Owning a rental property can be a smart investment, but it comes with its own tax structure, challenges, and rewards.

One of the biggest rewards is the tax benefits of rental property ownership. These tax benefits can save you a lot of money, but some of them might be lesser-known and easy to overlook.

In this post, we’ll explore the various tax benefits of owning rental property, including a few that even your accountant might overlook. Understanding these can help you make the most out of your investment and keep more money in your pocket.

1. Understanding Depreciation & Its Implications

Depreciation is a powerful tool that allows you to spread out the cost of your rental property over several years, reducing your taxable income annually. Think of it as a way to account for the gradual wear and tear on your property over time.

How Depreciation Works

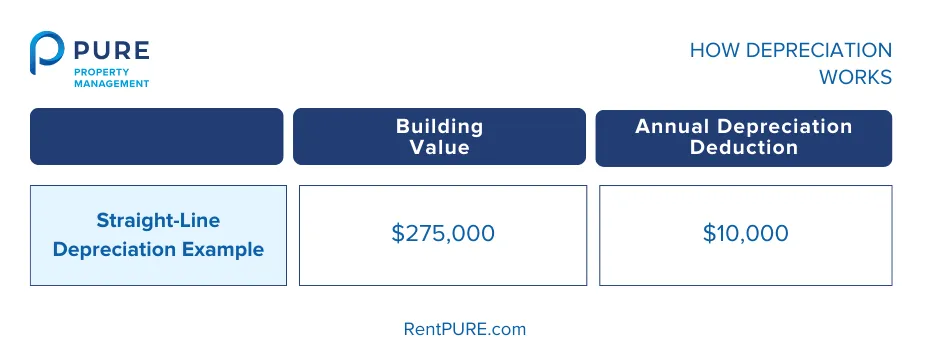

- Straight-Line Depreciation: The IRS allows rental property owners to use the straight-line method over 27.5 years. This means you can deduct an equal amount each year.

- Example Calculation: If the building (excluding land) is worth $275,000, you divide this by 27.5 years, resulting in an annual depreciation deduction of $10,000.

Key Points to Remember

- Only Buildings Depreciate: Land does not depreciate because it does not wear out. Ensure you only apply depreciation to the building’s value.

- Improvements and Additions: Major improvements (like adding a new roof) must be depreciated separately over their own useful lives.

- Recapture at Sale: When you sell the property, you may need to pay back some of the tax benefits through depreciation recapture. This is taxed at a higher rate, so plan accordingly.

Handling Property Improvements & Repairs

Another key aspect is the handling of property improvements. Repairs, on the other hand, are routine fixes that don’t increase your property’s value. Major improvements, like adding a new roof or upgrading the HVAC system, must be depreciated separately over their own useful lives.

- Shorter Depreciation Periods: For instance, appliances and carpeting have shorter depreciation periods than the building itself, allowing for faster deductions. Effective use of these strategies can boost an investor’s cash flow by up to 20% annually, as found by the National Multifamily Housing Council.

- Immediate Deduction: The cost of repairs can be fully deducted in the year they are made. This immediate deduction can help reduce your taxable income right away.

- Documentation: Keep detailed records of all repair expenses. This documentation is essential for accurately claiming deductions and can be helpful if audited.

- Strategic Planning: Schedule repairs strategically to take full advantage of immediate deductions, especially if you have high income in a particular year.

- Safe Harbor Rules: Utilize IRS safe harbor rules to simplify deductions. For instance, the De Minimis Safe Harbor Election allows you to deduct certain low-cost items in the year they are purchased.

Things to Look Out For

- Maximize Initial Cost Allocation: When purchasing a property, allocate as much cost as possible to the building instead of the land to maximize your depreciation deductions. This often requires a professional appraisal.

- Separate Depreciation Schedules: Keep separate depreciation schedules for different types of property improvements. For example, appliances and carpeting have shorter depreciation periods than the building itself.

- Partial Asset Disposition: If you replace part of the property (like a roof or HVAC system), you can write off the remaining value of the old asset. This can result in significant tax savings.

- Stay Updated with Tax Laws: Tax laws and regulations change. For instance, the Tax Cuts and Jobs Act introduced 100% bonus depreciation for certain types of property improvements. Keeping up with these changes can help you optimize your deductions.

- Leverage Cost Segregation Studies: These studies can break down the cost of your property into various components (like plumbing and electrical systems) that can be depreciated over shorter periods, increasing your deductions in the early years of ownership.

Depreciation can significantly reduce your taxable income, making it a critical benefit for rental property owners. Ensure you maximize this benefit by properly calculating and applying it every year.

2. Pass-Through Deduction

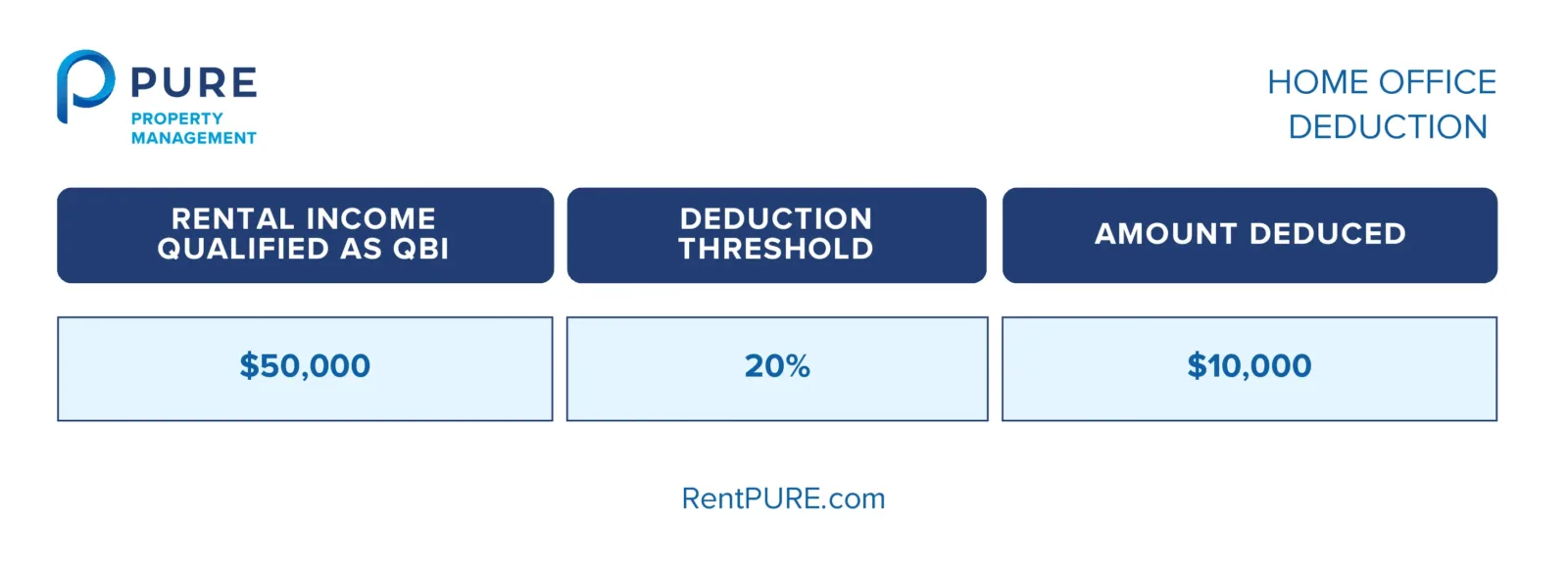

The pass-through deduction, also known as the Qualified Business Income (QBI) deduction, is a valuable tax benefit of rental property ownership. This deduction allows eligible taxpayers to deduct up to 20% of their qualified business income, effectively reducing the amount of income subject to federal income tax.

The 20% Pass-Through Deduction

For rental property owners, the 20% pass-through deduction can significantly lower taxable income. Here’s how it works:

- Qualified Business Income (QBI): Rental income that qualifies as QBI can benefit from this deduction. Essentially, if your rental activities are considered a trade or business, you may be eligible to deduct 20% of your rental income.

- Example Calculation: If you earn $50,000 in rental income, and it qualifies as QBI, you could potentially deduct $10,000 (20% of $50,000) from your taxable income.

Special Conditions and Restrictions

Income Thresholds:

The deduction is subject to income limits. For 2024, the full deduction is available for single filers with taxable income up to $191,950 and married couples filing jointly with taxable income up to $383,900. Above these thresholds, the deduction phases out and eventually becomes unavailable at higher income levels.

Trade or Business Requirement:

- Not all rental activities qualify: To be eligible, your rental activity must rise to the level of a trade or business. This generally means regular, continuous, and substantial involvement in managing the property.

- Safe Harbor Rule: The IRS has provided a safe harbor rule to help determine if rental real estate qualifies as a trade or business. Under this rule, you must perform at least 250 hours of rental services per year, among other requirements.

Rental Property Types:

- Short-Term Rentals: These may have different qualifying criteria, especially if substantial services (like cleaning and concierge services) are provided.

- Long-Term Rentals: Typically easier to qualify, but still must meet the trade or business standard.

Practical Tips for Maximizing the Deduction

- Ensure Qualification: Make sure your rental activity qualifies as a trade or business by meeting the IRS requirements or safe harbor rules.

- Maintain Detailed Records: Keep thorough documentation of all rental activities, income, and expenses. This includes hours spent managing the property, advertising, tenant interactions, and maintenance.

- Consult a Tax Professional: Given the complexity and specific requirements of the pass-through deduction, consulting with a tax professional can help ensure you maximize this benefit and stay compliant with all regulations.

Understanding and properly utilizing the pass-through deduction can lead to substantial tax savings for rental property owners. By ensuring your rental activities qualify and maintaining meticulous records, you can effectively reduce your taxable income.

3. Travel Expenses & Their Tax Offset

Rental property investors often need to travel to manage their properties effectively. Whether it’s meeting tenants, inspecting properties, or overseeing maintenance, these trips are a necessary part of the job.

Fortunately, travel is among the many rental property tax benefits which can help reduce taxable income significantly.

Qualifying Travel Expenses

Types of Travel that Qualify:

- Property Inspections: Trips to inspect the condition of the rental property.

- Tenant Meetings: Traveling to meet with current or prospective tenants.

- Maintenance and Repairs: Traveling to handle or oversee maintenance and repairs.

Examples of Deductible Expenses:

- Mileage: If you use your car for property-related travel, you can deduct the mileage. The IRS standard mileage rate for 2024 is $0.58 per mile.

- Airfare and Lodging: If you need to fly to manage your property, airfare and lodging expenses are deductible.

- Meals: Meals can be partially deductible (usually 50%) if they are directly related to managing the rental property.

Keeping Records

Importance of Maintaining Detailed Records:

Detailed records are crucial to substantiate your travel deductions if the IRS audits your return.

Tips for Documenting Travel:

- Mileage Log: Keep a log of miles driven for property management, noting the date, purpose of the trip, starting and ending locations, and miles traveled.

- Receipts: Save all receipts related to travel expenses, including gas, lodging, and meals.

- Digital Tools: Use apps like MileIQ or TripLog to track mileage and store digital receipts.

Practical Tips To Maximize Your Benefits

Planning Trips Efficiently:

- Combine Tasks: Plan trips that combine multiple property management tasks to maximize deductible expenses.

- Frequent but Necessary Travel: Ensure travel is necessary and directly related to managing the rental property.

Common Mistakes to Avoid:

- Personal vs. Business Travel: Don’t mix personal travel with property management travel unless the personal portion is separately accounted for and not deducted.

- Incomplete Documentation: Incomplete records can lead to disallowed deductions during an audit.

Consulting a Tax Professional:

- Given the complexities and specific requirements of travel expense deductions, consulting with a tax professional can help ensure you maximize this benefit and stay compliant with all regulations.

For rental property investors, understanding and documenting travel expenses can be a game-changer.

By keeping meticulous records and ensuring all travel is directly related to property management, investors can significantly boost their tax savings. This not only lowers taxable income but also enhances overall financial health, making property management more cost-effective and profitable.

4. Home Office Deduction

Rental property investors often need a dedicated space at home to manage their properties efficiently. The home office deduction allows these investors to deduct expenses related to the portion of their home used for business purposes, helping to reduce their taxable income.

Eligibility and Requirements

Exclusive and Regular Use: To qualify for the home office deduction, a part of your home must be used exclusively and regularly for business. This means the space must be your primary place of business for managing rental properties, and it should not be used for personal activities.

Principal Place of Business: The home office must be the principal place of business for your rental activities, or it must be used regularly to meet with tenants or conduct administrative tasks. If you don’t have another fixed location where you conduct substantial administrative or management activities, your home office qualifies by default.

Calculating the Home Office Deduction

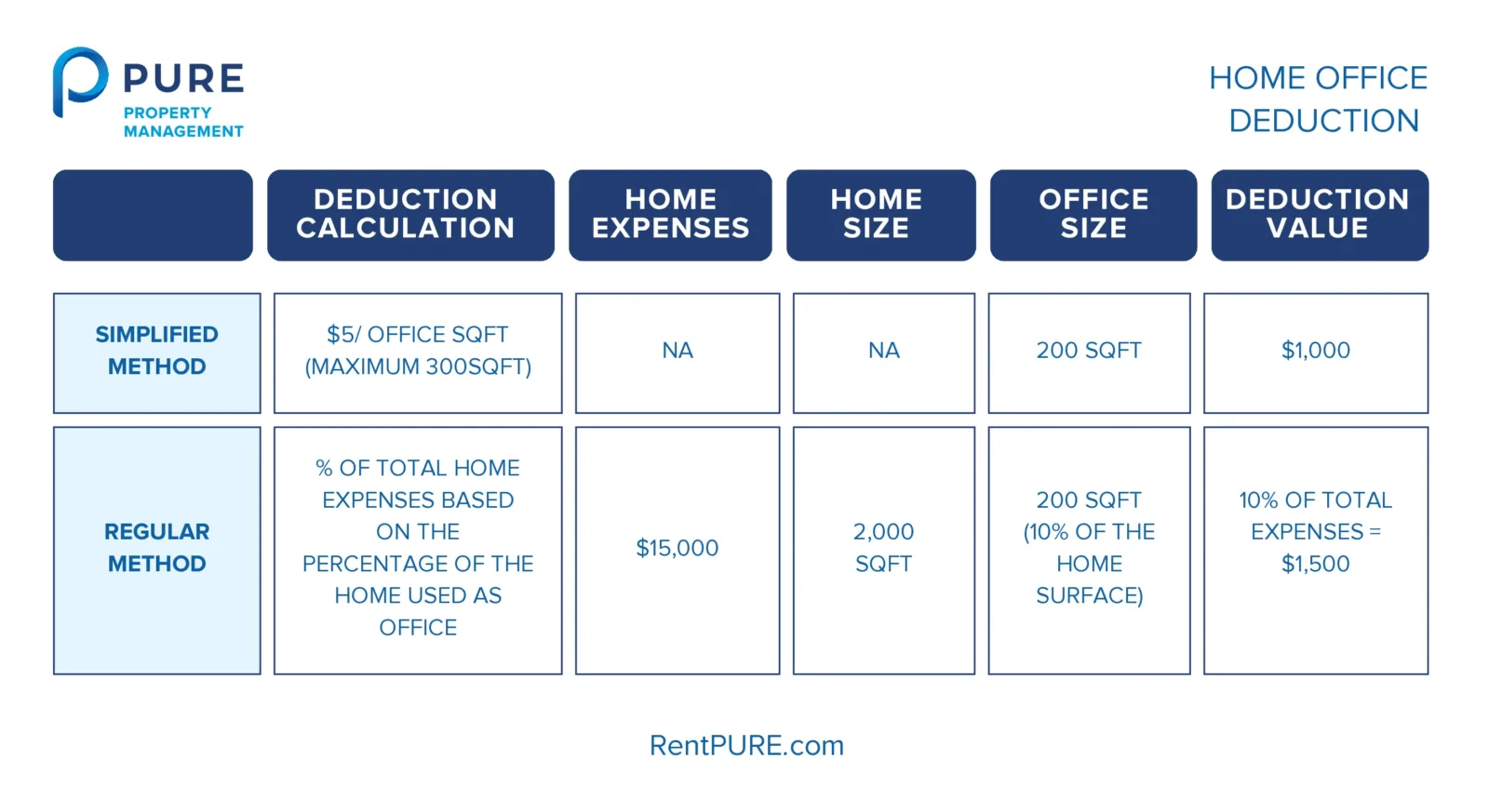

There are two methods to calculate the home office deduction:

Simplified Method:

- The IRS offers a simplified option where you can deduct $5 per square foot of your home office, up to a maximum of 300 square feet. This method is straightforward and doesn’t require detailed expense tracking.

- For example, if your home office is 150 square feet, you can deduct $750 ($5 x 150).

Regular Method:

- The regular method involves calculating the actual expenses of operating your home office, such as mortgage interest, utilities, insurance, repairs, and depreciation.

- You need to determine the percentage of your home that is used for business by dividing the square footage of your home office by the total square footage of your home. For instance, if your home office is 200 square feet in a 2,000-square-foot home, you can deduct 10% of your total home expenses.

Examples and Practical Tips

What Can Be Deducted:

- Direct Expenses: Costs that benefit only the home office, such as painting or repairs specific to the office space, are fully deductible.

- Indirect Expenses: These include a portion of overall home expenses like mortgage interest, utilities, and insurance, based on the percentage of the home used for business.

Maintaining Eligibility and Accurate Records:

- Keep detailed records of all expenses related to your home office. This includes receipts, utility bills, and any other relevant documents.

- Use tools and apps to track and document your expenses efficiently.

This not only helps in reducing taxable income but also improves the overall financial health of their rental business.

Ensure you meet the eligibility requirements and choose the calculation method that provides the best benefit for your situation. Consulting a tax professional can also help you navigate the complexities and maximize your deductions.

5. Tax-Free Exchange (1031 Exchange)

A 1031 exchange, named after Section 1031 of the Internal Revenue Code, allows rental property owners to defer paying capital gains taxes when they sell a property, provided they reinvest the proceeds into a similar, like-kind property. This powerful tax strategy can help property investors grow their real estate portfolio without immediate tax burdens.

What is a 1031 Exchange?

A 1031 exchange enables property owners to sell one investment property and purchase another without paying capital gains taxes on the sale. The key requirement is that the new property must be of “like-kind,” meaning it must be of the same nature or character, even if it differs in grade or quality. The properties involved must be held for productive use in a trade, business, or for investment.

How it Helps Defer Capital Gains Tax

When a rental property is sold, the owner typically owes capital gains tax on the profit. However, by using a 1031 exchange, the tax payment can be deferred, allowing the investor to use the full sale proceeds to purchase another investment property. This deferral can result in significant tax savings, which can then be used to acquire more valuable properties, thereby enhancing the investor’s portfolio.

Financial Benefits:

- Tax Deferral: Defers the payment of capital gains taxes.

- Increased Buying Power: Allows reinvestment of the full sale proceeds into a new property.

- Portfolio Growth: Facilitates the acquisition of higher-value properties without immediate tax consequences.

Steps to Use a 1031 Exchange

- Identify the Property to be Sold: Choose the rental property you plan to sell and prepare it for the market.

- Find a Qualified Intermediary: A qualified intermediary (QI) is required to facilitate the exchange. The QI holds the proceeds from the sale and uses them to purchase the new property. The seller cannot receive the proceeds directly.

- Identify Potential Replacement Properties: Within 45 days of selling the original property, you must identify up to three potential replacement properties. These must be documented in writing and delivered to the QI.

- Complete the Exchange: The purchase of the replacement property must be completed within 180 days of the sale of the original property. This involves transferring the title and ensuring all proceeds from the sale are reinvested.

Common Pitfalls to Avoid:

- Missing Deadlines: Strict adherence to the 45-day identification and 180-day completion periods is crucial.

- Not Using a Qualified Intermediary: Direct receipt of sale proceeds disqualifies the transaction as a 1031 exchange.

- Improper Identification of Replacement Properties: Ensure the identified properties meet the “like-kind” requirement.

Use these steps and team up with professionals to make the most of 1031 exchanges. This strategy will help you defer taxes, reinvest your profits, and steadily grow your real estate portfolio.

6. Lesser-Known But Important Deductions

Maximizing your tax deductions is key to making the most out of your rental property investments. While you’re probably familiar with common deductions like mortgage interest and property taxes, there are several lesser-known deductions that can save you even more money. Let’s dive into some of these hidden gems.

Legal Fees

Did you know you can deduct legal fees related to your rental property? Whether you’re evicting a tenant, drafting lease agreements, or consulting a lawyer for property-related advice, these expenses can reduce your taxable income. Keep track of all legal expenses to make sure you don’t miss out on these deductions.

Insurance Premiums

Your insurance premiums are another source of tax benefits to owning a rental property. Deductible premiums include:

- Landlord Insurance: Protects against property damage, liability, and loss of rental income.

- Liability Insurance: Covers injuries that occur on your property.

Property Management Fees

If you hire a property management company, their fees are deductible too. This includes costs for:

- Leasing services

- Maintenance and repair coordination

- Rent collection

Property management can make your life easier, and the tax deductions make it more affordable.

Advertising Costs

Any money spent on advertising your rental property is also deductible. This includes:

- Online listings

- Newspaper ads

- Signs and flyers

Effective marketing is crucial to keeping your property occupied, and these deductions help offset the costs.

In Conclusion

Maximizing the tax benefits of rental property ownership is crucial for rental property investors to enhance profitability and ensure long-term success.

By understanding and leveraging deductions like depreciation, repairs, travel expenses, the home office deduction, and the 1031 exchange, you can significantly reduce your taxable income.

Additionally, don’t overlook lesser-known deductions such as legal fees, insurance premiums, property management fees, and advertising costs.

Stay organized by keeping detailed records of all expenses and consult with a tax professional to navigate the complexities of tax laws. This proactive approach will help you optimize your tax strategy, allowing you to reinvest more into your properties and grow your real estate portfolio effectively.

Keep these strategies in mind, and you’ll be well on your way to making the most of your rental property investments.