges. -

What are the trade-offs of DIY management?

It offers control and avoids fees but requires significant time, effort, and local presence.

Choosing the Right First Property

One of the first steps to becoming a landlord starts with selecting the right property. This involves careful consideration of the property’s location and condition, as well as an assessment of its potential rental income.

If you’re interested in an in-depth guide to finding the perfect investment property, check out this one.

Evaluating Potential Rental Income

To ensure profitability, research rental prices of similar properties in the area using platforms like Zillow or local property managers. Features like extra bedrooms, modern appliances, or a backyard can justify higher rents. Properties in developing neighborhoods may start with lower income but can grow significantly over time.

Profitability Indicators

Check how profitable a property will be. Look at your potential income after expenses and ensure the rent covers a good portion of your costs. Quick rules, like comparing rent to purchase price, can help you decide if a property is worth it. Tools like online calculators make these checks easier.

Commuting Distance

If you’re managing the property yourself, choose one nearby. Long drives for repairs or tenant issues can be exhausting and costly over time.

Property Location

Pick a location with good schools, parks, and low crime rates, as these attract reliable tenants. Easy transportation and growing neighborhoods also increase rental demand. Research local developments or ask experts to spot the best opportunities.

Condition of the Property

Well-maintained homes cost less in upkeep and attract more renters, even if they’re a bit pricier. Homes needing minor fixes can still be great investments if they’re priced right. Focus on updated kitchens and bathrooms, as they’re popular with renters.

Financing Options

Choosing the right financing is crucial for turning a promising property into a successful investment. Mortgages are the most common choice, offering lower interest rates and the ability to buy higher-value properties, but they require a down payment and good credit. Loans, on the other hand, provide flexibility and quicker approval but often come with higher interest rates and shorter repayment terms.

If you prefer to avoid debt, using personal savings ensures full ownership without monthly payments, though it may limit your investment potential.

For more details on financing rental properties, read our full guide.

Buying a Rental Property

Purchasing a rental property involves a few essential steps to ensure a smooth and successful process. If you want a detailed breakdown of each step involved in buying a rental property, including tips and strategies, check out our full guide. Here’s a quick overview to get you started:

- Get Pre-Approved: Compare lenders to find the best loan terms and gather necessary documents like tax returns and pay stubs. Pre-approval ensures you’re financially ready to move forward.

- Hire an Expert Agent: Choose a real estate agent who specializes in investment properties. They’ll help you find the right property and negotiate the best deal.

- Make an Offer: Submit a competitive offer with contingencies for financing, inspection, and appraisal. Be prepared to negotiate terms until both parties agree.

- Inspect the Property: Hire a professional inspector to identify any repairs or potential issues. Use the findings to negotiate price adjustments or request repairs.

- Analyze the Market: Research local rental trends, vacancy rates, and demand to set a competitive rental price and understand the property’s income potential.

- Secure Financing: Finalize your loan, complete an appraisal, and ensure all paperwork is in order before closing.

- Do a Final Walkthrough: Inspect the property again to confirm its condition and ensure all agreed-upon repairs are complete.

- Close the Deal: Review and sign closing documents, pay costs, and receive the keys to your new rental property.

These steps will help you navigate the process with confidence. For a deeper dive into each stage, don’t miss our comprehensive guide.

Preparing the Property for Rent

Preparing your property for rent involves several key steps to ensure it’s attractive, safe, and compliant with regulations. This comprehensive checklist will help you cover all necessary aspects, from renovations and upgrades to setting up utilities and services.

Renovations and Upgrades

Making necessary repairs and improvements is crucial to maintain the property’s functionality and appeal. Additionally, enhancements can make your property more attractive to potential residents.

Necessary Repairs and Improvements:

- Fix structural issues such as the foundation and roof.

- Address plumbing problems, including leaks and water pressure.

- Repair electrical faults like outlets and wiring.

- Ensure all appliances are in working order.

- Clean and maintain the property thoroughly.

Enhancements to Attract Residents:

Resident retention is key to your success as a landlord. Here are some ways you can make sure your residents stick around for the long haul. Even if you’re planning on short-term rentals, these improvements will help justify higher rents.

- Apply fresh paint to walls and ceilings.

- Update fixtures, including lighting and faucets.

- Replace or clean flooring, whether carpets or hardwood.

- Install energy-efficient appliances.

- Add smart home features, such as thermostats and security systems.

- Improve curb appeal through landscaping and exterior painting.

Safety and Compliance

Ensuring the property meets health and safety standards is not only a legal requirement but also helps protect your residents and property. Compliance with local regulations is also essential to avoid legal issues.

Meeting Health and Safety Standards:

- Install smoke detectors in appropriate locations.

- Install carbon monoxide detectors where needed.

- Place fire extinguishers in key areas like the kitchen and hallways.

- Ensure all windows and doors have functioning locks.

- Fix any safety hazards, such as exposed wires and unstable staircases.

- Check for mold and pest infestations and address them.

Ensuring Property Complies with Local Regulations:

- Obtain necessary permits for renovations and rentals.

- Adhere to zoning laws and occupancy limits.

- Ensure accessibility features are in place if required by law.

- Comply with landlord-resident laws regarding leases, security deposits, and notice periods.

- Conduct regular inspections to ensure ongoing compliance.

Setting Up Utilities and Services

Setting up utilities and maintenance services is essential for a smooth transition for your residents and for maintaining the property’s condition over time.

Utilities Management:

- Arrange for water, electricity, and gas services.

- Set up internet and cable services.

- Decide if utilities will be included in rent or will be managed by the resident.

- Provide instructions for residents on how to set up their own utility accounts, if necessary.

Maintenance Services:

- Establish a schedule for regular property upkeep, such as lawn care and pest control.

- Create a plan for seasonal maintenance, including HVAC servicing and gutter cleaning.

- Hire a reliable handyman or maintenance service for repairs.

- Ensure residents know how to request maintenance services.

- Keep an emergency contact list for urgent repairs like plumbers and electricians.

|

SUMMARY Prepare your rental by fixing structural issues, updating fixtures, and enhancing curb appeal. Ensure safety with detectors, locks, and compliance with local laws. Set up utilities and schedule regular maintenance. Provide clear instructions for residents on utilities and maintenance requests to ensure a smooth transition and ongoing property care. |

Marketing Your Rental Property

Once your property is ready for residents, effective marketing is essential to attract quality residents. This involves creating attractive listings, choosing the right advertising channels, and setting a competitive rent price.

Creating Attractive Listings

The first step in marketing your rental property is to create an engaging and detailed listing.

Writing Effective Property Descriptions:

- Highlight the property’s best features, such as modern appliances, spacious rooms, and desirable locations.

- Use clear, concise language and avoid jargon.

- Mention any recent renovations or upgrades.

- Include information about local amenities like schools, parks, and public transportation.

Taking High-Quality Photos:

- Use a good camera or hire a professional photographer.

- Ensure the property is clean and well-lit before taking photos.

- Capture all key areas, including the exterior, living spaces, kitchen, bedrooms, and bathrooms.

- Take photos from multiple angles to provide a comprehensive view.

Advertising Channels

Choosing the right platforms to advertise your property is crucial for reaching potential residents.

Online Platforms:

- List your property on popular rental websites like Zillow, Craigslist, and Realtor.com.

- Use clear, keyword-rich titles to improve searchability.

- Regularly update and refresh your listings to keep them visible.

Social Media:

- Share your property listing on social media platforms like Facebook, Instagram, and Twitter.

- Join local community groups and housing forums to post your listing.

Local Newspapers and Community Boards:

- Place ads in local newspapers, especially in the classified section.

- Post flyers on community boards at local businesses, libraries, and community centers.

- Attend local events and network with community members to spread the word.

Setting the Right Rent Price

Setting a competitive rent price is key to attracting residents while ensuring profitability.

Competitive Analysis:

- Research similar properties in your area to understand the going rate for rentals.

- Compare features, sizes, and locations to ensure your price is competitive.

Factoring in Property Costs and Market Trends:

- Calculate your property’s costs, including mortgage payments, maintenance, and utilities.

- Monitor market trends to adjust your rent price according to demand and economic conditions.

- Consider seasonal fluctuations and adjust prices accordingly.

|

SUMMARY Market your rental property by creating detailed, attractive listings and using the right advertising channels. Highlight features, take quality photos, and post on platforms like Zillow and social media. Set a competitive rent price by researching similar properties, considering costs, and monitoring market trends. |

Quick Takeaways

What should every rental listing include?

A clear description of the property’s best features, plus recent upgrades and local amenities.

Why are photos important in rental marketing?

High-quality images of each room increase inquiries and help listings stand out.

Which online platforms reach the most renters?

Websites like Zillow, Realtor.com, and Craigslist are great starting points.

How can social media support rental marketing?

Sharing on Facebook, Instagram, and community groups expands reach beyond listing sites.

What factors influence the right rent price?

Comparable local rentals, your property costs, and seasonal market trends.

Screening and Selecting Residents

Proper resident screening is key to finding reliable residents. Without it, you will end up with residents who don’t pay on time and damage your property and reputation.

Resident Screening Process

Start by having potential residents fill out detailed application forms. Run background and credit checks to see their financial stability and rental history. Check their references and verify employment to confirm their credibility.

Fair Housing Laws

Know and follow fair housing laws to avoid discrimination. It’s crucial to ensure your screening process is fair and legal.

Interviewing Prospective Residents

When interviewing residents, ask about their rental history and current job. Pay attention to any red flags, like inconsistent information or reluctance to provide references. These steps will help you choose the best residents for your property.

Drafting and Signing the Lease Agreement

Creating a solid lease agreement is crucial for a smooth landlord-resident relationship.

Essential Lease Terms

Clearly outline the rent amount and its due date. Specify the security deposit amount and the conditions for its return. Define who is responsible for maintenance tasks. Include any rules and regulations, such as pet policies and noise restrictions.

Legal Considerations

Ensure the lease complies with local laws. It’s wise to have a lawyer review the lease to avoid any legal pitfalls.

A well-drafted lease agreement sets clear expectations and helps prevent future disputes, fostering a positive relationship with your residents.

Managing Residents and Property

Effective management is key to maintaining a successful rental property.

Communication Strategies

Maintain open lines of communication with your residents. Address resident complaints and requests promptly to show that you value their concerns. Building and maintaining a positive relationship with your residents can lead to longer tenancies and fewer issues.

Routine Inspections and Maintenance

Schedule regular inspections to ensure the property is in good condition. Use a checklist to manage repairs and maintenance tasks efficiently, addressing any issues before they become major problems.

Dealing with Late Payments and Evictions

Set up a reliable payment collection system to minimize late payments. Understand the legal process for handling evictions, ensuring you follow all necessary steps to protect your rights as a landlord.

Managing Turnovers

Handle move-outs smoothly by conducting a thorough inspection and addressing any necessary repairs or cleaning. This ensures the property is ready for the next resident quickly and efficiently.

Rental Expenses & Budgeting

After deciding on your rental business model, the next step is understanding your rental expenses, both before and during the rental period. Knowing what to expect financially before buying a property will help you determine how much you need to borrow from the bank or have on hand for transforming the property into a rental.

A Word of Advice on Expenses

Many new landlords create a fixed budget for rental expenses, expecting everything to go as planned. This rarely happens. Be flexible with your budget, as unexpected situations often arise, requiring you to spend more than anticipated.

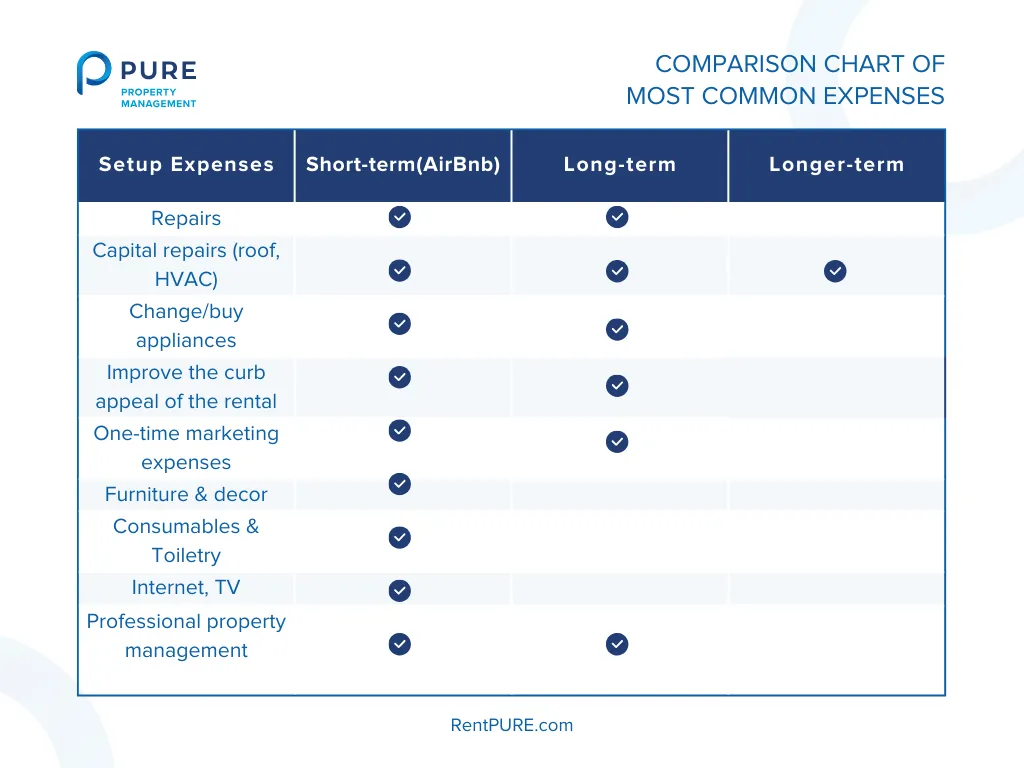

Types of Rental Expenses

For clarity, rental expenses are divided into two categories: one-time expenses for setting up the rental and ongoing expenses for running the rental.

One-time Expenses to Set Up the Rental:

- Routine repairs: Replace a window, fix a wall, or do a paint job.

- Capital repairs: Roof, HVAC, and electrical system improvements.

- Appliances: Replacing a microwave or fixing the refrigerator.

- Improve curb appeal: Repainting walls, trimming bushes, and other budget-friendly enhancements.

- One-time marketing expenses: Professional photos, videos, or rental portal account setup.

- Professional property management (optional).

Additional Expenses for Short-term Rentals:

- Furniture & decor: Everything from a couch to a nice carpet in the living room.

- Consumables & toiletries: Stock the house with essentials like detergent and sugar.

Let’s compare the most common expenses for short-term, long-term, and very long-term rentals side by side to visualize them better:

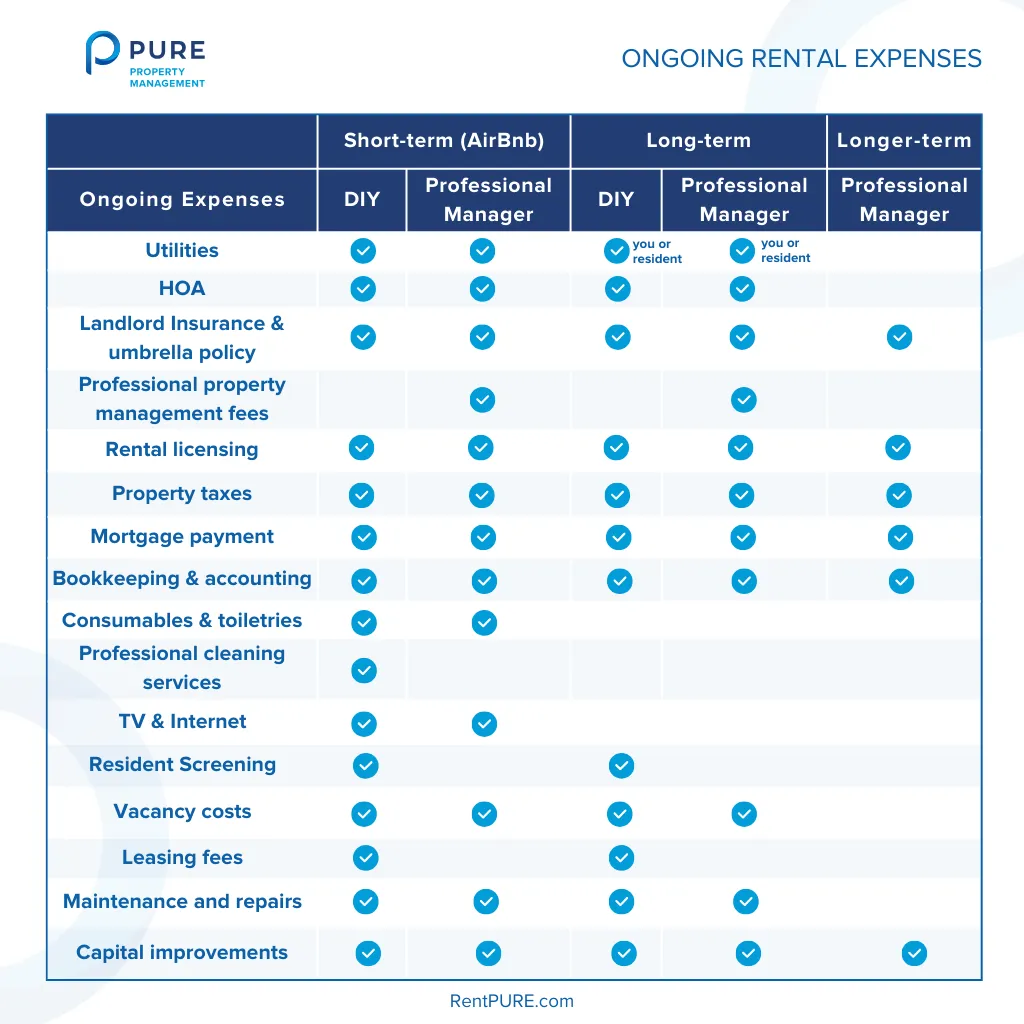

Ongoing Rental Expenses

Once your rental is set up and you have your first resident, you’ll start encountering recurring monthly and yearly expenses.

Fixed Expenses

These operating expenses are essential for sustaining your business and typically recur regularly.

- Utilities: Water, sewer, gas, electricity, and trash collection. Depending on your lease agreement, either you or your resident will cover these costs.

- HOA Fees: Monthly or yearly fees if your property is part of a homeowners association.

- Landlord Insurance: Protects against property damage and liability claims.

- Rental Licensing: Required permits and licenses for operating a rental property.

- Professional Property Management Fees: Costs for hiring a property manager, if applicable.

- Property Taxes: Annual taxes based on your property’s assessed value.

- Mortgage Payment: Monthly mortgage installments.

- Bookkeeping & Accounting: Services to keep your finances in order.

Additional Expenses for Short-term Rentals:

- Consumables: Regularly stocking items like detergent and sugar.

- Toiletries: Providing essentials for guests.

- Professional Cleaning Services: Ensuring the property is cleaned between guests.

- TV and Internet Subscription: Providing entertainment and connectivity.

Variable Expenses

Alongside fixed expenses, you might encounter variable costs depending on specific situations.

- Vacancy Costs: Lost income when your property is unoccupied.

- Leasing Fees: Fees for resident placement if you use a property manager.

- Resident Screening: Costs for using a screening platform if you manage residents yourself.

- Capital Improvements: Major updates like roof replacements, electrical system upgrades, and HVAC installations.

- Routine Maintenance & Repairs: Regular upkeep to keep the property in good condition.

Understanding and preparing for these ongoing expenses will help you manage your rental property effectively and maintain profitability.

Tracking Income and Expenses

Efficiently managing your rental property’s finances is crucial for success.

Using Property Management Software

Property management software helps automate and streamline financial tracking. It can manage rent collection, track expenses, and generate financial reports, saving you time and reducing errors.

Keeping Detailed Financial Records

Maintain detailed records of all income and expenses. This includes rent payments, maintenance costs, utility bills, and any other expenses. Organized records are essential for tracking profitability and simplifying tax filing.

Understanding Taxes

As a rental property owner, you can reduce your taxable income by deducting expenses like mortgage interest, property taxes, insurance, maintenance, repairs, and management fees. Keeping detailed financial records and understanding applicable deductions is crucial for accurate tax filing. Consulting a tax professional can help you maximize benefits and ensure compliance with tax laws.

Insurance

Proper insurance coverage, such as landlord insurance and property insurance, is essential to protect your investment from risks like property damage, liability, and loss of rental income. Review different policies to understand coverage options and ensure you have adequate protection against potential risks associated with renting out your property.

|

SUMMARY Understand rental expenses to budget wisely. Prepare for one-time setup costs and ongoing expenses like utilities and maintenance. Use software to track finances and consult a tax pro for deductions. Ensure you have the right insurance to protect your investment and maintain profitability. |

Scaling Your Landlord Business

How do you become a landlord? Consider acquiring additional properties in high-demand areas and using financing options like mortgages or partnerships. Implement property management software and online systems to streamline operations, enhance resident satisfaction, and simplify management. As your portfolio expands, hire a property manager and other professionals to handle daily operations and ensure regulatory compliance.

For a full guide on how to scale your rental income business, here’s a full guide.

In Conclusion

Becoming a landlord can seem overwhelming, but taking it step by step makes it easier. Here’s a quick summary of what we covered in this article:

- Choosing a Property: Look for properties with good rental income potential. Check out nearby schools, public transport, and job centers. Single-family homes are a great starting point since they’re easier to manage.

- Business Model: Decide if you want short-term rentals like vacation homes, long-term annual leases, or very long-term rentals. Choose between managing properties yourself or hiring a professional property manager.

- Buying a Property: Get pre-approved for a loan and hire a knowledgeable real estate agent. Make a competitive offer, conduct thorough inspections, and finalize your financing.

- Preparing for Rent: Fix any major issues, update the property with fresh paint and new fixtures, and ensure it meets safety standards. Set up utilities and make sure everything is in working order.

- Marketing: Create appealing listings with high-quality photos. Advertise on rental websites, social media, and local platforms. Research local rental prices to set a competitive rate.

- Resident Screening: Conduct background and credit checks, verify employment, and follow fair housing laws. Interview potential residents to find reliable ones.

- Managing Property: Communicate openly with residents and handle maintenance issues promptly. Schedule regular inspections, use an efficient rent collection system, and manage resident turnovers smoothly.

These steps will help you become a successful landlord. Stay proactive, keep learning, and ask for help if needed. Happy renting!

Additional Resources You may want to Read: