The property is the same, but the strategy changes everything. You could rent it nightly and run it like a micro-hotel, or lease it yearly and treat it like a business that runs itself. The choice between a short-term rental vs a long-term rental isn’t about which one is “better.” It’s about which one matches your goals, your time, and your appetite for management.

Both models can build wealth, but they move differently. Short-term rentals sprint; long-term rentals jog. Your success depends on knowing which pace fits your life.

New to investing? Start with our complete guide to rental property investing to build a solid foundation.

What Defines Short-Term vs Long-Term Rentals

A short-term rental is typically leased for less than 30 days at a time. Think vacation homes, Airbnb listings, and furnished stays for business travelers. They operate in the hospitality world, with bookings that change weekly or monthly.

A long-term rental, on the other hand, runs on annual or multi-year leases. You rent to residents who treat the property as their home. It’s more predictable, less hands-on, and built for consistency rather than speed.

If you’re wondering about the difference between short-term and long-term rental models, it comes down to one thing: how the property earns. Short-term rentals rely on nightly or weekly rates and active management, while long-term rentals depend on stable, recurring monthly rent from consistent residents.

The distinction isn’t just about length of stay, it’s about intent. Short-term rentals serve guests; long-term rentals serve residents. That difference affects everything from taxes and financing to how you handle maintenance and marketing.

The Appeal of Short-Term Rentals

Short-term rentals attract investors because they can deliver powerful income potential in the right market. You’re not locked into fixed rent. You can adjust prices daily, ride seasonal demand, and earn more in a single month than a long-term lease might bring in two.

The flexibility is another draw. You can block off dates to use the property yourself, pivot to mid-term stays when travel slows, or rent it out fully during peak seasons.

Pros:

- Higher earning potential when occupancy stays strong.

- Freedom to adjust pricing and availability.

- Ability to use the property personally.

- Guests prepay, improving cash flow reliability.

Cons:

- High turnover and frequent cleaning or repairs.

- Constant guest communication and reviews.

- Platform fees, local taxes, and legal compliance.

- Market volatility; income can swing monthly.

A short-term rental works best where tourism, business travel, or demand from hospitals and universities stays consistent. But it’s a hands-on business — more hospitality than passive income.

The Strength of Long-Term Rentals

Long-term rentals are slower and steadier. You lease to one resident for a year or more, collect rent monthly, and handle maintenance on your own schedule. The trade-off for lower upside is peace of mind.

Pros:

- Consistent, predictable income.

- Less daily management and fewer turnovers.

- Lower maintenance and marketing costs.

- Easier financing and clearer regulations.

Cons:

- Limited rent increases due to leases or rent control.

- Risk of problem residents who stay long-term.

- Less flexibility to use or sell the property quickly.

This model fits investors who value stability, patience, and simplicity. If short-term rentals are a high-yield hustle, long-term rentals are a steady business plan.

Short-Term Rental vs Long-Term Rental — The Numbers That Matter

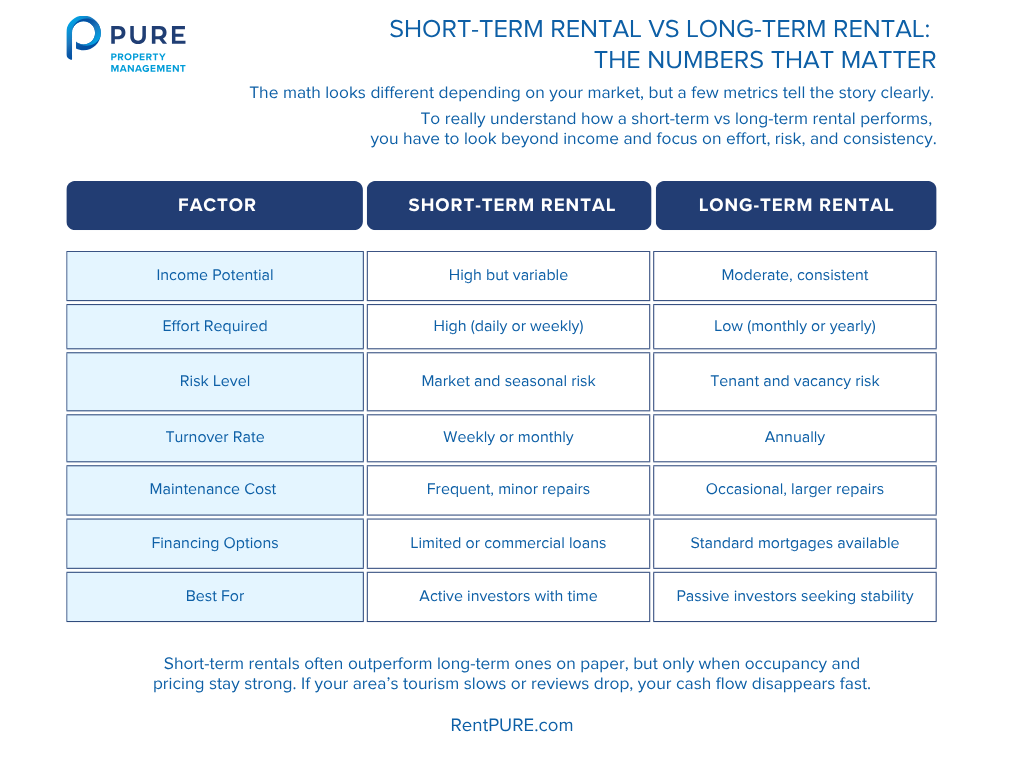

The math looks different depending on your market, but a few metrics tell the story clearly.

To really understand how a short-term vs long-term rental performs, you have to look beyond income and focus on effort, risk, and consistency.

Short-term rentals often outperform long-term ones on paper, but only when occupancy and pricing stay strong. If your area’s tourism slows or reviews drop, your cash flow disappears fast.

Quick Takeaways

1. What is the difference between short-term and long-term rentals?

Short-term rentals are leased for less than 30 days, often for travel or business stays, while long-term rentals typically last a year or more. The main difference is how they earn income—short-term rentals rely on frequent bookings, while long-term rentals earn steady monthly rent.

2. Are short-term rentals more profitable than long-term rentals?

Short-term rentals can earn more in high-demand markets because pricing adjusts with demand. However, they require more time, cleaning, and marketing. Long-term rentals bring lower but steadier income with less effort.

3. Which is better for beginners: short-term or long-term rentals?

Long-term rentals are usually better for beginners since they’re easier to manage, have stable residents, and come with predictable income. Short-term rentals demand constant attention and work best for investors with time and hospitality experience.

4. What are the risks of owning a short-term rental?

Short-term rentals face market swings, strict local regulations, and higher maintenance from frequent turnover. Occupancy can fluctuate seasonally, making income less predictable than traditional leases.

5. Can you switch from a long-term rental to a short-term rental?

Yes, but you’ll need to review local zoning laws and HOA rules first. You may also require different insurance, furnishings, and a marketing setup on platforms like Airbnb or VRBO.

Which Strategy Fits Your Goals

This is where the decision becomes personal.

Choose short-term rentals if:

- You enjoy marketing, communication, and fast-moving operations.

- You live near a tourist or business-travel destination.

- You want higher income potential and can handle variability.

Choose long-term rentals if:

- You prefer predictable income and low maintenance.

- You’re focused on steady equity growth.

- You don’t have time for active management.

Ask yourself a few questions:

- How much time can I realistically give to managing a property each week?

- Could I handle several slow months without stressing about cash flow?

- Do I see myself more as a host or a landlord?

The answers decide your path faster than any spreadsheet.

Hybrid Approach — The Best of Both Worlds

Some investors blend both strategies through medium-term rentals, which typically last 1–6 months. These are ideal for travel nurses, corporate relocations, or remote workers seeking furnished spaces.

You get the higher income of short-term rentals without the constant turnover. You also attract more responsible guests and can stay compliant in markets where nightly rentals face restrictions.

Medium-term rentals work exceptionally well in cities with strong healthcare or corporate demand. They’re the middle lane between volatility and boredom.

Market Considerations Before Choosing

Location dictates everything. A mountain cabin or beach condo screams short-term potential, while a suburban duplex near schools thrives on long-term residents.

Before choosing, research:

- Local occupancy rates and tourism cycles.

- City or HOA regulations on vacation rentals.

- Rent control laws and eviction timelines for long-term units.

Remember: the best strategy for someone in Miami might be the worst for someone in Milwaukee.

Tax and Financing Differences

Taxes separate the two models sharply. Short-term rental income is often classified as active income, which may be subject to self-employment tax. Long-term rental income is passive, taxed more favorably, and eligible for powerful deductions like depreciation and mortgage interest.

Financing also differs. Banks view long-term rentals as stable and are more willing to lend using standard mortgages. Short-term rentals, especially in vacation zones, often require commercial or DSCR loans since lenders consider them riskier.

If you’re serious about scaling, talk to a CPA who understands both models. The structure you choose now determines your tax efficiency later.

Final Thoughts — Build the Portfolio That Fits You

There’s no universal winner in the debate between short-term rental vs long-term rental investing. Both work when you align them with your goals, personality, and location.

If you want excitement, flexibility, and fast cash flow, short-term rentals deliver. If you want quiet, consistency, and time freedom, long-term rentals are your lane.

Savvy investors often start with one, master it, then diversify into the other. That’s how you build a portfolio that performs in every market — one that pays today and grows tomorrow.

Want to keep learning about rental investing? Take a look at these guides next: