Financing is the backbone of any successful rental property investment. Get it right, and you’re set up for steady growth and profitability. Get it wrong, and you might find yourself struggling with cash flow issues or missing out on great opportunities. Understanding the ins and outs of financing an investment property isn’t just smart—it’s essential.

In this post, we’ll dive into the different types of loans available to you, discuss how to position yourself for the best deals, and explore strategies tailored to different investment scenarios, including the best financing options for investment property.

This guide will equip you with the knowledge you need to make confident, informed decisions to grow your rental portfolio.

Types of Loans You Can Apply For

Choosing the right loan type is crucial because it directly impacts your investment’s profitability. Common options include:

- conventional loans

- rental portfolio loans

- hard money loans

Each has different terms, interest rates, and qualification requirements, so selecting the right one can save you money and align with your investment goals. Let’s explore the financing options that are available to you:

Conventional Bank Loans

Conventional loans are typically offered by banks, credit unions, and mortgage lenders, with terms that can vary depending on the type of mortgage selected.

These are best for first-time rental property investors looking for straightforward financing with lower interest rates.

Below, we’ll explore the key types of conventional bank loans, their conditions, and what you need to know to secure one.

Adjustable-Rate Mortgages (ARMs)

Adjustable-rate mortgages start with a lower interest rate for a fixed period, typically 5, 7, or 10 years. After this initial period, the rate adjusts annually based on market conditions, which can lead to lower or higher payments over time.

- Conditions: ARMs are best suited for investors who plan to sell or refinance before the adjustment period begins. They offer lower initial rates, which can make them attractive for short-term investments or properties expected to generate strong cash flow quickly.

- How to Do It: To secure an ARM, you’ll need a strong credit score, a solid down payment (usually around 20%), and a clear understanding of how the rate adjustments could impact your future payments. Be prepared to present a detailed plan on how you intend to manage the property, especially if you’re relying on early returns to cover the mortgage.

Fixed-Rate Mortgages

Fixed-rate mortgages offer stability with a consistent interest rate over the life of the loan, typically 15, 20, or 30 years. This predictability makes them a popular choice for long-term rental property investments.

- Conditions: With a fixed-rate mortgage, you lock in the interest rate, ensuring your monthly payments remain the same, regardless of market fluctuations. These loans require a solid down payment and a good credit history, and the interest rates may be slightly higher than ARMs initially.

- How to Do It: To get a fixed-rate mortgage, start by getting pre-approved from a lender. Ensure you have your financial documents in order, including proof of income, tax returns, and a detailed business plan for the rental property. Fixed-rate loans are particularly beneficial if you plan to hold the property for many years, as they protect you from rising interest rates.

|

Important: Choosing an adjustable-rate mortgage (ARM) in the current market could be a risky decision. With interest rates still climbing, your monthly payments may significantly increase after the initial fixed-rate period, potentially putting your investment at risk. A fixed-rate mortgage offers more stability, ensuring your payments remain consistent despite market fluctuations. |

Other Types of Bank Loans

Banks also offer other loan products, including interest-only loans and balloon mortgages, which might appeal to certain investors.

- Interest-Only Loans: These loans allow you to pay only the interest for a set period, usually 5-10 years, after which the full loan amount becomes due. This can be risky but might work for investors expecting a significant increase in property value or rental income.

- Balloon Mortgages: With a balloon mortgage, you make smaller payments for a set period, followed by a large “balloon” payment to pay off the loan. These are risky if you’re not prepared for the large payment at the end but can work if you plan to sell the property before the balloon payment is due.

Pros and Cons of Conventional Loans

| Loan Type | Pros | Cons |

| Adjustable-Rate Mortgages (ARMs) | Lower initial interest rate; potential savings in short-term investments. | Interest rates can increase significantly after a fixed period. |

| Fixed-Rate Mortgages | Predictable payments; stability over the long term. | Higher initial rates; less flexibility if rates drop. |

| Interest-Only Loans | Lower initial payments; more cash flow early on. | Risk of payment shock when principal payments start. |

| Balloon Mortgages | Lower payments during the initial period. | Large payment due at the end; risk of refinancing issues. |

Process of Getting the Loans

Securing a conventional bank loan involves several steps, which require careful preparation and attention to detail:

- Pre-Approval: Start by getting pre-approved with a lender. This involves submitting your financial details, including credit score, income, and existing debts. Pre-approval helps you understand how much you can borrow and at what interest rate.

- Property Appraisal: The bank will require an appraisal of the rental property to determine its value and ensure it meets the criteria for the loan amount.

- Documentation: Prepare your financial documents, including tax returns, bank statements, and any information related to other properties you own. Lenders will scrutinize your financial health to ensure you can handle the mortgage payments.

- Down Payment: Be prepared to make a substantial down payment, usually between 20-25% of the property’s purchase price. The exact amount may vary based on your credit score and the loan type.

- Closing Costs: Budget for closing costs, which typically range from 2-5% of the loan amount. These costs include fees for the appraisal, title insurance, and loan origination.

- Loan Approval and Closing: Once your loan is approved, you’ll move to the closing process, where you’ll sign the necessary documents and finalize the purchase. Make sure to review all the terms carefully and understand your obligations.

Things to Be Aware Of

- Interest Rates: Shop around for the best rates, and consider how both fixed and adjustable rates will affect your investment.

- Loan Terms: Understand the implications of the loan term (e.g., 15 vs. 30 years) on your cash flow and overall investment strategy.

- Market Conditions: Be mindful of current and projected market conditions that could impact your ability to refinance or sell the property if necessary.

- Loan-to-Value (LTV) Ratio: Banks typically require a maximum LTV ratio of 75-80%, meaning you’ll need to cover 20-25% of the property’s value upfront.

Picking the right conventional bank loan is key to financing an investment property successfully. When you know what each loan offers, you can choose one that matches your strategy, helping you avoid unnecessary costs and stay on track toward your financial goals.

Rental Portfolio Loans

Rental portfolio loans are an excellent financing option for investors looking to finance multiple rental properties under a single loan.

They’re ideal for experienced investors managing multiple rental properties who want to consolidate their financing.

This type of loan is specifically designed to cater to investors with a portfolio of properties, providing flexibility and convenience that traditional loans may not offer. Let’s dive into the details, including the pros and cons, the process of securing one, and where to find these loans.

Pros and Cons

| Pros | Cons |

|

|

Process of Getting a Rental Portfolio Loan

Securing a rental portfolio loan involves several steps, with a focus on demonstrating the overall health and profitability of your entire property portfolio. Here’s how the process typically works:

- Assess Your Portfolio: Start by taking a detailed look at your current properties. Document their current market values, rental income, expenses, and any existing debts. This information will be crucial when approaching lenders.

- Choose the Right Lender: Not all lenders offer portfolio loans, so you’ll need to find those who specialize in this type of financing. Look for lenders who understand the complexities of managing multiple properties and can offer terms that align with your investment strategy.

- Prepare Financial Documentation: Just like with other loans, you’ll need to provide comprehensive financial documentation. This includes your credit report, tax returns, bank statements, and a detailed report of your portfolio’s performance, including occupancy rates, maintenance costs, and profit margins.

- Appraisal and Inspection: The lender will likely require appraisals and inspections of all the properties in your portfolio. This is to ensure that the properties are valued correctly and meet the lender’s standards.

- Determine Loan Terms: Portfolio loans often come with more flexible terms than traditional mortgages. Work with your lender to determine the interest rate, loan term, and any specific clauses, such as the ability to add new properties or refinance existing ones.

- Underwriting Process: The lender will conduct a thorough underwriting process, assessing the risk associated with your portfolio. This will include a review of your financial stability, the properties’ income potential, and the overall market conditions.

- Loan Approval and Closing: Once the loan is approved, you’ll proceed to the closing process, where you’ll sign the necessary documents. Be sure to review the terms carefully, especially any clauses related to cross-collateralization or balloon payments.

Things to Be Aware Of

- Cross-Collateralization: This is a key feature of portfolio loans where all the properties serve as collateral for the loan. If one property fails to perform, it could jeopardize the entire portfolio.

- Balloon Payments: Some portfolio loans may have balloon payments due at the end of the term, requiring you to either pay off the remaining balance in full or refinance.

- Interest Rates: Rates can vary based on the size of the portfolio, your creditworthiness, and the properties’ income potential. It’s crucial to negotiate terms that will work for your long-term strategy.

- Loan-to-Value (LTV) Ratio: Portfolio loans often have LTV ratios between 70-75%, meaning you’ll need to cover 25-30% of the portfolio’s value upfront.

Where to Get Rental Portfolio Loans

Not every lender offers rental portfolio loans, so you’ll need to find one that does. Here are some options to consider:

- Commercial Banks

- Examples: Wells Fargo, Bank of America

- These large banks offer portfolio loans, particularly to investors with a significant number of properties. They may offer competitive rates but often have stringent requirements.

- Mortgage Brokers

- Examples: Walker & Dunlop, Arbor Realty Trust

- Mortgage brokers can help connect you with lenders who offer portfolio loans, often finding better deals by shopping around on your behalf. They can also provide advice on structuring the loan to fit your needs.

- Private Lenders

- Examples: Lima One Capital, CoreVest, Aloha Capital

- Private lenders often provide more flexible terms and are willing to work with investors who may not meet the strict criteria of traditional banks. They can be a good option if you need customized loan terms or quicker approval.

- Credit Unions

- Examples: Navy Federal Credit Union, PenFed Credit Union

- Credit unions may offer portfolio loans with more personalized service and potentially lower fees than large commercial banks.

Portfolio loans are better suited for experienced investors. They allow veterans who are financing an investment property to consolidate multiple properties under one loan, offering flexibility and scalability that benefit those managing larger real estate portfolios.

Hard Money Loans

Hard money loans are a popular option for real estate investors, particularly those looking to quickly acquire and renovate rental properties.

They are suited for investors needing quick financing for properties that require significant renovations or fast transactions.

These loans are typically provided by private lenders rather than traditional financial institutions and are based on the value of the property rather than the borrower’s creditworthiness.

Let’s explore the pros and cons, the process of securing a hard money loan, and where you can find these loans.

Pros and Cons

| Pros | Cons |

|

|

Process of Getting a Hard Money Loan

The process of securing a hard money loan is faster and less stringent than traditional loans, but it requires careful planning, especially in the context of rental property investment:

- Identify a Suitable Property: Hard money lenders base their loans on the value and potential of the property, particularly its after-repair value (ARV). Find a property with significant upside potential, whether through renovation or strategic management.

- Find a Hard Money Lender: Look for reputable hard money lenders who specialize in rental property investments. Networking with other real estate investors or attending local real estate investment groups can help you find trustworthy lenders.

- Prepare Your Proposal: Even though hard money lenders don’t focus heavily on credit scores, they still need to see a solid plan. Prepare a detailed proposal that includes the property’s current condition, your renovation plans, estimated costs, projected ARV, and your exit strategy (e.g., selling, refinancing into a conventional mortgage).

- Submit Your Application: Once you’ve identified a lender, submit your application along with your proposal. The lender will typically perform a quick assessment, often including a property inspection and valuation, to determine the loan amount and terms.

- Loan Approval and Funding: If approved, the lender will quickly process the loan, often within a few days. Funds are typically dispersed in stages, with an initial amount provided to purchase the property and additional funds released as renovations progress.

- Manage the Renovation: Efficiently manage the renovation to ensure the property is completed on time and within budget. This is crucial for either refinancing into a long-term loan or selling the property before the hard money loan term expires.

- Exit Strategy: Have a clear exit strategy in place. If the plan is to hold the property as a rental, work on securing a conventional mortgage or portfolio loan to refinance the hard money loan before it matures. If the plan is to sell, ensure the property is listed and sold before the loan term ends.

Things to Be Aware Of

- High Costs: Be prepared for higher interest rates and fees compared to conventional loans. Ensure that the potential profit from the property justifies these costs.

- Short Loan Term: Most hard money loans are short-term, so have a clear plan for repayment, either through refinancing or selling the property.

- Due Diligence: While the application process is quicker and less stringent, it’s essential to conduct thorough due diligence on both the property and the lender to avoid costly mistakes.

- Loan-to-Value (LTV) Ratio: Hard money lenders typically offer loans based on 65-75% of the property’s ARV, meaning you’ll need to cover the remaining costs, often through your own funds or additional financing.

Where to Get Hard Money Loans

Hard money loans are typically offered by private lenders, including individuals, private companies, and investment groups. Here are some examples and where to find them:

- Private Lenders

- Examples: LendingHome, Patch of Land

- These online platforms specialize in real estate loans, offering quick funding for hard money loans. They cater to investors looking for a streamlined application process and fast access to capital.

- Local Investment Groups

- Examples: Real estate investment clubs, local private lenders

- Many real estate investors find hard money lenders through local real estate investment clubs or networking events. These local lenders often have a deep understanding of the market and can offer terms tailored to your specific needs.

- Private Companies

- Examples: Lima One Capital, Civic Financial Services, Aloha Capital

- These companies offer hard money loans across the U.S., with a focus on real estate investors. They provide competitive terms and often have a strong online presence, making it easier to compare options and apply for loans.

- Direct Lenders

- Examples: CoreVest, Anchor Loans

- Direct lenders like CoreVest specialize in providing hard money loans for real estate investors. They offer customizable loan products and have experience working with investors pursuing rental property strategies, including the BRRRR method.

Hard money loans are best for experienced investors who need quick financing for property acquisitions or renovations and have a clear exit strategy.

Beginners should generally avoid them due to the higher interest rates, shorter terms, and the need for swift repayment, which can be risky without solid experience and planning. For those learning how to finance an investment property, exploring other loan options with more favorable terms may be a safer approach.

Private Money Loans

Private money loans are a flexible and personalized financing option that many real estate investors turn to when traditional lending isn’t the right fit.

They are best for investors who need flexible financing for properties that don’t meet conventional lending criteria, such as distressed properties, fix-and-flips, or those with quick closing timelines.

These loans are provided by private individuals or groups, often offering more tailored terms and quicker access to funds. They can be a valuable tool for rental property investment, particularly for those looking for creative financing solutions.

Unlike hard money loans, which focus mainly on the property as collateral, private money loans consider both the property’s value and the borrower’s financial strength.

This means private money loans can offer more flexible terms and are often tailored to fit the borrower’s needs, making them a versatile option for those financing an investment property who may not fit the strict criteria of hard money lenders.

Pros and Cons

| Pros | Cons |

|

|

Process of Getting a Private Money Loan

Securing a private money loan is a more personalized process compared to traditional bank loans, but it still requires thorough preparation:

- Identify Potential Lenders: Start by identifying potential private lenders within your network or through real estate groups. It’s essential to approach individuals or entities who have a clear understanding of real estate investments.

- Build a Relationship: Since private money loans are often based on trust and relationships, take the time to build a rapport with potential lenders. Attend real estate investment meetings, join online forums, and network actively to establish connections.

- Prepare a Detailed Proposal: Unlike traditional loans, where a bank might focus on your credit score, private lenders will be more interested in the specifics of the deal. Prepare a thorough proposal that includes the property details, your investment strategy, projected returns, and how you plan to repay the loan.

- Negotiate Terms: Private money loans offer the flexibility to negotiate terms that work for both parties. This might include the interest rate, repayment schedule, and any collateral required. Be clear and transparent about what you can offer and what you expect in return.

- Formalize the Agreement: Even though the loan is from a private source, it’s crucial to formalize the agreement with legal documentation. This should include the loan amount, interest rate, repayment terms, and any other agreed-upon conditions. It’s advisable to involve an attorney to draft or review the documents to ensure both parties are protected.

- Close the Deal: Once terms are agreed upon and the paperwork is in place, the lender will fund the loan. The process is usually quicker than traditional loans, with funds often available in a matter of days.

Things to Be Aware Of

- Interest Rates: Private money loans can have higher interest rates than traditional bank loans, often reflecting the increased risk or the speed of funding.

- Personal Relationships: Borrowing from friends or family can strain relationships if the investment doesn’t go as planned. It’s crucial to maintain clear communication and formalize the agreement to avoid misunderstandings.

- Repayment Flexibility: One of the advantages of private money loans is the potential for flexible repayment terms. However, ensure you fully understand the expectations and any penalties for late payments or early repayment.

Where to Get Private Money Loans

Private money loans can be sourced from a variety of places, often through personal or professional networks. Here are some common sources:

- Friends and Family

- One of the most common sources of private money loans is from friends and family. These loans can offer the most flexible terms, as they are based on personal trust and relationships. However, it’s essential to formalize the agreement to avoid any potential conflicts.

- Real Estate Investment Networks

- Examples: Local real estate investment clubs, online real estate forums (e.g., BiggerPockets)

- Networking through real estate investment clubs or online forums can help you connect with private lenders interested in funding real estate deals. These groups often include experienced investors looking to lend their capital for a profitable return.

- Private Lenders

- Examples: National Private Lenders Association (NPLA), private lending companies like LendingOne

- There are companies and associations specifically dedicated to connecting borrowers with private lenders. These organizations can help match you with lenders who specialize in real estate investments and can offer competitive terms.

- Real Estate Agents or Brokers

- Some real estate agents or brokers have connections with private lenders and can help facilitate the loan process. They may charge a fee for this service, but they can also provide valuable insights and guidance.

Private money loans can be a powerful tool for rental property investors, offering flexibility, speed, and access to capital that traditional lenders might not provide.

However, they come with their own set of risks and considerations, so it’s important to carefully evaluate them as part of your overall investment property financing strategy.

Home Equity Loans

Home equity loans are a popular financing option for real estate investors who already own property and want to leverage the equity they’ve built up to finance new rental properties.

They are great for homeowners wanting to leverage their existing home’s equity to finance the purchase of additional rental properties.

This section will explain how to secure a home equity loan, explore related options like HELOCs and cash-out refinancing, and discuss the pros and cons of using these methods for rental property investment.

Pros and Cons

| Pros | Cons |

|

|

Process of Getting a Home Equity Loan

A home equity loan allows you to borrow against the equity you’ve built up in your existing property. Here’s how the process works:

- Determine Your Home’s Equity: Start by calculating the equity in your home. This is the difference between your home’s current market value and the outstanding balance on your mortgage. Lenders typically allow you to borrow up to 80-85% of your home’s equity.

- Shop Around for Lenders: Different lenders offer varying terms for home equity loans, so it’s essential to shop around. Compare interest rates, fees, and loan terms from multiple lenders, including banks, credit unions, and online lenders.

- Prepare Your Financial Documentation: Lenders will require documentation similar to that needed for a traditional mortgage. This includes proof of income, tax returns, a current mortgage statement, and an appraisal of your home. The lender will assess your credit score and debt-to-income ratio to determine your eligibility.

- Submit Your Application: Once you’ve selected a lender, submit your application along with the necessary documents. The lender will review your application and may require an appraisal to confirm the value of your home.

- Loan Approval and Closing: If approved, the lender will provide you with a loan amount based on your home’s equity. You’ll go through a closing process similar to a mortgage, where you’ll sign the loan agreement and any other necessary paperwork. The funds will be disbursed as a lump sum, which you can then use for your rental property investment.

Things to Be Aware Of

- Loan-to-Value (LTV) Ratio: Lenders typically cap home equity loans at 80-85% of your home’s value, which means you’ll need to have significant equity to qualify for a large loan.

- Fixed Interest Rates: Home equity loans generally come with fixed interest rates, providing predictable monthly payments, but these rates might be higher than your original mortgage rate.

- Repayment Terms: Home equity loans have repayment terms that range from 5 to 30 years. The monthly payments are generally fixed, but missing payments could put your home at risk of foreclosure.

- Property Appraisal: Be prepared for the lender to require an appraisal to determine your home’s current market value, which will impact the loan amount you’re eligible for.

HELOCs (Home Equity Line of Credit)

A Home Equity Line of Credit (HELOC) is another way to tap into your home’s equity, but it works differently from a traditional home equity loan:

- How It Works: A HELOC is a revolving line of credit, similar to a credit card, that allows you to borrow as much or as little as you need, up to a certain limit. The credit line is based on your home’s equity, and you can draw from it over a set period (typically 10 years), followed by a repayment period (usually 10-20 years).

- Interest Rates: HELOCs often have variable interest rates, meaning your monthly payments can fluctuate based on the current interest rate environment.

- Flexibility: One of the significant advantages of a HELOC is its flexibility. You only pay interest on the amount you borrow, and you can use the funds as needed, which can be particularly useful for ongoing property renovations or other investment needs.

- Risks: Because HELOCs typically have variable rates, your payments could increase over time. Additionally, like with home equity loans, your home is used as collateral, so defaulting could lead to foreclosure.

HELOCs are ideal for investors who need flexible, ongoing access to funds for various property-related expenses or new investments.

Cash-Out Refinance

Cash-out refinancing is another option that allows you to access your home’s equity, but it involves replacing your existing mortgage with a new one:

- How It Works: With a cash-out refinance, you take out a new mortgage for more than what you currently owe on your home. The difference between the new mortgage amount and your current mortgage balance is given to you in cash, which you can then use for investment purposes.

- Interest Rates: Cash-out refinancing can be beneficial if current mortgage rates are lower than your existing rate, allowing you to lower your interest rate while accessing cash. However, you’ll also be extending or resetting your mortgage term, which could result in higher overall interest costs over time.

- Costs: Like with any mortgage, cash-out refinancing comes with closing costs, which can be substantial. These include appraisal fees, loan origination fees, and other closing costs.

- Risks: By taking on a larger mortgage, you’re increasing your debt burden, which could strain your finances if your rental investment doesn’t perform as expected.

Cash-Out refinancing is best for investors looking to tap into the equity of an existing property to fund new purchases or improvements.

Home equity loans, HELOCs, and cash-out refinancing offer valuable tools for real estate investors, particularly those looking to leverage their existing assets for new investments.

However, they carry significant risk since your primary residence is at stake.

Commercial Loans

Commercial loans are designed specifically for purchasing income-generating properties, such as multi-family apartment buildings, retail spaces, office buildings, and other types of commercial real estate.

These loans are typically larger, with more complex terms than residential loans, making them a critical tool for serious real estate investors.

Pros and Cons

| Pros | Cons |

|

|

Process of Getting a Commercial Loan

The process of securing a commercial loan is more involved than obtaining a residential mortgage, given the higher stakes and larger amounts involved. Here’s how it typically works:

- Assess Your Needs and Property Type: Start by determining the type of commercial property you’re interested in and the loan amount you need. Commercial loans vary significantly based on the property type (e.g., multi-family, retail, office) and the investment strategy (e.g., buy and hold, development, value-add).

- Choose the Right Lender: Commercial loans can be obtained from a variety of lenders, including banks, credit unions, commercial mortgage brokers, and private lenders. Each lender will have different criteria, terms, and expertise. It’s important to choose a lender experienced in the type of property you’re financing.

- Prepare Your Financial Documentation: Lenders will require detailed financial documentation, including:

- Business Plan: A comprehensive business plan outlining your investment strategy, property management plan, and financial projections.

- Personal Financial Statements: Your personal income, assets, liabilities, and net worth.

- Credit Reports: Both personal and business credit scores will be assessed.

- Property Details: Information about the property, including purchase price, location, condition, and expected income.

- Debt Service Coverage Ratio (DSCR): Lenders will calculate the DSCR, which is the ratio of the property’s net operating income to its debt obligations. A DSCR of 1.25 or higher is typically required.

- Property Appraisal and Inspection: The lender will require a professional appraisal and possibly an environmental inspection of the property to assess its value and any potential risks. This is a crucial step, as the loan amount will be based on the appraised value and the property’s income potential.

- Negotiate Loan Terms: Commercial loans offer more flexibility in terms of structure, including interest rates, loan terms, and amortization schedules. Work with your lender to negotiate terms that align with your investment strategy. Be aware that commercial loans often have shorter terms (5-10 years) with longer amortization periods, resulting in a balloon payment at the end.

- Underwriting Process: The underwriting process for commercial loans is rigorous, involving a detailed analysis of your financial statements, credit history, property appraisal, and business plan. Lenders will assess the risk of the loan and your ability to repay.

- Loan Approval and Closing: If the loan is approved, you’ll proceed to the closing process, which involves signing the loan agreement and any related documents. Closing costs for commercial loans can be significant, so it’s essential to budget for them. Once the loan is closed, the funds will be disbursed, and you can move forward with your property purchase.

Things to Be Aware Of

- Loan-to-Value (LTV) Ratio: Commercial loans typically have a lower LTV ratio than residential loans, often around 65-75%. This means you’ll need to cover a larger portion of the purchase price with your own funds.

- Interest Rates: Commercial loans usually have higher interest rates compared to

residential loans. The rates can be fixed or variable, and they are often tied to broader economic indicators. - Balloon Payments: Many commercial loans have balloon payments due at the end of the loan term, which requires either refinancing or paying off the remaining balance in full.

- Prepayment Penalties: Some commercial loans include prepayment penalties, making it costly to pay off the loan early. Be sure to understand these terms before committing.

Commercial loans are essential for serious real estate investors looking to acquire or develop larger, income-generating properties.

While they offer substantial capital and flexible terms, they also come with greater complexity, higher costs, and more significant risks than residential loans.

Going Beyond Traditional Loans

Traditional bank loans can be restrictive due to strict qualifications, high down payments, and rigid terms. For investors needing faster access to capital, more flexibility, or better cash flow management, alternative financing methods offer creative solutions that align better with specific investment goals. Here’s a look at these options and how they can enhance your rental property strategy.

Seller Financing

Seller financing can be a powerful tool, especially in a buyer’s market or when dealing with motivated sellers. In this scenario, the seller essentially becomes the lender, allowing you to make payments directly to them over time.

This approach is particularly advantageous if you’re having difficulty securing traditional financing due to credit issues or if you want to avoid the lengthy approval process typical of bank loans.

It also opens up the possibility for more flexible terms, such as a lower down payment or interest rate, which can make your investment more profitable from the start.

Lease to Own

Lease to own arrangements, also known as rent-to-own, provide a path to ownership that lets you generate rental income while still testing the waters of a property.

This approach involves leasing a property with the option to purchase it at the end of the lease term, with part of your rent payments often going toward the purchase price.

It’s particularly useful if you’re not ready to buy immediately but want to lock in a property at a set price while you prepare financially.

This method can also be a great way to secure a property in a rising market where prices are expected to increase.

Crowdfunding

Crowdfunding has revolutionized the way smaller investors can participate in real estate. Through online platforms, you can pool your money with other investors to fund larger rental properties or development projects.

This method allows you to diversify your portfolio by investing in multiple properties with relatively small amounts of capital. It’s a lower-risk way to get involved in real estate, especially if you’re just starting out or want to avoid the responsibilities of property management.

The key to successful crowdfunding is to thoroughly vet the platform and the project, ensuring that the deal aligns with your investment goals.

Syndication

Syndication takes the concept of pooling funds to the next level. In a syndication, a group of investors comes together, led by a syndicator or sponsor who manages the investment. This model is ideal for acquiring larger rental properties, like apartment complexes, which would be difficult to purchase individually.

As an investor, you benefit from the sponsor’s expertise and management while sharing in the profits. Syndications are particularly attractive if you’re financing an investment property and want to invest in high-yield properties without the hands-on involvement, as the sponsor handles everything from acquisition to management and eventual sale.

Owner Financing

Owner financing is similar to seller financing but often occurs in situations where the property owner is also the lender, such as when purchasing from a developer or builder.

This method can provide flexible terms and can be particularly appealing when dealing with smaller, less conventional properties that might not qualify for traditional loans.

Owner financing is often faster and less bureaucratic, allowing you to close deals quickly and capitalize on opportunities that might slip by if you were tied up in a bank’s loan approval process.

Government-Backed Loans

Government-backed loans can also be an effective option, especially if you’re looking at multi-family properties. Programs like FHA or VA loans are typically associated with first-time homebuyers, but under certain conditions, they can be used for rental properties.

For example, an FHA loan might allow you to purchase a multi-family building as long as you live in one of the units.

These loans often require lower down payments (as low as 3.5%) and offer favorable interest rates, making them an attractive option for newer investors looking to get started in real estate.

You could start your rental business easily by living in the same building complex that you’re renting out.

Joint Ventures

Joint ventures are a strategic way to expand your rental portfolio by partnering with other investors. In a joint venture, two or more parties come together, combining resources and expertise to purchase and manage a property.

This approach is particularly useful if you have strong property management skills but need more capital or if you have the capital but lack the time or experience to manage the property effectively.

Joint ventures allow you to take on larger projects that would be difficult to handle alone, sharing both the risks and the rewards with your partner.

How to Increase Your Chances of Getting a Loan for a Rental Property

Securing a loan for a rental property can be more challenging than obtaining a mortgage for a primary residence.

Lenders view rental properties as higher-risk investments, which means they often have stricter requirements.

Also, different types of rental property loans come with varying levels of difficulty and criteria.

Conventional loans require strong credit, steady income, and a solid financial history, making them harder to qualify for. Portfolio loans are designed for seasoned investors with multiple properties, offering flexibility but requiring more experience.

Hard money loans are easier to get but come with higher costs and shorter terms, focusing more on the property than your financial background.

However, by following a strategic approach, you can significantly improve your chances of getting the financing you need to grow your rental portfolio (regardless of the type of loan you’re applying for).

1. Improve Your Credit Score

A strong credit score is essential for securing any loan, but it’s especially important when dealing with investment properties.

Lenders use your credit score to assess your reliability as a borrower. If your score is less than ideal, take steps to improve it before applying for a loan. This could involve paying down existing debt, correcting any errors on your credit report, and ensuring you make all payments on time.

A higher credit score can lead to better loan terms, including lower interest rates.

2. Prepare a Strong Financial Profile

When applying for a rental property loan, lenders will scrutinize your financial health. This means you need to demonstrate stable income, either from your current job or from other rental properties.

Reducing your debt-to-income ratio (DTI) is also crucial, as it shows lenders that you have the capacity to take on additional debt.

Additionally, having a solid cash reserve not only helps with the down payment but also reassures lenders that you can handle unexpected property expenses, like maintenance or vacancies.

3. Choose the Right Lender

When choosing a lender for your rental property, focus on finding one that understands real estate investments and offers terms that align with your goals.

Look for lenders with experience in rental property financing, as they’ll be more familiar with the unique challenges involved. Compare interest rates, loan terms, and fees across different lenders.

Also, consider their flexibility with down payments and their willingness to work with your financial situation. Ultimately, choose a lender who offers competitive terms, clear communication, and a solid understanding of your investment strategy.

4. Present a Compelling Investment Plan

Lenders want to see that you have a well-thought-out plan for your rental property. This includes a detailed analysis of the property’s potential, such as market rent, occupancy rates, and expected cash flow.

Highlighting the potential for property appreciation and your expected return on investment (ROI) can strengthen your application.

If you have experience managing rental properties, make sure to emphasize this, or consider partnering with an experienced property manager to boost your credibility.

5. Highlight Property Profitability

Lenders are particularly interested in the profitability of the property you’re purchasing. A strong Debt-Service Coverage Ratio (DSCR), which shows that the property’s income can cover its debt obligations, is a key indicator.

A favorable Debt-to-Income Ratio (DTI) also helps, demonstrating that you can manage the loan along with your other financial commitments. Provide detailed projections of rental income and expense management to reassure lenders of consistent cash flow.

6. Increase Your Down Payment

A larger down payment reduces the lender’s risk, making them more likely to approve your loan. It also shows your commitment to the investment.

If possible, aim to increase your down payment, as this can also lead to better loan terms. Strategies to accumulate additional capital might include selling non-performing assets, using savings, or pooling resources from other investments.

7. Consider Pre-Approval

Getting pre-approved for a loan can significantly strengthen your position when negotiating with sellers.

Pre-approval shows that you’re a serious buyer and that a lender is already on board with your purchase, subject to final approval.

This can be particularly advantageous in competitive markets where sellers may be fielding multiple offers.

8. Minimize Existing Debts

Before applying for a rental property loan, it’s wise to pay off as much existing debt as possible. This improves your debt-to-income ratio and demonstrates financial stability, both of which are critical factors in loan approval.

Lenders are more likely to approve your loan if they see that you have manageable debt levels and a solid plan for handling additional financial obligations.

9. Use Collateral or Co-Signers

If you’re having trouble securing a loan on your own, consider offering additional collateral or bringing in a co-signer. Using other investment properties or assets as collateral can strengthen your application.

Similarly, a co-signer with a strong financial background can provide extra security to the lender, increasing your chances of approval.

10. Be Ready to Negotiate

Loan terms for rental properties can vary significantly, so be prepared to negotiate. Understand the specifics of rental property loan terms, including interest rates, amortization periods, and any fees.

By negotiating effectively, you can secure terms that align better with your investment strategy and long-term goals, ensuring you find the best way to finance investment property that suits your needs.

11. Stay Informed About Rental Market Conditions

Market conditions can greatly influence loan approval and terms. Lenders pay attention to trends like vacancy rates, rental demand, and local economic conditions.

Staying informed about these factors allows you to adapt your strategy and present a more compelling case to lenders. Additionally, understanding how changing interest rates and lender policies might affect your loan can help you make more informed decisions.

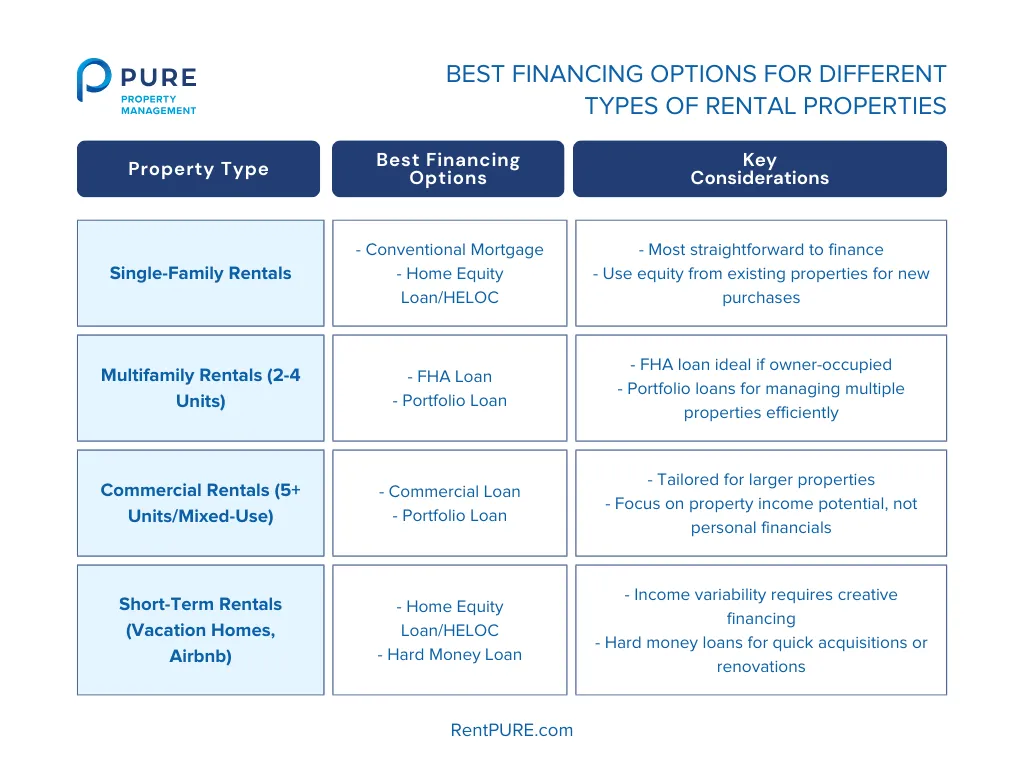

Best Financing Options for Different Types of Rental Properties

Different rental property types require tailored financing solutions to fit their unique needs.

Whether you’re investing in a single-family home, a multifamily building, a commercial property, or a short-term rental, the right loan can significantly impact your investment’s success.

This section outlines the best financing options for each property type, helping you choose the most suitable loan to support your investment goals and ensure long-term profitability.

Here’s a straightforward guide to help you figure out the best financing options for each type of rental property:

1. Single-Family Rentals

Best Financing Options: Conventional Mortgages, Home Equity Loans

If you’re buying a single-family rental, you’re in luck—these are usually the easiest to finance. Conventional mortgages are often your best bet because they’re widely available and offer good rates.

If you already own a home with some equity built up, you might want to consider a home equity loan or HELOC. This lets you tap into your home’s value to buy your next rental without going through the hassle of taking out a brand-new mortgage.

Start with a conventional mortgage for your first single-family rental. As you grow your portfolio, think about using the equity in your current properties to fund new ones.

2. Multifamily Rentals (2-4 Units)

Best Financing Options: FHA Loans, Portfolio Loans

Multifamily properties with two to four units can be a great way to get more rental income from one property.

If you’re planning to live in one of the units, an FHA loan is a great choice because it offers a low down payment and easier credit requirements.

But if you’re already an investor with multiple properties, a portfolio loan might be more your speed. It lets you bundle several properties into one loan, which can make things simpler and sometimes cheaper.

Go for an FHA loan if you’re just starting out and want to live in one unit while renting the others. If you’re thinking bigger, a portfolio loan can help you manage multiple properties without juggling multiple mortgages.

3. Commercial Rentals (5+ Units or Mixed-Use)

Best Financing Options: Commercial Loans, Portfolio Loans

When you’re dealing with larger properties like apartment buildings or mixed-use spaces, you’ll need a commercial loan.

These loans are designed for bigger projects and focus more on the property’s income potential than on your personal finances.

If you’re handling multiple commercial properties, a portfolio loan can also be a good fit, giving you more flexibility and making your finances easier to manage.

Use a commercial loan for bigger projects or if you’re buying something like a mixed-use building. If you’re managing several properties, consider a portfolio loan to keep your financing streamlined.

4. Short-Term Rentals (Vacation Homes, Airbnb Properties)

Best Financing Options: Home Equity Loans, Hard Money Loans

Short-term rentals like vacation homes or Airbnbs can be a bit trickier to finance because the income can be unpredictable.

If you have equity in another property, a home equity loan or HELOC is a solid option—it lets you use the value of what you already own to finance your new rental.

For situations where you need to move quickly, or if the property needs a lot of work, a hard money loan might be the way to go, though you’ll want to refinance as soon as possible to avoid high interest rates.

If you’ve got equity in another property, leverage it with a home equity loan for your short-term rental. If the property needs work or you need to act fast, a hard money loan can bridge the gap—but plan to refinance quickly.

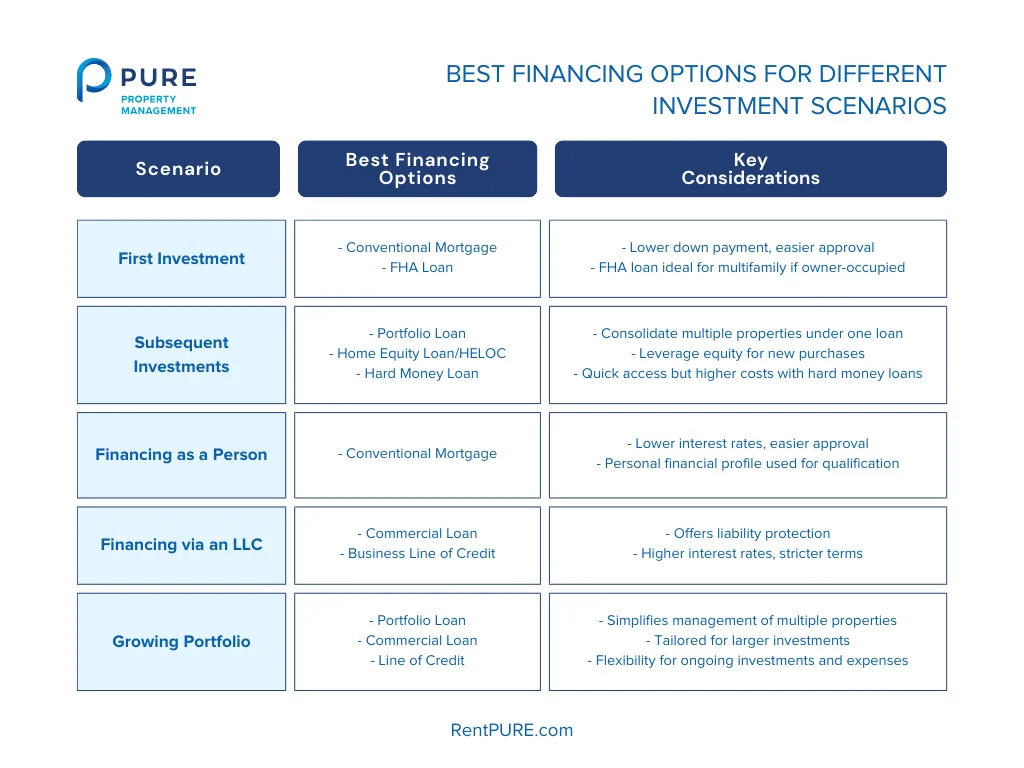

Best Financing Options for Different Investment Scenarios

Selecting the right financing for your rental property isn’t a one-size-fits-all approach. Your best option for financing an investment property will depend on factors like whether you’re making your first investment, expanding your portfolio, or choosing between personal and LLC-based financing.

This section provides a clear guide to help you match the right financing strategy to your specific investment scenario, ensuring you make informed decisions that support your goals.

Whether you’re financing your first property or growing your portfolio, here’s a guide to help you navigate the different scenarios you have to consider when investing in rental property:

1. Financing Your First Investment vs. Subsequent Investments

First Investment: If you’re financing your first rental property, you’ll likely want to stick with straightforward, traditional options like a conventional mortgage or an FHA loan.

These loans are designed for first-time buyers and typically offer favorable terms, such as lower down payments and competitive interest rates.

FHA loans are particularly attractive if you’re buying a multifamily property and plan to live in one of the units, as they allow you to start investing with minimal upfront costs.

Subsequent Investments: Once you’ve got your first property under your belt, your financing strategy can become more flexible.

Portfolio loans are a strong option for those looking to purchase multiple properties, as they allow you to consolidate your loans under one umbrella, making it easier to manage your investments.

Home equity loans or HELOCs are also effective if you’ve built up equity in your first property, letting you leverage that value to fund new investments. Additionally, if you need quicker access to funds or are purchasing properties that require significant renovation, hard money loans can be useful, though they come with higher costs and shorter terms.

For your first property, start with a conventional mortgage or FHA loan. As you expand, explore portfolio loans or use the equity from your initial investment to fund further purchases.

2. Financing via an LLC vs. Financing as a Person

Financing as a Person: Financing a rental property in your personal name is often simpler and can lead to better terms, like lower interest rates and easier approval processes, especially if you have a strong credit history.

Conventional mortgages are usually more accessible when you’re applying as an individual, and lenders are more likely to offer favorable terms based on your personal financial profile.

Financing via an LLC: Using an LLC to finance your rental properties has its advantages, particularly in terms of liability protection.

If you’re serious about growing your real estate business or own multiple properties, an LLC can help shield your personal assets from potential legal issues related to your rental properties. However, financing through an LLC often means higher interest rates, stricter terms, and more documentation, as lenders view LLCs as higher risk than individual borrowers.

You may also need to secure a commercial loan or a business line of credit, which can be more complex and costly.

If you’re just starting out or only own a few properties, financing in your personal name may be easier and more cost-effective. As your portfolio grows and you want more liability protection, consider transitioning to financing through an LLC, even if it means navigating more complex loan processes.

3. Financing a Growing Portfolio

As your real estate portfolio expands, your financing needs will evolve. Managing multiple properties often requires a more strategic approach to ensure that your investments remain profitable and sustainable.

Portfolio Loans: These loans are designed for investors with multiple properties, allowing you to bundle several mortgages into one. This not only simplifies management but can also provide better interest rates and terms. Portfolio loans are particularly useful for investors who plan to continue expanding, as they offer the flexibility to add more properties over time.

Commercial Loans: If your portfolio includes larger multifamily or mixed-use properties, commercial loans might be necessary. These loans are tailored for higher-value investments and focus more on the property’s income potential than your personal financials. They often come with higher interest rates and shorter terms but are well-suited for investors with larger portfolios.

Lines of Credit: Establishing a business line of credit can be a smart move for investors looking to grow their portfolios. This allows you to access funds quickly for new investments, property repairs, or unexpected expenses without the need to apply for a new loan each time. A line of credit offers flexibility and can help smooth out cash flow fluctuations as your portfolio grows.

As your portfolio grows, look into portfolio loans for efficiency and better terms. Consider commercial loans for larger properties, and establish a line of credit to keep your financing flexible and responsive to opportunities.

In Conclusion

Financing an investment property is a critical component of your rental property investment strategy. Choosing the right type of loan and understanding how to position yourself for the best terms can significantly impact your profitability and long-term success.

In this post, we covered:

- The different types of conventional loans, including adjustable-rate and fixed-rate mortgages, and their pros and cons.

- Alternative financing options like rental portfolio loans, hard money loans, and private money loans.

- Strategies to increase your chances of getting approved for a loan, including improving your credit score and presenting a strong investment plan.

No matter where you are in your investment journey—whether buying your first property or expanding your portfolio—understanding your financing options is key to making smart, strategic decisions.

Armed with this knowledge, you’re better positioned to secure the financing that aligns with your goals and sets you up for success in the competitive world of real estate investing.

If you want to know what comes after financing your rental property, here are some great resources: