Tax season can be a source of stress, but for savvy rental property investors, it’s an opportunity to boost profitability by reducing taxable income. Rental property tax deductions allow you to subtract a variety of eligible expenses—like repairs, mortgage interest, and property taxes—from your rental income, significantly lowering your tax bill.

Understanding and applying these deductions correctly can make the difference between a property that struggles to stay profitable and one that thrives.

If you’re new to property taxes, check out our full guide.

The Importance of Maximizing Deductions for Your Profit

Every dollar saved on taxes is a dollar reinvested into your business. By fully utilizing all available deductions, you can maintain more substantial cash flow, protect your margins, and reinvest in your portfolio. Whether you own one property or manage several, knowing which deductions apply and how to claim them is essential for landlords who want to stay competitive in today’s market.

Overview of the 2024 Tax Landscape for Landlords: What’s New About Deductions?

The tax rules landlords follow don’t stay static. This year, a few key updates (which you can read more about on the IRS website) may impact how much you can save. Here’s what you need to know:

- Changes to Bonus Depreciation: If you’ve relied on bonus depreciation to write off the cost of new property acquisitions in recent years, be aware that the percentage you can deduct in the first year has dropped from 100% to 80% in 2024. This means more considerable expenses will take longer to depreciate, which could reduce immediate tax savings but still provide benefits over time. This shift requires careful planning to manage cash flow and optimize deductions for landlords planning to purchase new properties or major assets.

- Adjustments to Section 179 Expensing: Section 179 lets you deduct the full cost of qualifying property, like equipment or vehicles, in the year it’s placed in service. In 2024, the maximum deduction is $1,160,000, but it phases out if your total property expenses exceed $2,890,000. For landlords managing multiple properties or making significant investments in equipment, understanding these limits ensures you can take advantage of this deduction without exceeding the thresholds.

- Increased Mileage Rates: For landlords who travel frequently for property management, the updated mileage reimbursement rate of 65.5 cents per mile means slightly larger deductions for vehicle-related expenses. It’s a small change, but these savings can add up over the year—especially for landlords managing properties in multiple locations.

Why does all this matter? These updates show how small shifts in tax rules can affect your bottom line. Understanding and adapting to these changes, especially when it comes to tax deductions for rental property, will help you make smarter decisions—whether it’s timing your property acquisitions to align with depreciation benefits or logging mileage to maximize deductions.

In the rest of this guide, we’ll dive into the specific deductions available in 2024 and how to make the most of them.

This article is based on insights from PURE Property Management’s Investor Education Series webinar: Tax Benefits and Deductions for Rental Property Investors, featuring Brandon Hall, CPA, a seasoned expert with over eight years of experience helping real estate investors build tax-smart portfolios. Brandon’s firm, Hall CPA, specializes in tax planning and compliance for real estate investors, providing invaluable guidance to maximize deductions and improve profitability.

What Qualifies as a Deductible Expense for the Fiscal Year 2024?

Navigating the tax landscape for rental property owners involves understanding which expenses are deductible and how to classify them appropriately. For the fiscal year 2024, several updates and clarifications have emerged that landlords should be aware of to optimize their tax strategies.

What Qualifies as a Deductible Expense for Fiscal Year 2024?

While many deductible expenses remain consistent, such as mortgage interest, property taxes, and maintenance costs,staying informed about any changes or clarifications introduced by the IRS for 2024 is essential. Currently, there are no significant new categories of deductible expenses specific to this fiscal year. However, landlords should remain vigilant for any IRS announcements or legislative changes that may impact deductible expenses.

IRS Guidelines on Rental Deductions

The IRS provides comprehensive guidelines on rental income and expenses. According to IRS Publication 527, rental property owners can deduct expenses necessary for managing and maintaining their properties. These expenses include, but are not limited to, advertising, cleaning and maintenance, utilities, insurance, and depreciation. It’s crucial to differentiate between expenses that can be deducted in the current year and those that must be capitalized and depreciated over time.

Capital vs. Current Expenses

Understanding the distinction between capital and current expenses is vital for accurate tax reporting:

- Current Expenses: These costs keep the property in its ordinary, efficient operating condition without adding significant value or extending its life. Examples include minor repairs like painting or fixing leaks. Such expenses are typically deductible in the year they are incurred.

- Capital Expenses: These involve improvements that add value to the property, prolong its useful life, or adapt it to new uses. Examples include adding a new roof, installing a central air-conditioning system, or making structural modifications. These costs must be capitalized and depreciated over the property’s useful life.

Properly classifying expenses ensures compliance with tax laws and maximizes potential deductions. For more detailed information, refer to the IRS guidelines on distinguishing capital improvements from repairs.

Ordinary and Necessary Expenses

The IRS allows deductions for expenses that are both ordinary and necessary:

- Ordinary Expenses: Common and accepted costs in the rental business, such as property management fees, advertising, and routine maintenance.

- Necessary Expenses: Appropriate and helpful costs for the rental activity, including insurance premiums, legal fees, and utilities.

Ensuring that expenses meet these criteria is essential for their deductibility. Maintaining detailed records and receipts will support these deductions in the event of an audit.

Tax Deductible Items for Rental Property

As a landlord, understanding rental property tax deductions and the array of deductible expenses available can significantly enhance the profitability of your rental properties. Here’s a comprehensive overview of key deductible expenses for the fiscal year 2024 to help you maximize your savings and investment returns:

Mortgage Interest

- Eligibility Criteria: Interest paid on loans to acquire or improve rental properties is deductible. Ensure the rental property secures the loan and that the property is actively rented or available for rent during the tax year.

- Points and Loan Origination Fees: Points and loan origination fees paid to obtain a mortgage for a rental property can be deducted over the life of the loan. For example, paying $3,000 in points on a 30-year mortgage can deduct $100 annually.

- Documentation Required: Maintain detailed records, including loan agreements and payment statements, to substantiate the interest and fees paid.

Property Taxes

- State and Local Tax Deductions: Property taxes levied by state and local governments on rental properties are fully deductible. This includes annual property taxes assessed based on the property’s value.

- Limitations Under the Tax Cuts and Jobs Act: The $10,000 cap on state and local tax deductions imposed by the Tax Cuts and Jobs Act does not apply to rental properties, as they are considered business assets.

Repairs and Maintenance

- Distinguishing Between Repairs and Improvements: Repairs that maintain the property’s current condition, such as fixing leaks or repainting, are deductible in the year incurred. Improvements that add value or extend the property’s life, like installing a new roof, must be capitalized and depreciated over time.

- Examples of Deductible Repairs: Replacing broken windows, repairing gutters, and fixing plumbing issues are considered deductible repairs.

- Safe Harbor Rules: The IRS provides safe harbor rules allowing landlords to deduct certain routine maintenance expenses without capitalizing on them. For instance, expenses not exceeding $2,500 per invoice or item may qualify under the de minimis safe harbor election.

Insurance Premiums

- Types of Deductible Insurance: Premiums for fire, theft, flood, and liability insurance on rental properties are deductible. Additionally, landlord-specific policies covering loss of rental income are also deductible.

- Prepaid Insurance and Refunds: If you prepay insurance premiums covering multiple years, deduct only the portion applicable to the current tax year. Refunds received from canceled policies must be reported as income.

Utilities and Services

- Electricity, Water, and Gas: Payments for utilities provided to tenants are deductible. If tenants reimburse you, report the reimbursements as income.

- Trash Removal and Landscaping: Expenses for waste management, lawn care, and snow removal are deductible, as they contribute to the property’s upkeep.

Professional Fees

Fees paid to professionals for services related to your rental activity are deductible. This includes legal fees for lease agreements, accounting services for tax preparation, and property management fees for overseeing daily operations.

Advertising and Marketing Costs

Expenses incurred to attract tenants, such as online listings, signage, and print media advertisements, are deductible. Effective marketing can reduce vacancy periods, enhancing rental income.

Travel and Transportation

- Local Travel Expenses: Costs for travel to and from your rental properties for management purposes, including mileage, parking fees, and tolls, are deductible. For 2024, the standard mileage rate is 67 cents per mile.

- Long-Distance Travel Considerations: If managing properties requires overnight travel, expenses for airfare, lodging, and meals are deductible, provided the primary purpose of the trip is rental activity.

- Record-Keeping Requirements: Maintain detailed logs of travel dates, destinations, purposes, and expenses to substantiate deductions.

Depreciation of Rental Property

- Understanding Depreciation: Depreciation allows you to recover the cost of the property over its useful life, reducing taxable income annually.

- What Assets Can Be Depreciated: The building structure, appliances, carpeting, and furniture used in the rental property are depreciable assets.

- Recovery Periods for Different Property Types: Residential rental property is depreciated over 27.5 years, while nonresidential property is depreciated over 39 years.

- How to Calculate Depreciation:

- Straight-Line Depreciation Method: This method spreads the deduction evenly over the asset’s useful life.

- Modified Accelerated Cost Recovery System (MACRS): The IRS requires using MACRS for most property, which applies predetermined depreciation rates.

- Section 179 Expensing: Allows immediate expensing of certain property, subject to limits. For 2024, the maximum deduction is $1,160,000, with a phase-out threshold of $2,890,000.

- Limits and Exceptions: Land cannot be depreciated. Additionally, properties used for personal purposes for part of the year require adjustments to depreciation calculations.

- Depreciation Recapture Upon Sale: When selling the property, previously taken depreciation deductions may be subject to recapture at a 25% tax rate.

- Adjustments for Personal Use: If you use the property personally, depreciation deductions must be prorated based on rental use.

- Improvements vs. Repairs: Improvements must be capitalized and depreciated, while repairs are deductible in the year incurred.

1031 Exchanges

A 1031 exchange allows the deferral of capital gains taxes by reinvesting proceeds from selling one investment property into another like-kind property. Key considerations include:

- Like-Kind Property: Both properties must be of a similar nature or character and used for investment or business purposes.

- Timeline: Identify replacement property within 45 days and complete the exchange within 180 days of selling the original property.

- Qualified Intermediary: Engage a qualified intermediary to facilitate the exchange, as the direct receipt of sale proceeds can disqualify the exchange.

Advanced Deduction Strategies

As a rental investor, implementing advanced deduction strategies can significantly enhance the profitability of your rental properties. Below are key strategies to consider:

Home Office Deduction

If you use part of your home exclusively and regularly for rental property management, you may qualify for a home office deduction. This deduction allows you to allocate some of your home’s expenses—such as utilities, insurance, and depreciation—to your rental business.

- Qualifying Criteria: The space must be used exclusively and regularly for rental management activities. It should be your principal place of business or where you meet with clients or customers in the normal course of your business.

- Simplified vs. Regular Method: The IRS offers two methods to calculate the deduction:

- Simplified Method: Multiply the square footage of your home office by a prescribed rate (e.g., $5 per square foot, up to 300 square feet).

- Regular Method: Calculate actual expenses, including mortgage interest, utilities, and insurance, and allocate them based on the percentage of your home’s square footage used for business.

Passive Activity Loss Rules

Rental real estate activities are generally considered passive, meaning losses are typically deductible only against passive income. However, exceptions exist:

- Active Participation: If you actively participate in the rental activity, you may deduct up to $25,000 of rental losses against other income, subject to income phase-outs.

- Real Estate Professional Status: If you qualify as a real estate professional and materially participate in your rental activities, your rental income may be considered non-passive, allowing you to deduct losses against other income.

Material Participation Standards

To materially participate in a rental activity, you must meet at least one of the following tests:

- Participate for over 500 hours during the year.

- Your participation constitutes substantially all of the participation in the activity.

- Participate for more than 100 hours, and no one else participates more than you.

Meeting these criteria can reclassify rental income as non-passive, allowing for broader deduction opportunities.

Deducting Losses from Disasters

If your rental property suffers damage due to a federally declared disaster, you may be eligible to deduct casualty losses.

- Casualty and Theft Losses: Deductible losses are generally limited to the lesser of the property’s adjusted basis or the decrease in fair market value due to the casualty, minus any insurance reimbursements.

- Filing Amended Returns: If you previously deducted a casualty loss and later received an insurance reimbursement, you may need to amend your tax return to report the income.

Implementing these advanced strategies for rental property tax deductions requires careful planning and meticulous record-keeping. Consulting with a tax professional can help ensure compliance with regulations while optimizing your tax benefits to maximize profitability.

Record Keeping and Documentation

Accurate record-keeping is the backbone of successful rental property tax management. Maintaining organized records ensures that you claim every eligible deduction, prepares you for potential audits, and protects you in case of disputes.

Importance of Accurate Records

Supporting deductions requires proof. Every deduction you claim must be backed by clear, thorough documentation, such as receipts, invoices, or contracts. These are necessary to avoid losing valuable tax savings or facing penalties during an audit. Additionally, having detailed records simplifies tax preparation and ensures compliance with IRS regulations.

Preparation for Potential Audits

The IRS may scrutinize tax returns, particularly for businesses like rental property investments, where deductions can be significant. Accurate, well-organized records reduce stress during an audit, as they provide the necessary evidence to substantiate your claims. Being proactive in record-keeping demonstrates your commitment to compliance and minimizes the likelihood of disputes.

Best Practices for Record Keeping

Organizing both physical and digital receipts is essential. Develop a system to categorize expenses by type, such as repairs, utilities, or advertising. Use labeled folders for physical receipts and cloud-based storage solutions for digital copies.

Tracking income and expenses consistently ensures nothing is overlooked. Regularly update records of rental income, maintenance costs, and other financial transactions. Consider reconciling these monthly to avoid end-of-year stress.

Recommended Tools and Software

Investing in accounting software can save time and improve accuracy. Options like QuickBooks, Wave, or Buildium are designed for property management, allowing you to track income, expenses, and deductions easily.

Expense tracking apps like Expensify or Mint help you log and categorize expenses on the go. Many of these apps sync with your bank accounts or credit cards, making it more straightforward to maintain up-to-date financial records.

Adhere to these practices and leverage modern tools to streamline your record-keeping process and ensure you’re always prepared for tax season.

Filing Your Taxes with Deductions

Filing taxes as a landlord requires careful attention to detail, especially when claiming deductions. Here’s a streamlined guide to help you navigate the process effectively.

Completing Schedule E (Form 1040)

Schedule E is where you report your rental income and expenses. Accurately input all eligible deductions, such as mortgage interest, property taxes, and maintenance costs, to reduce your taxable income. To avoid common errors, double-check calculations, ensure consistency with your records, and confirm that all supporting documentation is readily available.

Deadlines and Extensions

Mark your calendar with key tax dates. The primary deadline for individual tax returns is April 15th, but you can file for an extension using Form 4868 if needed. Keep in mind that an extension gives you extra time to file, not to pay, so estimate and submit any owed taxes by the original deadline to avoid penalties.

Working with Tax Professionals

Collaborating with a tax professional can simplify the process and help you maximize your deductions. Choose someone experienced in rental property taxes, as they can identify opportunities you might miss. A skilled advisor ensures compliance, reduces errors, and provides peace of mind, particularly if your tax situation is complex.

Tax Planning for Future Investments

Proactive tax planning is essential for landlords looking to maximize their savings and reinvest in their portfolios. Incorporating thoughtful strategies throughout the year ensures you’re prepared for tax season and aligned with long-term financial goals.

Year-Round Tax Strategies

Adjusting withholdings and estimated payments can help manage cash flow and avoid surprises at tax time. If rental income fluctuates or significant changes occur in your expenses, adjusting quarterly estimated tax payments ensures you stay on track and avoid penalties.

Planning for significant expenses, such as major repairs or property improvements, can also create opportunities for strategic tax deductions. Timing these expenses within the same tax year allows you to maximize benefits, particularly when income levels are higher.

Staying Informed on Tax Law Changes

Monitoring legislation that impacts landlords keeps you ahead of the curve. Tax laws often shift, introducing new opportunities or challenges for property owners. Staying informed ensures you can adapt your strategies, whether leveraging new deductions or responding to changes in depreciation rules.

Adapting your approach to align with updates in tax law helps protect profitability and positions you for continued growth. Regularly consulting with a tax professional can also provide clarity on how emerging legislation affects your investments.

Effective tax planning ensures you remain agile, informed, and prepared to maximize future opportunities.

In Conclusion

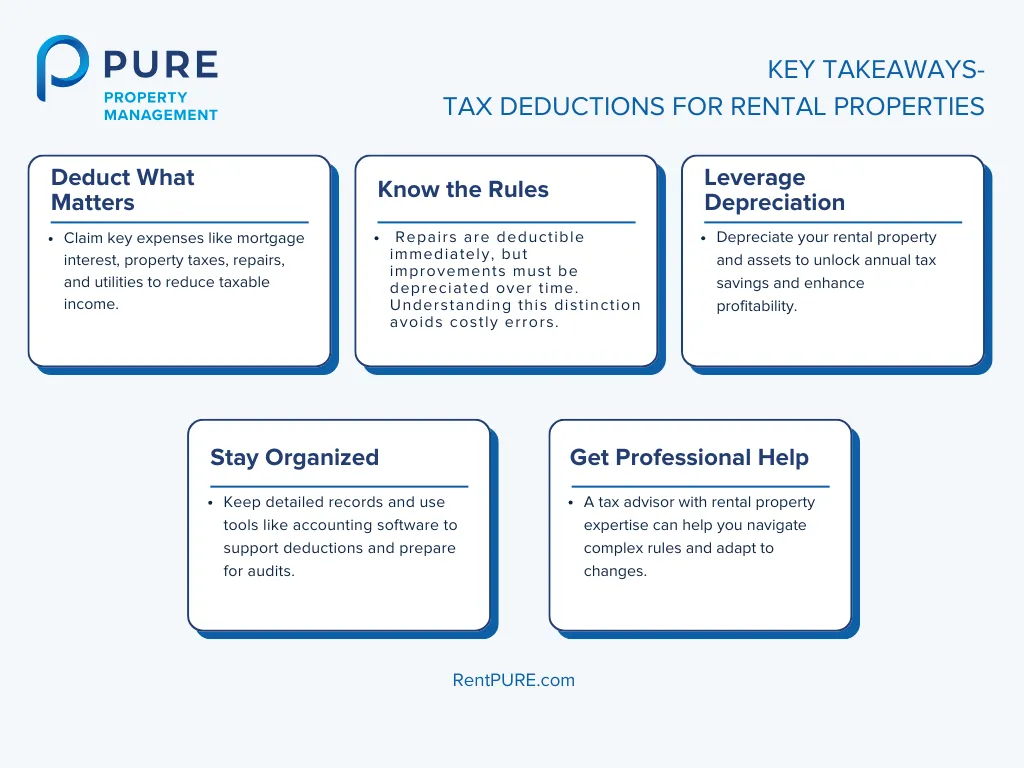

Navigating the world of rental property tax deductions is more than a way to save money—it’s a critical strategy for enhancing profitability and achieving long-term success as a landlord. This guide has equipped you with the knowledge to confidently maximize your deductions for 2024 while staying compliant with tax laws.

The rental property tax deductions and strategies outlined here aren’t just about minimizing taxes; they’re about strategically positioning your rental business for growth. Whether you’re claiming deductions for routine expenses or exploring advanced strategies like the home office deduction and disaster loss claims, each step you take contributes to improving your bottom line and building long-term profitability.

Tax laws change, but your ability to adapt will keep your investments protected and profitable. By staying organized, informed, and proactive, you can confidently approach every tax season and ensure your rental business thrives.

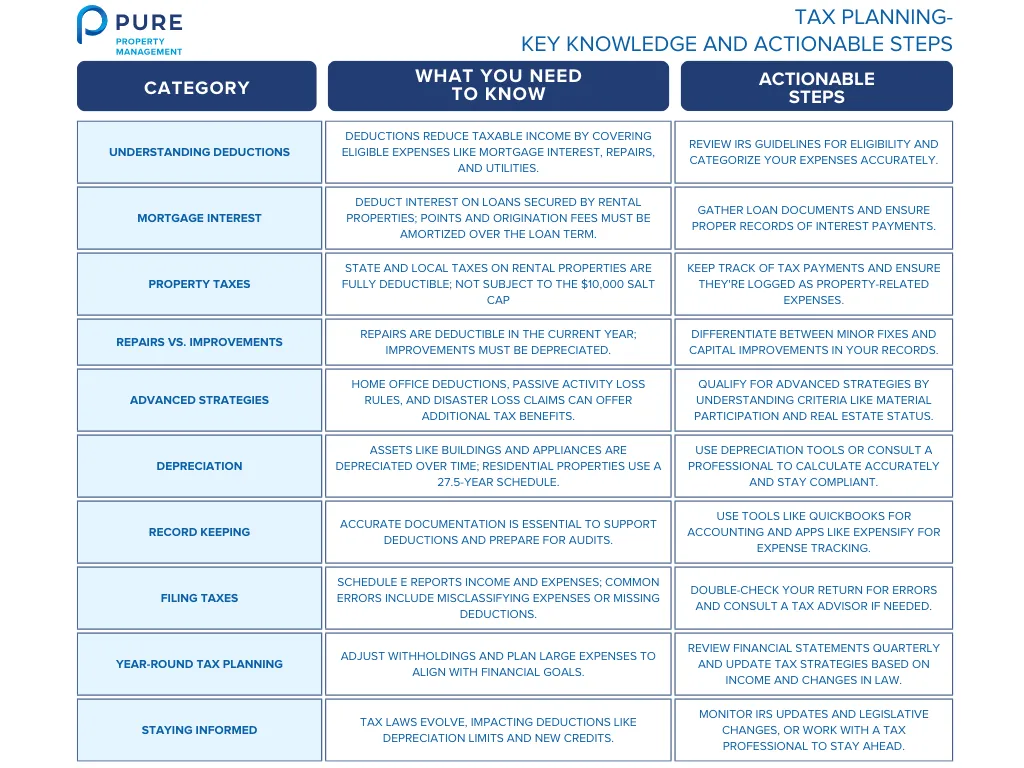

Key Knowledge and Actionable Steps

This table serves as a quick reference, ensuring you can apply the knowledge from this guide to your rental property business effectively.

Taking these steps will reduce your tax burden and help you reinvest savings into your portfolio, grow your business, and protect your investments in an ever-changing tax landscape.

As Brandon explained during the webinar, “We pay a lot in taxes, and the goal should really be, how do we reduce our effective tax rate over time?”

Whether you’re managing a single property or a portfolio of short-term rentals and multifamily units, fully utilizing all available deductions protects your cash flow and enhances long-term profitability.

If you want to know more about how to become a successful rental investor, check out more of our guides: