Most investors learn early that money helps—but structure wins.

The truth is, you don’t need piles of cash to grow a real estate portfolio. You need a strategy. The investors who scale fastest aren’t always the richest; they’re the ones who know how to buy investment property with no money down using advanced, ethical, and proven frameworks.

This guide breaks down the next level of real estate investing—the methods professionals use to acquire properties creatively, protect their downside, and build lasting wealth. We’ll walk through subject-to financing, shared equity deals, and self-directed IRA investing, showing how each can open doors that traditional lenders never could.

3 Ways of Buying Investment Property With No Money Down

Once you’ve learned the fundamentals, you start to see real estate differently.

You realize money is never the only way to control property — structure is.

These advanced strategies are how experienced investors scale intelligently without gambling or overleveraging.

They take more knowledge and patience, but they unlock opportunities that most beginners never see.

Used properly, they can accelerate your portfolio growth while keeping your risk low and your reputation intact.

Let’s look at a few of the best.

1. Subject-To Financing — Taking Over a Mortgage the Smart Way

If you’ve ever looked at a beautiful property and thought, “I’d buy this if only I didn’t need a new loan,” subject-to financing might be the move that changes everything.

In this strategy, you buy a property subject to the existing mortgage — meaning you take ownership, but the seller’s original loan stays in place. You don’t apply for a new mortgage. You take over their payments on theirs.

Sounds unusual, right? It is — but it’s also perfectly legal when done correctly. And it’s one of the few ways to get into a property without qualifying for a new loan or putting much money down.

Why It Works

Subject-to financing exists because sometimes sellers need relief more than profit.

Picture this:

A seller has a mortgage they can’t keep up with — maybe due to a divorce, job relocation, or financial strain.

They owe $240,000 on a house worth $250,000. If they sold it the traditional way, by the time they pay commissions and closing costs, they’d have to bring money to the table just to sell.

You step in and offer a simple solution: “I’ll take over your mortgage payments and handle everything from here.”

They walk away debt-free. You walk away with a property that’s already financed — often at a below-market interest rate.

How It Works (Step-by-Step)

- Find a motivated seller.

These are typically owners who want out fast — not desperate, but done. Life changes, relocations, or job losses often create opportunities. - Agree to buy the property “subject to” the existing loan.

That means you take title (ownership) of the property, but the current mortgage stays in the seller’s name. - Take over the payments.

From that point on, you pay the mortgage directly (or through a servicing company that forwards the payments). - Protect everyone involved.

Use a proper contract and close through a title company or real estate attorney. You’ll need a disclosure confirming that both sides understand the arrangement. - Stabilize the property.

Once you’ve taken control, you can rent it out, live in it, or refinance it later into your own name when your credit or income is ready.

Real Example

Let’s say you find a seller with a home worth $300,000 and a mortgage balance of $270,000 at a 3% interest rate.

If you were to buy that property today with a bank loan, you’d likely face a much rate — a massive difference in both cost and approval requirements.

Instead, you agree to buy subject to their existing loan. You might pay them a small amount for their equity (say $5,000–10,000), take title to the property, and start making the same monthly mortgage payments they were making.

Your cost of borrowing is now theirs, not today’s higher rate. You’ve just acquired a home at below-market financing, without applying for a new loan.

That’s why seasoned investors love subject-to deals; they create instant leverage without extra risk, when done responsibly.

What to Watch Out For

Subject-to financing isn’t illegal, but it does require care and integrity. Here’s what you need to know before trying it:

- Use professionals.

Always close with a real estate attorney or title company.

A simple mistake in paperwork can cause major issues later. - Understand the “due-on-sale” clause.

Most mortgages allow the bank to demand full repayment if the property transfers ownership.

In practice, this rarely happens if payments stay current — but it’s still a risk to be aware of. - Keep payments immaculate.

The mortgage remains in the seller’s name.

If you miss a payment, their credit suffers. That’s not just bad business — it’s unethical. - Plan your exit.

Eventually, you’ll refinance into your own name or sell.

Don’t take on a subject to deal without knowing how you’ll transition out.

When structured cleanly, subject-to deals are a win-win: you help a seller move on, and you acquire a property that cash flows — often at a rate that would be impossible with new financing.

When It Works Best

- Interest rates are high and you find a seller with a low-rate loan.

- The seller has limited equity and can’t afford to sell conventionally.

- You have the discipline to manage the payments flawlessly.

- You’re working with an experienced real estate attorney who understands creative financing.

Bottom Line

Subject-to financing isn’t a loophole — it’s a sophisticated, relationship-driven solution for unique situations. It takes trust, professionalism, and clean execution.

But for investors who master it, it’s one of the most powerful tools in the game.

2. Shared Equity Deals — Partnering Without Losing Control

There’s a quiet truth about real estate investing that most people overlook: you don’t need to own 100% of a property to build 100% of your wealth.

Shared equity is the art of letting others bring the money, while you bring the opportunity, effort, or management. It’s how savvy investors build portfolios faster — without losing control or relying on endless debt.

At its heart, a shared equity deal is simple: two or more people buy a property together, agreeing in advance how the costs, responsibilities, and profits will be split.

But when it’s structured right, it can change everything.

Why It Works

Everyone has something they can bring to the table.

- You might have time, hustle, or local knowledge.

- Someone else might have cash, credit, or connections.

Shared equity deals allow both sides to win — the investor gets a solid return without doing the work, and you get to buy a property you couldn’t afford on your own.

How It Works (Step-by-Step)

- Find the Right Partner

You’re not looking for “a rich friend.”

You’re looking for someone whose goals match yours — long-term growth, not quick flips.

This could be a family member, a professional investor, or even a colleague who wants passive income. - Define the Roles

Decide early who does what.- Who finds and analyzes the property?

- Who manages the rehab or residents?

- Who handles bookkeeping and communication?

Write it down. Clarity saves relationships.

- Structure the Deal

Ownership can be divided any way that feels fair —

common splits include 50/50, 60/40, or even 70/30 if one partner does all the active work.

The key is that both sides understand their contributions and rewards. - Put It in Writing

Never rely on handshake deals, even with friends.

Use a lawyer to draft a joint venture (JV) agreement or LLC operating agreement.

It should cover:- Ownership percentage

- Who manages decisions

- How profits are split

- What happens if one party wants to exit

- Execute, Communicate, Repeat

Once the property is purchased, transparency is everything.

Send updates, track expenses, and keep expectations aligned.

A shared equity deal succeeds when both sides feel seen and respected.

Real Example

Imagine a $400,000 duplex. You find it, analyze it, and confirm it cash flows — but you don’t have the $40,000 down payment.

You approach a retired professional who wants passive income but doesn’t want to manage residents.

You propose:

- They invest the full down payment and are a 50% partner.

- You find the deal, manage the property, and handle all operational matters.

Each month, the property nets $600 after expenses. You split it $300 each.

When the property sells or refinances later, your partner gets their initial capital back + 50% of appreciation, and you walk away with experience, credibility, and half the equity — even though you didn’t invest a dollar upfront.

That’s shared equity in action.

What to Watch Out For

Partnerships build empires or destroy friendships. The difference lies in structure, clarity, and communication.

- Don’t skip legal agreements. Ever.

Good contracts make great partnerships. - Don’t overpromise.

Be clear about risks, cash flow timing, and potential delays. - Don’t mix personal relationships with unclear money.

If you’re partnering with family or friends, treat it even more professionally — not less. - Keep decision-making power balanced.

One person should manage, but both should stay informed.

If one partner starts feeling powerless or misled, the deal will crumble — no matter how profitable it looks on paper.

When It Works Best

- You’re confident finding and managing deals but lack cash.

- You have a partner who trusts you and prefers passive returns.

- The property has strong, reliable cash flow.

- Both sides care about long-term wealth, not short-term flips.

Bottom Line

Shared equity deals turn potential investors into active ones. They’re the middle ground between “doing it all yourself” and “waiting forever to save up cash.”

Handled correctly, they can fund your next property — and the next, and the next.

3. Self-Directed IRA Investing — Turning Retirement Funds Into Real Estate Wealth

Most people think their retirement money is locked inside Wall Street forever. They imagine two buttons — stocks and bonds — and assume that’s all their IRA or 401(k) can ever hold.

But that’s not true. With a Self-Directed IRA (SDIRA), you can use your retirement savings to buy real estate directly — without penalties or losing tax advantages. It’s completely legal, regulated, and used quietly by thousands of experienced investors every year.

The difference between a traditional IRA and an SDIRA isn’t the tax benefit — it’s the freedom.

Why It Works

A self-directed IRA works under the same tax rules as a regular IRA, but instead of being limited to mutual funds or ETFs, you can hold tangible assets like:

- Rental properties

- Raw land

- Commercial real estate

- Private loans or notes

- Even shares of LLCs that own property

That means your money isn’t tied to market swings; it’s backed by something tangible.

And the best part? All profits inside the SDIRA — rental income, appreciation, or capital gains — grow tax-deferred (Traditional IRA) or tax-free (Roth IRA).

It’s not a trick. It’s a smarter way to use money you already have.

How It Works (Step-by-Step)

- Set Up a Self-Directed IRA Custodian

You can’t use a normal brokerage for this.

You need a custodian that specializes in self-directed accounts — they handle compliance, recordkeeping, and IRS reporting. - Transfer or Roll Over Funds

Move money from an existing IRA or 401(k) into the SDIRA.

This isn’t a withdrawal — it’s a transfer, so it stays tax-protected. - Choose an Investment Property

You (or your property manager) find the deal.

The property must be for investment only — not for you or your family to live in or vacation at. - Buy the Property in the Name of the IRA

The buyer on the purchase contract is your IRA, not you personally.

Example: “ABC Trust Company FBO John Smith IRA #12345.” - All Expenses and Income Flow Through the IRA

Rent checks are returned to the IRA.

Repairs, taxes, and insurance are paid from the IRA’s funds — not your personal money. - Let It Grow — Tax-Deferred or Tax-Free

Every dollar of income or appreciation stays sheltered until withdrawal (Traditional) or forever (Roth).

Real Example

You roll over $100,000 from an old 401(k) into a self-directed IRA.

Instead of leaving it in index funds, you buy a $200,000 single-family rental, using the $100,000 as a 50% down payment and the rest financed with a non-recourse loan (a special type of loan allowed for IRAs).

Each month:

- Rent: $1,800

- Expenses + loan: $1,200

- Net income: $600 → deposited straight back into your IRA

That income grows tax-free. After 10 years, the property is worth $300,000, and the loan is paid off — your IRA has turned $100,000 into $300,000, without ever touching the stock market.

That’s the quiet power of patient investing.

What to Watch Out For

Self-directed IRAs are incredible tools, but they come with strict rules. Ignoring them can ruin the tax benefits.

- No self-dealing.

You can’t live in the property, rent it to family, or use it personally, ever. - No commingling funds.

Every expense and payment must go through the IRA. Never pay with personal money. - Loans must be non-recourse.

That means the lender can only go after the property, not your personal assets, if something goes wrong. - Stick to passive income.

You can’t perform active labor (such as rehabbing the property yourself), or it could trigger penalties.

These aren’t barriers; they’re boundaries. Once you learn them, operating inside them becomes second nature.

When It Works Best

- You have an existing retirement account with significant funds.

- You’re frustrated with market volatility and want diversification.

- You prefer predictable, asset-backed growth.

- You think in decades, not months.

Bottom Line

A Self-Directed IRA gives you what every investor wants — control and tax efficiency. You’re not giving up the safety of retirement investing; you’re upgrading its intelligence.

If you have patience, discipline, and the right custodian, your retirement account could become your most powerful real estate partner.

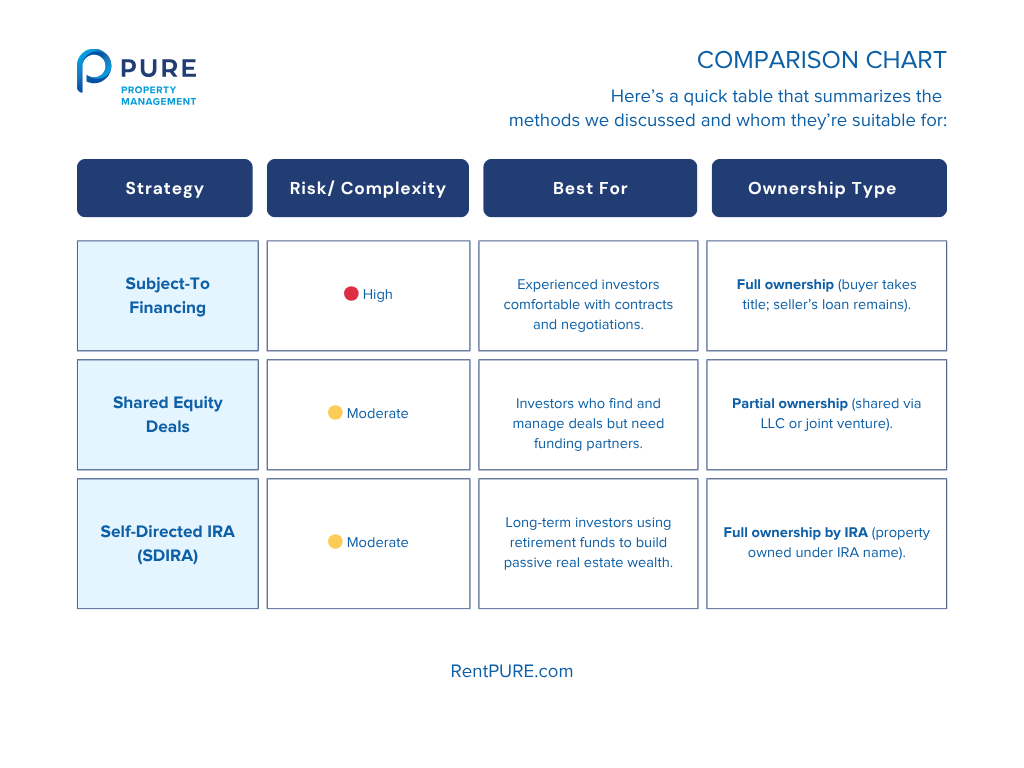

Comparison Chart

Here’s a quick table that summarizes the methods we discussed and who they’re suitable for:

Quick Takeaways

1. What is subject-to financing in real estate?

Subject-to financing means you buy a property while the seller’s existing mortgage stays in place. You take ownership and make their loan payments instead of getting a new mortgage. It lets investors control property with minimal cash or credit, but it requires clean paperwork and complete transparency with the seller.

2. Is subject-to financing legal and safe?

Yes, subject-to deals are legal when appropriately done through an attorney or title company. The main risk is the “due-on-sale” clause, which allows the lender to call the loan if ownership of the underlying asset changes. Most investors avoid issues by keeping payments current and disclosing all terms to the seller.

3. What is a shared equity agreement in real estate?

A shared equity agreement is a partnership where one person provides the money and another manages the property. Profits and appreciation are split based on each person’s contribution. It’s ideal for investors who have strong deal flow or management skills but lack cash for down payments.

4. Can I use my IRA or 401(k) to buy rental property?

Yes. A Self-Directed IRA (SDIRA) lets you use retirement funds to buy real estate directly. Your IRA owns the property, not you personally, and all rent or profit goes back into the account tax-deferred or tax-free. You just can’t live in or personally manage the property.

5. What are the risks of using a Self-Directed IRA for real estate?

The main risks are violating IRS rules or mismanaging funds. You can’t use the property personally, mix personal and IRA money, or perform hands-on labor. Breaking these rules could trigger taxes and penalties, so most investors work with experienced custodians and advisors.

How to Stress-Test Any “No Money Down” Deal

Buying a rental property with no money down can work beautifully — but only if the deal itself is solid.

A good strategy can’t save bad numbers. That’s why every smart investor “stress-tests” their deals before signing a single document.

Think of the stress test as your financial inspection. It’s how you find cracks in the math before they become cracks in your wallet. If your deal can survive this checklist, it’s not just clever — it’s strong.

1. Check the Cash Flow Math (Reality, Not Optimism)

Start with a simple question: “If every bill hit on the same day, could the rent still cover it?”

Break it down honestly:

- Gross Rent: total rent collected each month.

- Operating Expenses: taxes, insurance, maintenance, management, and HOA fees you pay.

- Mortgage Payment: principal + interest.

- Net Cash Flow: what’s left.

If you’re barely breaking even before the first repair or vacancy, it’s not a deal — it’s a donation.

A healthy property should cash-flow positively from day one, even if the profit looks modest at first. Small, steady wins scale faster than risky “home-run” guesses.

2. Run the Coverage Ratio

This is the safety valve in every professional investor’s spreadsheet.

Your debt-service-coverage ratio (DSCR) measures how comfortably your income covers your debt.

The math: Net Operating Income ÷ Total Debt Payment = DSCR

Aim for 1.2 or higher — meaning your rent exceeds your mortgage and expenses by 20 percent or more. Anything under 1.1 means one bad month could erase your cushion.

It’s not about greed — it’s about sleep.

3. Plan for Vacancy Before It Happens

Every property will sit empty at some point. Your stress test assumes that reality rather than ignoring it.

Add a 5%–10% vacancy buffer into to your projections. If your deal only works at 100 percent occupancy, it’s not stable enough. Smart investors model for the “what if”:

- What if one resident leaves suddenly?

- What if you need a month to repaint and re-advertise?

If your numbers still look healthy with that built-in downtime, you’re safe.

4. Keep a Three-Month Reserve (Non-Negotiable)

This is the single biggest difference between investors who survive downturns and those who panic-sell.

Before you close, make sure you have:

- Three months of total expenses (mortgage + tax + insurance + average maintenance).

- Enough liquidity to handle surprise repairs.

You don’t need that cash sitting idle in a checking account — a separate savings or line of credit works fine. But if you can’t weather 90 days of pain, you’re investing naked.

5. Stress-Test Your Exit Plan

“No money down” should never mean “no way out.”

Ask yourself three questions:

- Can I refinance this loan if rates rise or values dip?

- Could I sell the property and still break even if I had to?

- If the market froze for a year, could I comfortably hold it?

A good deal always has two exits — one planned (steady cash flow), and one emergency (fair resale value).

6. Question Your Assumptions

The most dangerous phrase in real estate is “It should be fine.” Run your numbers, but this time, be pessimistic:

- Drop rents by 5–10 percent.

- Raise expenses by 10–15 percent.

- Add one extra month of vacancy.

If it still makes sense, congratulations! You’ve found a strong deal. If it collapses under that pressure, the property isn’t ready. Numbers don’t lie, but hope does.

Final Thought

A “no money down” deal that passes this stress test isn’t just safe — it’s scalable. It means you can grow without gambling, build wealth without burning out, and sleep peacefully knowing your math is airtight.

Quick Takeaways

1. How do you know if a rental property deal is safe?

A rental property is safe if it cash flows positively after accounting for all costs—mortgage, taxes, insurance, maintenance, HOA fees, and a vacancy buffer. If your numbers still show profit after those deductions, the deal can likely handle real-world stress.

2. What is a good debt-service coverage ratio (DSCR) for rental property?

A good DSCR for a rental property is 1.2 or higher. That means your property’s income exceeds all debt and expenses by at least 20%. Anything below 1.1 indicates that even a single slow month could lead to losses or late payments.

3. How much cash reserve should you keep for a rental property?

Smart investors keep at least three months of total expenses in reserve for every rental property. This cushion covers repairs, vacancies, and market slowdowns—letting you stay calm, avoid panic selling, and protect your investment long term.

In Conclusion

Advanced real estate investing is about control, not capital. The smartest investors don’t rush into deals or chase easy wins; they build structures that protect their downside and multiply their options. Learning how to buy investment property with no money down gives you more than leverage; it gives you flexibility.

Each strategy in this guide works when backed by precise numbers, transparent communication, and professional guidance. Whether you’re partnering through shared equity, taking over existing financing, or using retirement funds strategically, the goal remains the same: consistent, sustainable growth.

Real wealth in real estate comes from understanding how money moves, not just how to spend it. Master that, and you’ll never run out of opportunities.